Taxpayer Compliance: More Income Reporting Needed for Taxpayers Working through Online Platforms

Fast Facts

Smartphones and apps have made it easier for people to find work through new online marketplaces, such as ride sharing or meal delivery. But these “platform” or “gig” workers may not understand all of the tax obligations of their new job. For example, companies may classify them as independent contractors instead of employees, and they may not know to make estimated quarterly tax payments.

As the platform workforce grows, this issue could pose problems for workers and the Internal Revenue Service. Our 7 recommendations to IRS could help increase workers’ awareness of their tax responsibilities and improve their ability to comply with them.

A driver in a car transporting a passenger in a backseat using a cell phone

Highlights

What GAO Found

The platform economy is an arrangement where workers offering goods or services connect with customers through an app or other online platform. Estimates of the population of platform workers lack certainty, but generally range from around 1.5 million to 2 million workers for recent years and suggest that the platform workforce may be growing. According to stakeholders, such as researchers and tax preparers, platform workers may not realize that a company is treating them as independent contractors rather than employees and that they must comply with different tax requirements. To help address this challenge, the Internal Revenue Service (IRS) developed a communications plan aimed at workers in the platform economy (which IRS calls the gig economy).

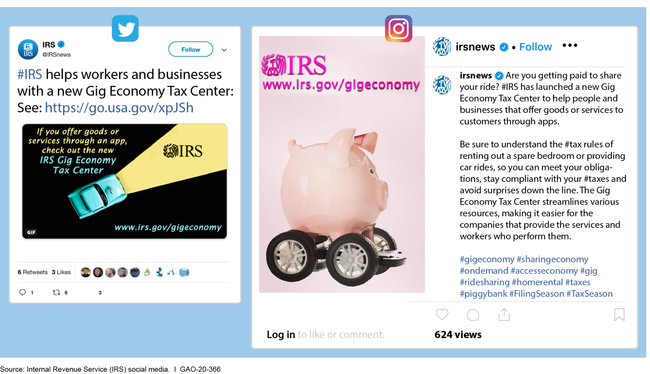

Examples of IRS's Social Media Communications Tailored for Platform Workers

The communications plan incorporates leading practices for redesigning web pages and improving the online user experience, but lacks a monitoring plan to help assure IRS's efforts address platform workers' tax challenges.

GAO found that platform workers may not receive information on their earnings, creating compliance challenges for them and enforcement challenges for IRS. GAO identified actions that could promote compliance. For example, some platform companies only report total annual payments for workers if they exceed $20,000 and 200 transactions—an amount that exceeds the average gross pay from a single company for many platform workers. Amending this rule to lower the reporting thresholds would provide workers with more information to help them comply with their tax obligations. The change could also enhance IRS's ability to ensure that these workers are correctly reporting their income. Additionally, IRS could implement voluntary withholding on payments to independent contractors (including platform workers). IRS data indicate that tax withholding substantially increases the compliance rate.

Why GAO Did This Study

Platform companies typically classify workers offering services as independent contractors and do not withhold taxes from their payments for remittance to IRS.

GAO was asked to review issues related to platform workers and tax compliance. This report, among other things, examines (1) what is known about the platform workforce, and (2) options to promote compliance among its workers.

GAO reviewed research on the U.S. platform economy and interviewed stakeholders on the tax-related challenges platform workers face; reviewed IRS documents; interviewed IRS officials; and assessed potential impacts of some options that could address platform worker tax-related challenges.

Recommendations

GAO is making seven recommendations to IRS, including actions to enhance its communications plan, increase information reporting for platform workers, and allow voluntary withholding. IRS agreed with the recommendation to enhance its communications plan. For four recommendations related to information reporting and voluntary withholding, IRS either disagreed or said it was unable to agree because it could not commit to an implementation date due to higher priorities. GAO continues to believe that all the recommendations are valid, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of IRS should change Schedule C or Form 1099-NEC so that taxpayers can identify if they received payment for platform work. (Recommendation 1) |

IRS disagreed with our recommendation to change Schedule C or Form 1099-NEC so that taxpayers can identify if they received payments for platform work. IRS said it has no evidence that platform workers pose a greater compliance risk and that the platform worker designation, by itself, would not be a selection factor for compliance actions. We found that IRS has not measured this risk, in part, because it cannot easily identify the workers. Further, we did not intend that IRS use the data to initiate compliance against the workers; our report discussed using the data to identify workers and their reporting behaviors to improve services and voluntary compliance. IRS concluded that the additional taxpayer burden and its costs were not warranted at this time. IRS did not identify the level of burden or costs, and the burden from checking a box on Schedule C does not seem high. We asked about the costs to revise the forms to add a checkbox but IRS did not provide them. As for IRS's costs to capture the data, we note that IRS's costs to transcribe the data would be zero for returns filed electronically. Individual taxpayers (including platform workers) electronically filed 138 million of 156 million (89 percent) tax returns--which includes the Schedule C--during 2019. If IRS intends to help these workers become more aware and reduce their taxpayer burdens to comply, identifying them and their tax behaviors would enhance those efforts. As of March 2025, IRS has not changed its position as originally stated in its 180-day letter in December 2020.

|

| Internal Revenue Service | The Commissioner of IRS should develop a process for monitoring feedback on its communications efforts and products tailored for platform workers, which should include documenting and evaluating feedback. (Recommendation 2) |

In May 2020, we recommended the Commissioner of IRS should develop a process for monitoring feedback on its communications efforts and products tailored for platform workers, which should include documenting and evaluating feedback. IRS agreed with this recommendation and has since taken several steps to implement it. In February 2021, IRS produced a document defining the kinds of partner feedback it intended to collect and monitor. IRS also developed a new database to collect this information, including description, details, and subsequent IRS action taken. According to IRS officials, IRS has been collecting the feedback information and relevant Communications staff monitor that information on a quarterly basis.

|

| Internal Revenue Service | The Commissioner of IRS should clarify the instructions and publications for Forms 1040 and 1099-K by adding plain language to clearly indicate to platform workers that the forms apply to them. (Recommendation 3) |

IRS agreed with this recommendation and made several changes intended to help platform workers more clearly understand which forms they should use when filing their taxes. In 2022, IRS updated Publication 334, Tax Guide for Small Business, adding clarifying language that platform workers may be considered independent contractors and may receive a Form 1099-K for consideration when determining their income. IRS also added a reference and link to the gig economy and it's landing page on the form 1099-K instructions to payees. By including plain language, platform workers may be more likely to recognize which information applies to them. Further, simplifying one aspect of the tax system for platform workers by making the forms easier to understand could lead to enhanced tax compliance.

|

| Internal Revenue Service | The Commissioner of IRS should work with the Secretary of the Treasury to amend the 6050W "tie-breaker rule" that applies to duplicative reporting requirements so that payments made through a TPSO's third party payment network are reportable under Section 6041, rather than under Section 6050W. (Recommendation 4) |

To provide workers with more information to comply with their tax responsibilities and give IRS additional information to support enforcement efforts, we recommended in 2020 that the Commissioner of IRS work with the Secretary of the Treasury to amend the 6050W "tie-breaker rule" that applies to duplicative reporting requirements so that payments made through a Third Party Settlement Organization's (TPSO) payment network are reportable under Section 6041, rather than under Section 6050W. In March 2021, Congress passed and the President signed into law the American Rescue Plan Act of 2021; the act changed reporting requirements for these platform companies by requiring information reporting for annual payments exceeding $600, down from $20,000 and 200 transactions. This Congressional action addresses GAO's recommendation. The Act increases information reporting for online platforms, which will help platform workers better compute their taxable income, and also improve taxpayer compliance. House Ways and Means Committee staff who drafted the provision credited GAO's recommendation as a non-partisan, good-governance change, which was effective in helping them to get the provision passed.

|

| Internal Revenue Service | The Commissioner of IRS should work with Treasury to determine what thresholds would be the most appropriate for payment information reporting and, if warranted, recommend that Congress adjust the thresholds. (Recommendation 5) |

IRS stated that it could not agree with our recommendation because it could not commit to implementation dates because of higher priority guidance projects, especially in light of the many new tax provisions enacted by Congress. We acknowledge IRS's need to prioritize guidance projects, but we do not understand why it does not agree to address problems that will persist into the future absent corrective actions or why IRS believes it cannot agree unless it commits now to a future implementation date. IRS said it is willing to meet with Treasury officials to discuss the need to analyze the current thresholds. The American Rescue Plan, enacted in March 2021 changed the reporting requirements, providing an excellent opportunity for IRS to analyze the amount and quality of information received before and after passage of the law. Doing so could help inform what the appropriate reporting requirements are in today's economy. During 2024, we asked IRS and Treasury officials about any research or data they have on what would be appropriate thresholds. As of March 2025, Treasury and IRS officials have not responded to our queries about determining appropriate thresholds.

|

| Internal Revenue Service | The Commissioner of IRS should work with the Secretary of the Treasury to implement withholding that is voluntary for companies making payments for services to platform workers and other independent contractors who choose to participate. (Recommendation 6) |

IRS disagreed with our recommendation to work with Treasury to implement withholding that is voluntary for companies making payments for services to workers who choose to participate. IRS said that its role is to administer tax law rather than propose tax policy changes. As we discuss in the report, IRS has the authority to take this action if the Secretary of the Treasury agrees that the action would improve tax administration and our recommendation focuses on working with Treasury officials. IRS also stated that it cannot commit to an implementation date for publishing guidance on a voluntary withholding program due to higher priorities, including implementing various COVID-19 relief programs. We do not understand why current higher priorities would prevent IRS from taking future corrective actions or why IRS believes it must commit to an implementation date at this time. We continue to believe that voluntary withholding has potential to improve compliance and reduce taxpayer burden. As of March 2025, IRS has not changed its position since it sent the 180-day letter in December 2020.

|

| Internal Revenue Service | The Commissioner of IRS should assess the impact of withholding that is voluntary for companies, once implemented, and if warranted, work with the Secretary of the Treasury on a proposal to Congress that would require TPSOs to offer tax withholding to platform workers and other independent contractors who choose to participate. (Recommendation 7) |

IRS said it would not assess the impact of such voluntary withholding and thus not work with Treasury on a proposal to Congress that would require third party settlement organizations to withhold taxes for workers who choose to participate. IRS's rationale was that it disagreed with the voluntary withholding recommendation. We believe this proposal has potential to improve compliance and an assessment would help inform Congressional deliberations about additional statutory changes that could enhance tax compliance among platform workers. As of March 2025, IRS has not changed its position since it sent the 180-day letter in December 2020.

|