2019 Tax Filing: IRS Successfully Implemented Tax Law Changes but Needs to Improve Service for Taxpayers with Limited-English Proficiency

Fast Facts

Para la versión de esta página en español, ver a GAO-20-313.

The IRS implemented significant changes to the tax laws before the 2019 filing season.

We identified several areas where the IRS could improve customer service and facilitate compliance with tax requirements. For instance, the agency only has a few services for taxpayers with limited English-language skills, and the translated content on its website is outdated. IRS also hasn’t assessed whether to translate many of its common tax forms (such as Form 1040).

We recommended (among other things) that the IRS improve services to taxpayers with limited English skills, which could help improve compliance with tax laws.

Form 1040, flag

Highlights

Para la versión de esta página en español, ver a GAO-20-313.

What GAO Found

In advance of the 2019 filing season, the Internal Revenue Service (IRS) collaborated with the Department of the Treasury (Treasury) and the Office of Management and Budget (OMB) to implement significant tax law changes from Public Law 115-97—commonly known as the Tax Cuts and Jobs Act (TCJA). This included publishing guidance, creating tax products (e.g., forms), and reprogramming systems. IRS also took several steps to inform the public of the changes through public media campaigns and outreach.

IRS’s performance during the 2019 filing season was initially hindered by significant challenges that IRS largely overcame. As the agency implemented TCJA, a five-week lapse in appropriations furloughed many IRS employees during critical filing season preparations. This led to sharp declines in telephone service early in the filing season along with delays in paper return processing and backlogs of taxpayer correspondence. While IRS improved performance over the course of the filing season, overall performance remained lower than last year.

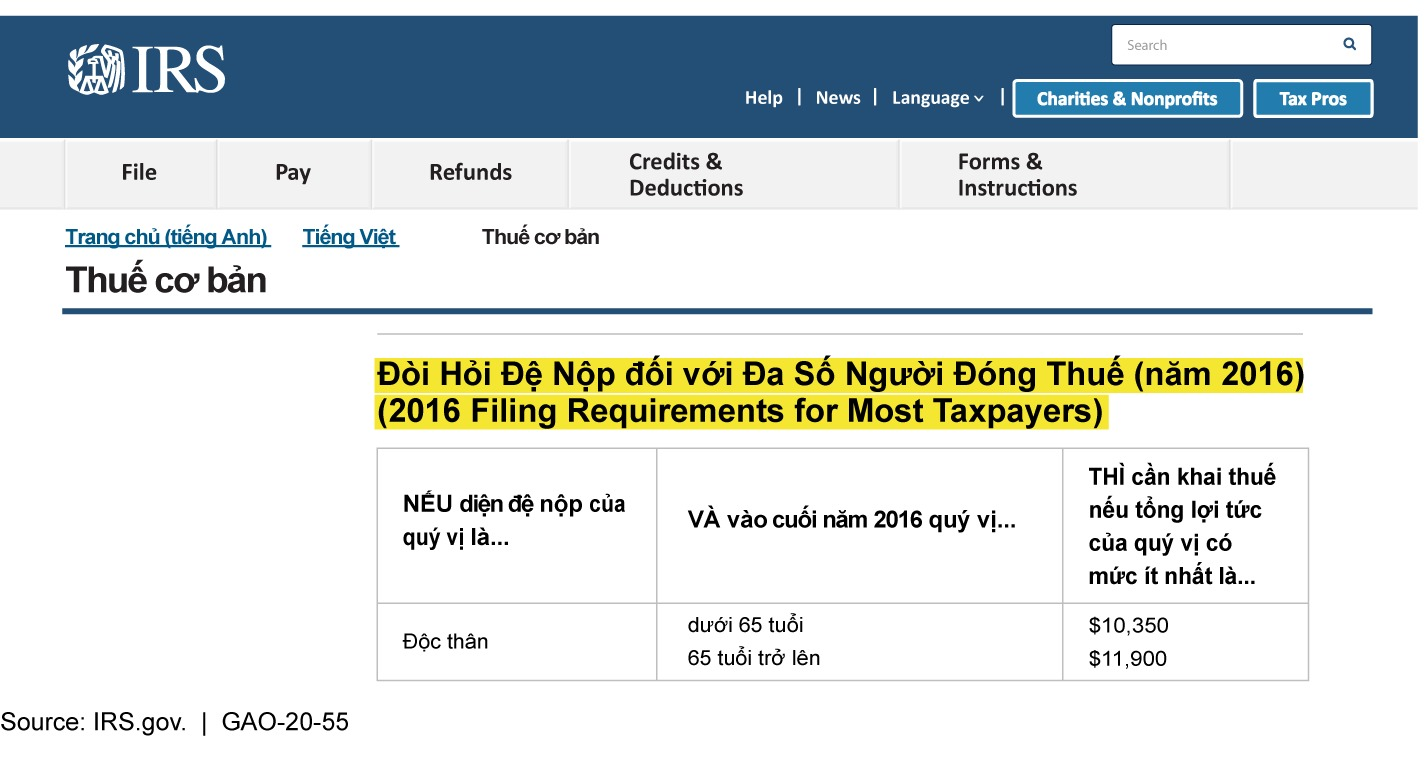

GAO identified several areas for IRS to improve customer service and facilitate compliance. First, its services to taxpayers with limited-English proficiency (LEP) are very limited, inaccurate in some cases, and difficult to access. For example, weaknesses in IRS procedures for reviewing and updating translated content lead to outdated information on its website (see figure). Also, IRS has not assessed and documented its decisions whether to translate many vital tax products, including Form 1040—one of the most commonly-used forms for individuals—and what oral interpretive services to potentially provide to taxpayers with LEP. Improving services for taxpayers with LEP will help them better understand their tax obligations and could help enhance compliance.

Figure: Outdated Translated Information on IRS.gov for 2019 Filing Season

IRS also does not regularly use employee input to evaluate the impact of customer service training on performance to identify improvements. Finally, GAO found that IRS increasingly relies on overtime to meet processing and service goals; however, IRS lacks a strategy for efficiently using overtime. Dependence on overtime can increase costs to IRS and lead to employee burnout.

Why GAO Did This Study

During the tax filing season, generally from January to mid-April, IRS processes more than 100 million individual and business tax returns and provides telephone, correspondence, online, and in-person services to tens of millions of taxpayers. The 2019 filing season is the first during which most individuals and businesses filed returns affected by major tax law changes under TCJA.

GAO was asked to review IRS’s performance implementing TCJA and managing the 2019 filing season. GAO assessed (1) IRS’s performance collaborating with Treasury and OMB to implement TCJA prior to the 2019 filing season and IRS’s efforts to communicate tax law changes to the public; (2) IRS’s performance providing customer service and processing individual and business income tax returns during the 2019 filing season compared to prior filing seasons; and (3) any opportunities that may exist to improve IRS’s ability to provide quality customer service and to facilitate taxpayer compliance. GAO analyzed IRS, Treasury, and OMB documents and data and interviewed cognizant officials.

Recommendations

GAO made 8 recommendations to IRS, including improving service to taxpayers with LEP by ensuring translated information on its website is updated, and assessing and documenting the appropriate mix of language services it should provide; using employee input to evaluate the impact of customer service training on performance; and implementing a strategy for efficient use of overtime. IRS agreed with 6 recommendations and neither agreed nor disagreed with 2 recommendations, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should make publicly available, such as on its website, a list of tax topics considered out of scope for CSRs to answer on the telephone, as well as include references for how and where to find information about these topics. (Recommendation 1) |

In response to this recommendation, during the 2020 filing season, the telephone assistance section of the IRS website featured a message notifying taxpayers that customer service representatives (CSR) are unable to assist with some topics and included a link to the Internal Revenue Manual section listing these topics. In August 2020, IRS took additional action to implement the recommendation by connecting visitors to the help section of the IRS website with more organized content on complex tax law topics considered out of scope for CSRs. The list of topics linked to publications, forms, and other relevant content. By presenting this information, IRS may decrease the number of calls received on topics CSRs are unable to address while still providing those taxpayers with the information they need to fulfill their tax obligations.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should reconcile authority and implement procedures for routinely reviewing the English versions of IRS's most commonly used vital tax products and web pages to ensure that information is included in commonly encountered languages about where taxpayers with LEP can obtain the translated content. If such content is not translated, the products and web pages should include information about where taxpayers with LEP can obtain language assistance from IRS. (Recommendation 2) |

IRS took several actions in response to the recommendation to implement procedures for expanding service to taxpayers with LEP and guiding them to assistance in their language. For example, in 2020, IRS developed a Servicewide Multilingual Improvement Strategy and other LEP initiatives that included the Language Services Executive Advisory Committee. The committee was charged with further expanding available platforms and increasing available languages across multiple channels, including digital tools, telephone assistance, tax forms and publications, written correspondence, and outreach and education. As of December 2021, IRS translated the Form 1040 into Spanish for the 2021 filing season. In addition, IRS translated publication 17 "Your Federal Income Tax (For Individuals)" into multiple languages and added more translated content online in 20 languages. Specifically, IRS translated content on its "Help" webpage under "Other Languages" on topics such as taxpayer rights. IRS also added information on how taxpayers can receive assistance in their language if they are unable to find it online. For example, as of January 2024, if IRS's translated webpage directs taxpayers to an untranslated page, IRS includes an alert in the taxpayer's chosen language on that page that the information is not translated in the taxpayer's language. The alert directs the taxpayer to IRS's "Help" webpage which provides a phone number for taxpayers to call for assistance in their language. IRS's translated versions of publication 17 also provide a link to the "Help" page. These efforts help ensure that taxpayers with LEP can obtain information in their chosen language to get assistance needed to file a return and pay taxes owed.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should reconcile authority and implement procedures for routinely reviewing its multilingual web pages to effectively prevent, or detect and correct, errors such as incorrect or outdated information. For example, these procedures could call for the divisions to work with the Linguistics, Policy, Tools, & Services (LPTS) section whenever the English version of translated content is updated. (Recommendation 3) |

IRS agreed with GAO's January 2020 recommendation and has taken action to prevent outdated multilingual web pages. In May 2024, IRS implemented a tool to ensure that each time an English webpage was revised, a request to update any translated versions of that page would also be generated through the tool. At the same time, IRS revised its policy to include this process. As a result, IRS can better ensure that its translated web content is updated when changes are made to the English version.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should conduct the four-factor assessment of its language services to persons with LEP for its most commonly used vital tax products to determine (1) which products should be translated and into what languages, and (2) what interpretation assistance will be provided to arrive at the appropriate mix of translation and interpretation services. IRS should document these assessments, including the determinations it made, and take action as appropriate based on these assessments. (Recommendation 4) |

IRS agreed with GAO's January 2020 recommendation and has taken steps to produce some of its tax products in languages other than English for taxpayers with LEP. For example, in 2021, IRS developed Form 1040-NR -- including its instructions and attendant schedules -- and Publications 334 and 519 in Spanish. IRS also developed six other tax products each in Spanish, Simplified and Traditional Chinese, Korean, Vietnamese, and Russian. However, as of December 2025, IRS has not provided us with documentation showing that it has conducted an individualized four-factor assessment for each of its most commonly used vital tax products. Treasury guidance states that it determines language services using an individualized assessment that balances the following four factors: (1) the number or proportion of persons with LEP eligible to be served or likely to be encountered; (2) frequency of interactions with a program; (3) the nature and importance of the program to people's lives; (4) the resources available and costs. Until IRS can document its decision-making with regard to translation, IRS cannot support its assertion it is ensuring meaningful access to its services that taxpayers with LEP need to understand and fulfill their tax obligations.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should collect and use employee input on the strengths and weaknesses of its customer service training, including on whether training is effective in improving CSRs' performance, to inform changes to its training program and strategy under the Taxpayer First Act. (Recommendation 5) |

IRS agreed with our recommendation and took steps to collect and use employee feedback to improve training. First, in 2022, IRS determined that level three evaluations should be completed for all mission critical training programs. Second, to ensure that these level three evaluations are completed and distributed to managers and participants in courses requiring them, IRS developed new standard operating procedures for the process that were formally approved in July 2022. By implementing a standard process to collect information from employees about the extent to which trainings affect their behavior, IRS will better understand the value of its mission critical training programs and gain insight into practical changes it could make to improve employee training.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should direct the Wage and Investment division to develop and implement a strategy, in collaboration with its strategic workforce planning initiative, for the efficient use of overtime. (Recommendation 6) |

IRS agreed with our January 2020 recommendation but stated, in December 2021, that its existing process within the Wage and Investment division for the use and approval of overtime is sufficient and it would not take any further action. However, as we reported in January 2020, offices in the Wage and Investment division had exceeded their overtime allocations in several of the preceding years. Further, we reported in April 2022 that IRS's use of overtime doubled during fiscal year 2021 compared to the prior year. In December 2022, we reported that IRS used its direct-hire authorities to help meet urgent staffing needs and address its backlog of returns. Although those helped IRS to meet its 2022 fiscal year hiring goal, many new hires were not trained on time for the filing season. As a result, IRS continued to use a mix of mandatory and voluntary overtime during the 2022 filing season to reduce its backlog. For the 2023 filing season, IRS used Inflation Reduction Act funds to help hire more than 5,000 new customer service representatives and continued its use of direct-hire authority to hire staff to support the filing season. For the 2024 filing season, IRS used IRA funding and direct hire authority to hire more employees than in the previous five filing seasons. Even with the additional staff, IRS officials said that the agency still faced challenges in some locations with processing operations. IRS continued to experience higher turnover for its filing season workforce than for the agency as a whole. In addition, IRS increased the use of overtime during the 2025 filing season. IRS officials told us that their use of mandatory and voluntary overtime was due in part to IRS's inability to hire staff because of the federal hiring freeze that went into effect before the filing season began. Dependence on overtime can contribute to skills gaps and negatively affect employee morale. We continue to believe that a strategy, in collaboration with IRS's strategic workforce planning initiative, would help ensure efficient use of overtime.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should further assess the increase in "system downtime" and identify possible solutions to mitigate any problems and reduce system downtime. (Recommendation 7) |

IRS agreed with GAO's January 2020 recommendation and took action to reduce system downtime. In July 2020, IRS said it completed a further assessment after GAO's audit and identified potential contributing factors. As of December 2020, IRS reported that it had installed new software on all laptops and workstations used by its customer service representatives (CSRs). This software enables IRS to monitor its system performance and analyze any individual or larger-scale issues affecting performance. IRS information technology staff can use the software to proactively reach out to CSRs and address issues identified by the monitoring software. IRS also implemented additional system upgrades, including new laptops for CSRs. In October 2021, IRS provided information showing improved system availability and performance as a result of the monitoring system and additional upgrades. IRS officials reported that CSR time charges to system downtime had decreased from 109 full time equivalents (FTEs) in fiscal year 2019 to 65 FTEs (as of September 18, 2021) in fiscal year 2021. These actions allowed IRS to identify problems contributing to system downtime and identify solutions to reduce it.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should perform regular monitoring of fluctuations in system downtime charges, such as increases overall or by specific units, to determine what, if any, factors are interrupting CSRs' work. (Recommendation 8) |

IRS agreed with GAO's January 2020 recommendation and said it would monitor the system downtime reported by the customer service representatives (CSR) in Customer Account Services, but its actions are not complete. As of May 2021, IRS said it had implemented changes to the call center environment and updated the CSR technology platform to further improve system availability. In October 2021, IRS provided information showing improvement in actual system availability and performance. However, as of January 2024, IRS had not demonstrated capability to regularly track timecard charges by CSRs for downtime, and as of December 2025, IRS has not provided any additional information on actions it had taken to implement our recommendations. In January 2024, IRS officials told us they did not track CSR time charges to identify system issues as they had other types of monitoring systems in place, including the one they implemented in response to our recommendation. However, time charges can reflect issues other than IRS system downtime, such as outages at a CSR's telework location, which may interrupt availability to assist taxpayers. Conducting monitoring of charges over time would better position IRS to identify and resolve any issues that could lead to increased costs and service delays to taxpayers.

|