Higher Education: Children's Savings Account Programs Can Help Families Build Savings and Envision College

Fast Facts

It can be hard for lower-income families to save for their children's higher education. Children's savings account programs can help by providing financial contributions—like initial deposits—to savings or investment accounts. Some programs also offer financial education or other support to families. States, cities, and other organizations operated 82 of these programs in 2019.

While amounts saved by some families are small, there is evidence that children's savings account programs have had positive effects so far. For example, studies show modest increases in savings and higher educational expectations among families.

Highlights

What GAO Found

Eighty-two Children's Savings Account (CSA) programs operated and had collectively enrolled about 700,000 children in 2019, according to survey data from the nonprofit organization Prosperity Now. These programs—operated by states, cities, and other organizations—use a variety of strategies to enroll families, especially those with lower incomes, and help them save and prepare for college. For example, CSA programs enroll families by partnering with trusted organizations (e.g., schools) or through automatic enrollment, according to the Consumer Financial Protection Bureau (CFPB) and CSA experts. In addition, these programs help families build savings once children are enrolled by, for example, providing initial deposits or financial education. While experts GAO interviewed said savings may be modest given lower-income families' and programs' limited resources, CSA programs also aim to help lower-income families prepare for college, such as by increasing financial knowledge.

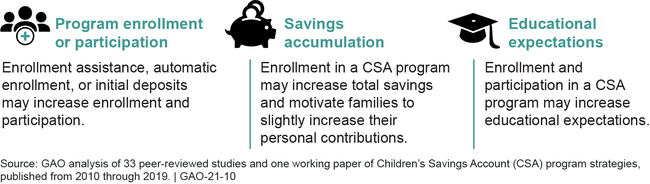

There is evidence that CSA program strategies have positive short-term effects on families, including those with lower incomes. These effects include increased CSA program enrollment and participation, amounts saved, and educational expectations, based on research GAO reviewed (see figure). For example, strategies such as automatically enrolling families and providing financial contributions (e.g., initial deposits) may help CSA programs reach more families and encourage saving. Several studies of a CSA program that used both these strategies found increases in the number of children enrolled and the amount saved by enrolled families. One study found that families who were enrolled for 7 years saved over four times more of their own money, on average, than families who were not enrolled—$261 compared to $59. When including financial contributions from the CSA program, enrolled families had about six times more total savings ($1,851) compared to other families ($323). Enrollment and participation in CSA programs may also increase families' educational expectations for their children. For example, a study found that parents with children enrolled in one CSA program were nearly twice as likely to expect their children to attend college. However, information on college enrollment and other long-term effects on families participating in CSA programs is limited because most of the children have not yet reached college age.

Effects of CSA Program Strategies in Three Commonly Assessed Areas

Why GAO Did This Study

Rising college costs have outpaced federal grant aid and placed more of the financial burden on students and their families. CSA programs help families, especially lower-income families, save for college—and other postsecondary education—by providing financial contributions and possibly other supports. A Senate Appropriations Committee report included provisions for GAO to examine various aspects of college savings account programs and their effectiveness.

This report examines (1) the number of CSA programs and how they use strategies to help families, especially lower-income families, save and prepare for college; and (2) what is known about the effects of these strategies on families, including lower-income families. GAO reviewed 2016–2019 annual CSA program survey data collected by the nonprofit Prosperity Now. GAO also analyzed CFPB documents and the findings of 33 peer-reviewed studies from 2010 through 2019—and one working paper from 2017—that met GAO's criteria for inclusion, for example, used data from the United States. In addition, GAO interviewed officials from CFPB, the Department of Education, and four organizations that have expertise on these programs.

For more information, contact Melissa Emrey-Arras at (617) 788-0534 or emreyarrasm@gao.gov.