Troubled Asset Relief Program: Treasury Continues Winding Down Housing Programs

Fast Facts

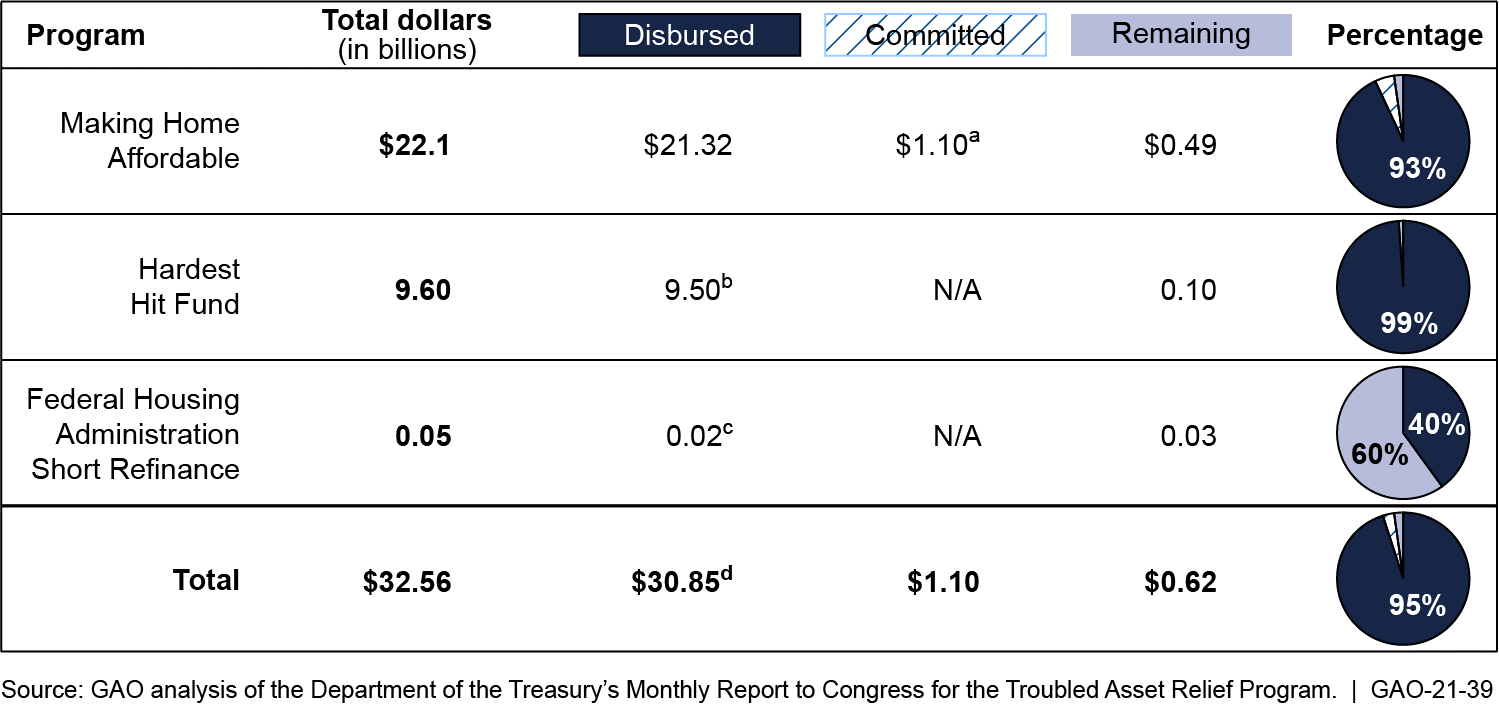

In response to the 2008 housing crisis, the Treasury Department used Troubled Asset Relief Program funding to establish 3 housing programs to help struggling homeowners avoid foreclosure and preserve homeownership. Since 2009, Treasury has obligated $32.56 billion for such housing programs.

As of Sept. 30, 2020, it had disbursed $30.85 billion (95%) of the funding. Treasury continues to wind down the programs.

A program that targeted the hardest hit housing markets has been extended through June 2021 because of the economic impact of the COVID-19 pandemic on some participants.

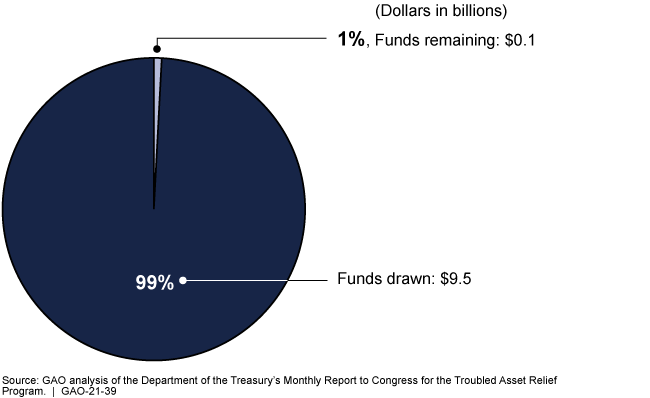

The Hardest Hit Fund is one of three TARP-funded programs designed to help homeowners. Little of its funding remains.

Highlights

What GAO Found

The Department of the Treasury (Treasury) continues to wind down housing assistance programs funded by the Troubled Asset Relief Program (TARP). Treasury has extended one program to assist certain program participants who have been affected by the COVID-19 pandemic, although limited program funds remain at this point. As of September 30, 2020, Treasury had disbursed $30.85 billion (95 percent) of the $32.56 billion TARP funds obligated to the three housing programs (see figure).

- The Making Home Affordable program allowed homeowners to apply for loan modifications to avoid foreclosure. Treasury will continue to provide incentive payments for loan modifications through 2023.

- The Housing Finance Agency Innovation Fund for the Hardest Hit Housing Markets provided funds to 18 states and the District of Columbia to help struggling homeowners through programs tailored to the state. Treasury extended this program through June 2021 because of the COVID-19 pandemic's negative economic effects on some program participants.

- The Federal Housing Administration (FHA) Short Refinance program allowed eligible homeowners to refinance into an FHA-insured loan. Under this program, Treasury made TARP funds available to provide additional coverage to lenders for a share of potential losses on these loans for borrowers who entered the program by December 31, 2016.

Status of Troubled Asset Relief Program Housing Programs, as of September 2020

aAccording to the Department of the Treasury (Treasury), these funds have been committed to future financial incentives for existing Making Home Affordable transactions, as of September 30, 2020.

bRepresents the amount of funds that states and the District of Columbia have drawn from Treasury.

cIncludes about $11.6 million in administrative expenses and $10 million of reserve funds, as of September 30, 2020. Treasury will be reimbursed for unused reserve amounts.

dAmounts do not add up due to rounding.

Why GAO Did This Study

In response to the 2008 housing crisis, Treasury established TARP-funded housing programs to help struggling homeowners avoid foreclosure and preserve homeownership. Since 2009, Treasury has obligated $32.56 billion for such housing programs. The Emergency Economic Stabilization Act of 2008 provided GAO with broad oversight authorities for actions taken related to TARP.

This report provides an update on the status of TARP-funded housing programs, as of September 30, 2020. GAO reviewed Treasury program data and documentation, and interviewed Treasury officials. This report contains the most recently available public data at the time of GAO's review, including obligations, disbursements, and program participation.

For more information, contact John H. Pendleton at (202) 512-8678 or pendletonj@gao.gov.