IRS Direct File: Actions Needed during Pilot to Improve Information on Costs and Benefits

Fast Facts

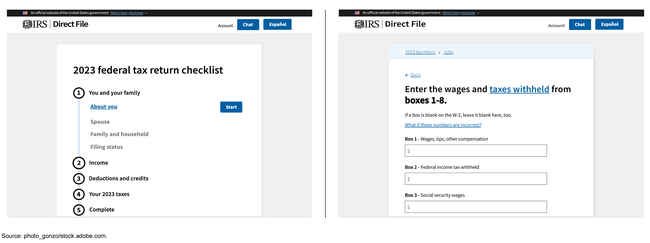

IRS is piloting Direct File during the 2024 tax filing season. It is a system that will guide certain taxpayers through preparing and filing their tax returns on IRS's website for free.

IRS estimated that Direct File could cost $64-$249 million annually—depending on assumptions such as the number of taxpayers served. IRS estimated that participating taxpayers may save $21 million in tax preparation costs. However, IRS's cost estimates did not include start-up costs, such as technology required for a new system.

We recommended, among other things, that IRS estimate the full costs of developing and operating a Direct File system.

IRS Direct File Interface as of January 2024

Highlights

What GAO Found

The Internal Revenue Service (IRS) reported to Congress in May 2023 that it estimated the annual costs of a Direct File tax system could range from $64 million to $249 million depending on the number of taxpayers served and the complexity of tax situations supported. IRS also described assumptions used to estimate costs—a best practice for cost estimation. For example, IRS noted that it assumed a Direct File system would start with a limited tax scope. IRS also included elements of a sensitivity analysis, another best practice for cost estimation, to examine how changes in assumptions may affect cost estimates. IRS described how costs were expected to change depending on the number of taxpayers served and the complexity of tax situations supported.

However, IRS's cost estimates did not address other recommended best practices, such as ensuring all costs were included and documented. GAO and the Treasury Inspector General for Tax Administration found that IRS had no documentation to support the underlying data, analysis, or assumptions used for Direct File cost estimates. Further, IRS officials told GAO that the cost estimates did not include start-up costs, such as technology for a novel system, which could be substantial. A best practice for cost estimation is to include development costs as part of a complete cost estimate. Without a comprehensive accounting of costs, IRS's estimates could understate the full amount of resources required to develop and maintain a permanent Direct File program.

A Direct File pilot provides opportunities for IRS to improve its cost estimates. IRS officials stated that they will update the cost estimates after the pilot. However, GAO found insufficient documentation to provide reasonable assurance that the pilot will capture the necessary data to inform more complete cost estimates. IRS officials reported that their current focus is to evaluate critical operational aspects of the pilot. However, IRS officials risk missing time-sensitive opportunities to inform cost estimates in such categories as customer service costs, potential costs of integrating a federal Direct File system with additional state-level direct file systems, and incremental costs of expanding the system's capabilities to assist taxpayers with additional tax situations. Complete cost information informs decisions about program design tradeoffs such as what additional tax situations to support.

The Direct File pilot also provides opportunities for IRS to estimate potential benefits for taxpayers and for improving tax administration. IRS estimates that the Direct File pilot for the 2024 tax filing season will save taxpayers $21 million in compliance costs. In addition, IRS identified other potential benefits of Direct File, such as making it easier for eligible taxpayers to claim credits and deductions, reducing the volume of paper returns, and reducing errors. However, IRS evaluation documents did not consistently identify relevant metrics for measuring these potential benefits.

IRS officials told GAO in February 2024 that senior leadership has not decided on the future of the pilot beyond the 2024 tax filing season. IRS officials reported that the time required to continue Direct File would depend on several factors, such as the size of the team working on the program. They noted that hiring new employees to replace outgoing employees is a lengthy process. Thus, IRS officials will have a short amount of time to analyze cost and benefit information before making decisions about the pilot for the 2025 tax filing season.

Why GAO Did This Study

IRS is piloting an online tax filing system to allow certain taxpayers to prepare and file their tax returns on an IRS website for free using a question-and-answer format during the 2024 tax filing season. Once mature, a government-run tax filing system could save taxpayers time and money, make it easier to claim tax benefits, and provide several benefits to IRS. Questions have been raised about how much funding will be required to support such a system, including providing a sufficient level of customer service.

The Inflation Reduction Act of 2022 appropriated funds for IRS to study the cost of developing and running a free Direct File tax return system. IRS submitted its report to Congress in May 2023. The act also includes a provision for GAO to oversee the distribution and use of such funds. For this report, GAO evaluated IRS's estimates of the costs and benefits of Direct File and opportunities to use the pilot to collect data to improve those estimates to inform future decisions. GAO compared IRS's initial cost and benefit estimates against best practices for cost estimation and an IRS strategic goal of ensuring a Direct File system is cost effective.

Recommendations

GAO is recommending that IRS (1) ensure that best practices are used to estimate and document the full costs of developing and operating a Direct File system; (2) ensure that the potential benefits of a Direct File system are estimated and documented; and (3) use the cost and benefit data collected during the pilot along with other relevant considerations, to inform future decisions about the Direct File system.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that relevant officials apply best practices to estimate and document the full costs of developing and operating a Direct File system. (Recommendation 1) |

IRS agreed with our recommendation and stated that a pilot of the Direct File system conducted during the 2024 tax filing season would help officials improve cost estimates. In a May 2024 IRS report stated that the agency spent $24.6 million during the 2024 Direct File pilot. IRS also provided more comprehensive cost information compared to the initial cost estimates by including development costs and estimating the cost of support provided by another federal agency. IRS expanded the tax situations supported by Direct File during the 2025 tax filing season and a May 2025 agency report stated that an additional $41 million had been spent. While IRS made efforts to develop forward-looking cost estimates for Direct File, circumstances have evolved since we made our recommendation. In July 2025, Public Law 119-21 section 70607 provided $15 million for the Department of the Treasury to report to Congress on the cost of establishing and enhancing public-private partnerships to provide free tax filing to replace direct e-file programs run by IRS. Following this new law, IRS stated in August 2025 that agency efforts to address additional recommendations we made in GAO-25-106933 concerning the Direct File program were contingent upon the program's continuation.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that relevant officials estimate and document the potential benefits of a Direct File system. (Recommendation 2) |

IRS agreed with our recommendation and stated that a pilot of the Direct File system conducted during the 2024 tax filing season would help officials evaluate the benefits of Direct File. A May 2024 IRS report summarized the results of a survey of more than 15,000 taxpayers who used Direct File during the 2024 tax filing season with 76 percent having described their experience as "much easier" or "easy" compared to the prior year's filing experience. Further, the Department of the Treasury estimated that the Direct File pilot saved taxpayers $5.6 million in tax preparation fees. IRS expanded the tax situations supported by Direct File during the 2025 tax filing season and a May 2025 agency report described how officials sought to improve the taxpayer experience by reducing errors. IRS stated that 88 percent of Direct File returns submitted during the 2025 tax filing season were accepted which was an increase from the 73 percent accepted during the 2024 tax filing season. IRS concluded that these improvements had made Direct File the most accurate "do it yourself" filing method. IRS's report also summarized the results of two surveys administered to Direct File taxpayers with the majority of respondents having provided positive feedback in several areas, including confidence that the return had been prepared accurately. While IRS had outlined plans to conduct additional research to identify other potential benefits of Direct File, circumstances have evolved since we made our recommendation. In July 2025, Public Law 119-21 section 70607 provided $15 million for the Department of the Treasury to report to Congress on the cost of establishing and enhancing public-private partnerships to provide free tax filing to replace direct e-file programs run by IRS. Following this new law, IRS stated in August 2025 that agency efforts to address additional recommendations we made in GAO-25-106933 concerning the Direct File program were contingent upon the program's continuation.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should use the cost and benefit data collected during the pilot along with other relevant considerations to inform future decisions about the Direct File system. (Recommendation 3) |

IRS agreed with our recommendation. In May 2024, IRS published an evaluation of the Direct File pilot which determined that the system cost less to develop and operate than previously estimated. IRS also surveyed taxpayers who generally reported that Direct File was easier to use than the tax preparation method the taxpayer had previously used. While IRS continues to collect and analyze cost and benefit information, agency officials determined that they had collected sufficient cost and benefit data to make Direct File a permanent filing option starting in 2025 citing the generally positive feedback from taxpayers.

|