Department of Defense: Actions Needed to Reduce Accounting Adjustments

Fast Facts

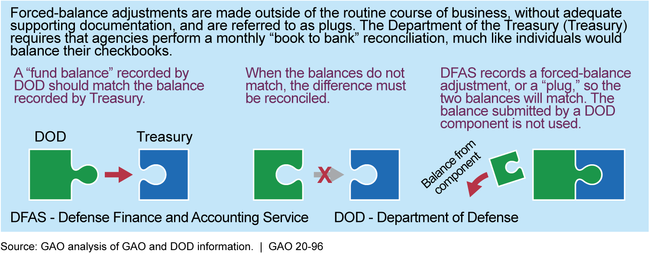

DOD uses accounting adjustments to record corrections or changes in its financial systems. Such adjustments should be accompanied by documentation showing why the change was needed. Some accounting adjustments that DOD frequently makes—including “forced-balance” adjustments to make its financial systems agree with Treasury balances—don’t have adequate supporting documentation.

We recommended that DOD reduce the use of accounting adjustments to ensure they have reliable and accurate financial information. The agency’s financial management has been on our High Risk list since 1995.

Accounting

Highlights

What GAO Found

While the use of accounting adjustments is a common practice, the Department of Defense's (DOD) reliance on a large volume of nonroutine adjustments to prepare its financial statements is primarily a result of deficient business processes and limitations in accounting systems that DOD components use to process financial information. For example, the Defense Finance and Accounting Service (DFAS) continues to rely on forced-balance adjustments to replace the financial information that DOD's components submit to force agreement with Department of the Treasury balances without reconciling and researching the cause of differences (see figure). The recording of these adjustments was identified as a material weakness in DOD's internal control over financial reporting in its fiscal year 2018 financial statement audit.

Forced-Balance Adjustment Process

GAO found that DOD and DFAS policies and procedures for accounting adjustments are insufficient, outdated, and inconsistently implemented. For example, DOD's current policies do not define what constitutes adequate supporting documentation for system-generated adjustments, nor have DOD and DFAS established policies for identifying the cause of the adjustments, developing and implementing action plans to reduce the need for adjustments, and monitoring the effectiveness of those action plans. Because DOD and DFAS are not ensuring that their policies and procedures are up-to-date and consistently implemented, there is an increased risk that inaccurate, invalid, or unapproved adjustments will be recorded in DOD's core financial reporting system, resulting in a misstatement in DOD's consolidated financial statements.

DOD and DFAS have undertaken initiatives to address some of the issues that contribute to the need for adjustments. Both organizations have developed strategies to decrease adjustments; however, neither has developed specific outcomes or detailed procedures for achieving stated goals in the strategies. Without clear procedures on how to implement its initiatives and a complete understanding across DOD of the issues contributing to the need for accounting adjustments, there is an increased risk that management efforts to reduce adjustments at the DOD consolidated level will be inefficient and ineffective.

Why GAO Did This Study

DOD remains the only major federal agency that has been unable to obtain a financial statement audit opinion. One of the contributing factors is DOD's large volume of nonroutine accounting adjustments, which are used for recording corrections or adjustments in an accounting system. This report examines accounting adjustments and their effect on the reliability of DOD's financial information, the extent to which DOD has established and implemented policies and procedures for recording accounting adjustments, and the extent to which DOD has taken actions to reduce adjustments recorded at the consolidated level.

For this report, GAO reviewed DOD and DFAS's policies and procedures, interviewed DOD officials about the adjustment process, and reviewed initiatives to reduce the number of adjustments being recorded. GAO also selected a random sample of 242 adjustments recorded at the DOD consolidated level for the fourth quarter of fiscal year 2018 to determine whether the adjustments were recorded in accordance with established policies.

Recommendations

GAO is making eight recommendations to DOD, which include updating and implementing policies and procedures on recording accounting adjustments and identifying steps to reduce the need for recording adjustments across the department. DOD agreed with all eight recommendations and cited actions to address them.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Defense Finance and Accounting Service | The Director of DFAS should, in accordance with the FMR, implement procedures to help ensure that FBWT reconciliations are consistently performed and that all DFAS sites review and document research conducted on the causes of any differences arising from these reconciliations. (Recommendation 1) |

The Department of Defense (DOD) concurred with this recommendation. In response to our recommendation, DOD developed procedures outlining the required reporting and reconciling process, including requirements for researching and documenting the causes of the differences for FBWT adjustment reporting. Additionally, DOD updated their internal policy to align their FBWT reconciliation requirements with Treasury guidance and added a summary table with deadlines for completing the fund balance with Treasury (FBWT) reconciliations. If fully and effectively implemented, the new procedures should allow DOD and its components to consistently perform and document the required reconciliations, identify the causes for these types of adjustments, and take steps to resolve them, which will help DOD produce reliable and auditable consolidated financial statements.

|

| Under Secretary of Defense (Comptroller) | The Under Secretary of Defense (Comptroller) should update the FMR to clearly define the required supporting documentation for system-generated accounting adjustments, including the required documentation of business rules driving the recording of these adjustments, such as documentation of the programming logic. (Recommendation 2) |

The Department of Defense (DOD) concurred with this recommendation. In response to our recommendation, the OUSD (Comptroller) updated its guidance to require (1) specific supporting documentation for system-generated accounting adjustments and (2) standardized narratives for recurring system-generated accounting adjustments that provide a description of the predefined business rules used to execute the adjustments. If fully and effectively implemented, the new procedures for maintaining adequate supporting documentation for system-generated accounting adjustments and for the business rules driving the adjustments will allow management and others to determine whether an adjustment was recorded for a valid reason and for the correct amount.

|

| Under Secretary of Defense (Comptroller) | The Under Secretary of Defense (Comptroller) should perform and document a comprehensive review of the FMR accounting adjustment category codes to determine their ongoing applicability or the need for additional codes to reflect the current financial reporting environment. (Recommendation 3) |

The Department of Defense (DOD) concurred with this recommendation. In response to our recommendation, OUSD (Comptroller) solicited and documented comments about the applicability of the existing category codes from DOD components. Based on responses received, OUSD (Comptroller) validated the applicability of existing category codes and updated the descriptions of the category codes in its guidance. If fully and effectively implemented, the use of the updated category codes should allow DOD to properly capture reasons for recording adjustments, which will improve the Defense Finance and Accounting Service's ability to provide DOD management and auditors with reliable information about recorded accounting adjustments.

|

| Under Secretary of Defense (Comptroller) | The Under Secretary of Defense (Comptroller) should establish procedures to help ensure the consistent implementation of the requirements of DFAS Form 9339. (Recommendation 4) |

The Department of Defense (DOD) concurred with this recommendation. In response to our recommendation, DOD developed mandatory training for staff on the use and inclusion of Form 9339 in every accounting adjustment package. If fully and effectively implemented, the training will help ensure that the accounting adjustment packages contain all required supporting documentation, which may reduce the risk of inaccurate accounting adjustments being recorded and improve the overall reliability of DOD's consolidated financial statements.

|

| Under Secretary of Defense (Comptroller) | The Under Secretary of Defense (Comptroller) should update policies and procedures to identify the causes of out-of-balance accounting adjustments and resolve the causes in a timely manner. (Recommendation 5) |

The Department of Defense (DOD) concurred with this recommendation. As of July 2025, DOD has updated its Financial Management Regulation, Volume 6A, Chapter 2 to convey that out-of-balance accounting adjustments are not authorized and is collaborating with its components to resolve out-of-balance accounting adjustments. This collaborative effort focuses on identifying root causes, implementing corrective actions, monitoring progress, and leveraging data analysis to strengthen internal controls and prevent future financial inaccuracies. The estimated completion date for this recommendation is December 30th, 2025. We will continue to follow-up with DOD on the status of this recommendation.

|

| Under Secretary of Defense (Comptroller) | The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should develop and implement policies and procedures to help ensure that root cause analyses for accounting adjustments are consistently performed and documented across DOD. (Recommendation 6) |

The Department of Defense (DOD) concurred with this recommendation. In response to this recommendation, in April 2020, DOD issued the Mandatory Use of Root Cause Indicator Code (RCIC) memo, requiring the use and documentation of RCICs consistently throughout DOD. Additionally, DOD developed a Root Cause Analysis Dashboard for analyzing root causes at the aggregate level based on RCICs. If fully and effectively implemented, the use of the RCIC and Root Cause Analysis Dashboard will assist DOD management in identifying the causes and developing action plans for reducing accounting adjustments.

|

| Under Secretary of Defense (Comptroller) | The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should develop and implement policies and procedures to help ensure consistent development, implementation, monitoring, and documentation of action plans across DOD that address accounting adjustment causes that staff identified internally. (Recommendation 7) |

The Department of Defense (DOD) concurred with this recommendation. In April 2021, DOD issued a memorandum requiring DOD components to create action plans with supporting documentation to address the causes of unsupported accounting adjustments. Additionally, the memorandum requires the Defense Finance and Accounting Service (DFAS), upon receipt of these action plans, to assign an action plan code to each accounting adjustment, which will be entered into a DOD analytic system and used to measure and monitor the effectiveness of efforts to reduce unsupported accounting adjustments. If fully and effectively implemented, the memo and the use of data analytics should improve the consistency of development, implementation, monitoring, and documentation of action plans across DOD, which over time may help reduce the number of accounting adjustments and improve the overall reliability of DOD's consolidated financial information.

|

| Under Secretary of Defense (Comptroller) | The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should develop and implement procedures across DOD that include clearly defined outcomes focused on reducing accounting adjustments (supported and unsupported) with specific actionable steps and procedures for achieving stated goals. (Recommendation 8) |

The Department of Defense (DOD) concurred with this recommendation. In response to our recommendation, OUSD (Comptroller) issued guidance requiring the use of root cause indicator codes (RCIC) to identify the cause of accounting adjustments and developed a Root Cause Dashboard for analyzing root causes at an aggregate level based on RCIS's. DOD also issued guidance requiring DOD components to create action plans to address the causes of unsupported accounting adjustments. This guidance required Defense Finance and Accounting Service (DFAS) to assign an action plan code to each accounting adjustment, which will be entered into a DOD analytics system and used to measure and monitor the effectiveness of efforts to reduce unsupported accounting adjustments. Further, DOD developed a Journal Voucher Trend Analysis dashboard which tracks and reports on accounting adjustments , allowing executives throughout DOD to view their component's trends and compare themselves to other components within the Department. OUSD and DFAS work collaboratively to monitor accounting adjustments, with OUSD providing oversight to the components and DFAS working with the components to support accounting adjustment requirements. If fully and effectively implemented, this mulit-faceted and collaborative effort will assist DOD and its components' management in reducing accounting adjustments.

|