Abusive Tax Schemes: Offshore Insurance Products and Associated Compliance Risks

Fast Facts

Obtaining insurance from offshore companies can provide legitimate federal tax benefits, as long as the insurance is genuine and taxpayers accurately report assets, claim appropriate benefits, and pay taxes owed.

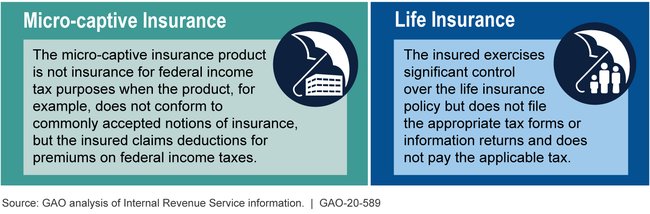

But offshore insurance products can also be abused. We reviewed abuses of two types—"micro-captive insurance" and variable life insurance. For example, micro-captive insurance is when small insurance companies are owned by the businesses they insure. They can offer insurance products that aren't actually genuine insurance. Certain tax deductions taken related to such products would be illegal.

Highlights

What GAO Found

Federal law provides certain tax benefits for transactions involving genuine insurance products, including insurance products held offshore. While taxpayers may lawfully hold offshore insurance products, they contain features that make them vulnerable for use in abusive tax schemes. For example, offshore insurance products can be highly technical and individualized, making enforcement challenging, according to Internal Revenue Service (IRS) officials. Furthermore, insurance is not defined by federal statute, potentially making a determination of what constitutes genuine insurance for federal tax purposes unclear.

Offshore micro-captive insurance products, which are made by small insurance companies owned by the businesses they insure, may be abused if the corporate taxpayer improperly claims deductions for payments made to a micro-captive for federal tax purposes. Courts have applied certain considerations to determine whether these deductions can be claimed. For example, one consideration is whether the insurance legitimately distributes risk across participating entities. IRS officials said they expend significant resources reviewing these schemes because of the varied ways insurance companies may work.

Offshore variable life insurance products, which are insurance policies with investment components over which the insured has certain control, may be abused if the individual taxpayer fails to meet IRS reporting requirements or pay appropriate federal income taxes. Federal regulations require that taxpayers with certain foreign life insurance accounts report this information to IRS and the Financial Crimes Enforcement Network. The structure of life insurance products may vary and taxpayers are required to pay taxes based on the underlying type of financial product the policy represents.

The figure below shows how noncompliance may occur when taxpayers use life insurance and micro-captive insurance in abusive tax schemes.

Abusive Use of Micro-captive and Life Insurance

Why GAO Did This Study

When structured in abusive ways, insurance products held offshore can be designed to aid in unlawful tax evasion by U.S. taxpayers. Two products that IRS has recently warned have the potential for such abuse include micro-captive insurance and variable life insurance policies.

GAO was asked to review how taxpayers may abuse offshore insurance products. This report describes (1) how offshore insurance tax shelters provide opportunities for income tax abuse; (2) how offshore micro-captive insurance is used and how it is used in abusive tax schemes; and (3) how offshore variable life insurance is used and how it is used in abusive tax schemes.

GAO reviewed IRS tax and information return forms, relevant U.S. case law and IRS guidance, academic and trade publications, and applicable statutes and regulations. GAO also interviewed IRS officials and professionals in the tax preparation and insurance industries.

For more information, contact Jessica Lucas-Judy at (202) 512-9110 or LucasJudyJ@gao.gov.