Opportunity Zones: Improved Oversight Needed to Evaluate Tax Expenditure Performance

Fast Facts

Congress created Opportunity Zones to spur investment in distressed communities. About 10% of Americans live in the nearly 9,000 zones.

In these areas, certain business investments can bring significant tax benefits to the investor. Unlike other, similar tax incentives, there is no limit on the amounts investors can claim for tax breaks.

But how will opportunity zone investments actually affect these communities? Congress should consider having the Treasury Department collect whatever data is needed to find out.

Example of development in an Opportunity Zone in Washington, D.C.

Highlights

What GAO Found

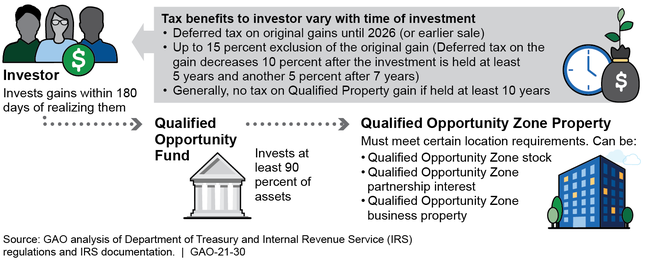

Congress created Opportunity Zones (OZ)—a tax expenditure that reduces taxpayers' liabilities and federal revenues—to spur investment in distressed communities. OZ allows taxpayers to defer taxes on invested gains, and in certain circumstances pay reduced taxes, by investing in distressed communities designated as Qualified Opportunity Zones (Zones) through Qualified Opportunity Funds.

Basic Structure of and Tax Benefits from Investments in Opportunity Zones

Compared to some other community development tax expenditures, OZ generally has fewer limits on the project types that can be financed and fewer controls to limit potential revenue losses. While OZ can generally be used to support investment in any type of tangible asset class within a Zone, some other tax expenditures, such as the Low Income Housing Tax Credit, are targeted at specific project types. OZ is also not subject to limits on the aggregate dollar amount that can be claimed, unlike the New Markets Tax Credit.

Congress did not designate an agency with the responsibility and authority to collect data, evaluate, and report on OZ performance. GAO has previously reported that the Department of the Treasury (Treasury) could be the most appropriate agency to evaluate any tax expenditures that do not have logical connections to program agencies. GAO has also previously reported that achieving complex outcomes can benefit from collaboration among agencies. A member of an interagency council has issued a report estimating the effects of OZ, but the long-term future of this council, including any plans to continue evaluations over the duration of the tax expenditure, is uncertain.

As a result of unclear statutory authority, there are insufficient data available to evaluate OZ performance. The Internal Revenue Service (IRS) administers and collects data explicitly for tax compliance purposes. Some of these data, such as investment amounts, can be used to evaluate outcomes. Without additional data, however, only limited reporting on performance is possible. Additional data collection and reporting on OZ are necessary to evaluate outcomes. It would be beneficial for Congress to indicate what questions it would like such evaluations to address, such as what are OZ's effects on employment and housing in the Zones.

Why GAO Did This Study

Congress created OZ to spur investments in distressed communities. According to Census Bureau data, about 10 percent of Americans live in the nearly 9,000 Zones. Taxpayers who invest in Qualified Opportunity Funds—that in turn invest in Zones—have the potential to receive significant tax-related benefits on their qualified investments. GAO was asked to review OZ implementation.

This report (1) describes key features of OZ and how it compares to other federal tax expenditures aimed at spurring investment in low-income and distressed areas, and (2) evaluates the executive branch's ability to effectively evaluate OZ's performance. GAO compared OZ's key features with those of three other community development tax expenditures, analyzed executive branch documentation, and interviewed agency officials about plans to collect data and report on performance.

Recommendations

GAO is identifying two matters for congressional consideration, including that Congress consider providing Treasury with authority and responsibility to collect data and report on OZ's performance, in collaboration with other agencies. As part of that deliberation, Congress should also consider identifying questions about OZ's effects that it wants Treasury to address in order to help guide data collection and reporting of performance, including outcomes.

In its comments, Treasury acknowledged the lack of clear guidance and authority to collect OZ data.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider providing Treasury with the authority and responsibility to collect data and report on the performance of the Opportunity Zones tax expenditure, in collaboration with other agencies. (Matter for Consideration 1) | In July 2025, Congress passed and the president signed into law Pub. L. No. 119-21, which requires Qualified Opportunity Funds to annually report to Treasury information about their investments that could be used to report on the tax expenditure's performance. The law also requires Treasury to report on the number of Funds and the amount and characteristics of investments made by Funds, and every 5 years on the impacts and outcomes from designating certain Census tracts as Opportunity Zones. Such reporting will provide policymakers with information on the Opportunity Zone incentive's performance and help determine the extent to which it is improving the economic well-being of people in these communities. | |

| As part of the deliberation, Congress should also consider identifying questions about the performance of the Opportunity Zones tax expenditure that it wants Treasury, in collaboration with other agencies, to address in order to help guide data collection and reporting of performance, including outcomes. (Matter for Consideration 2) | In July 2025, Congress passed and the president signed into law Pub. L. No. 119-21, which requires Treasury to issue annual reports on Qualified Opportunity Funds and reports every 5 years on the impacts and outcomes from designating certain Census tracts as Opportunity Zones. The law specifies the characteristics of investments to be reported, including the amount of investment, the industry types receiving investment, and employment and housing data associated with Qualified Opportunity Zone investments. The law further specifies economic indicators to be used as a measure of the impact of the Opportunity Zones designation, including unemployment rate, poverty rate, and housing characteristics of designated Opportunity Zones tracts and comparison with similar but undesignated tracts. Such reporting will provide policymakers with information on the Opportunity Zone incentive's performance and help determine the extent to which it is improving the economic well-being of people in these communities. |