Payments in Lieu of Taxes: Revisions to DOE Order Could Provide Better Assurance That Payments Meet Goals

Fast Facts

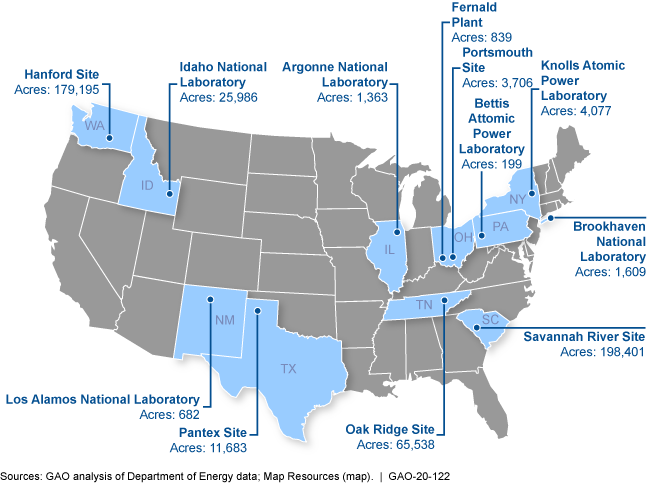

The federal government has acquired over 2 million acres for nuclear weapons development and energy research. This property is not subject to property taxes. In lieu of taxes, the Department of Energy provides payments to some local communities that host DOE sites. In fiscal year 2017, payments totaled $23 million for eligible acreage, with 70% going to communities near the largest sites—Hanford, Washington, and Savannah River, South Carolina.

DOE tries to make payments reflect what communities would have received had the property remained on the tax rolls. However, DOE has not consistently met this goal. We recommended actions to make payments more consistent.

DOE Sites with Communities that Receive Payments in Lieu of Taxes and the Amount of Acres Associated with Payments

Map showing locations in WA, ID, NM, TX, IL, TN, OH, NY, PA, and SC

Highlights

What GAO Found

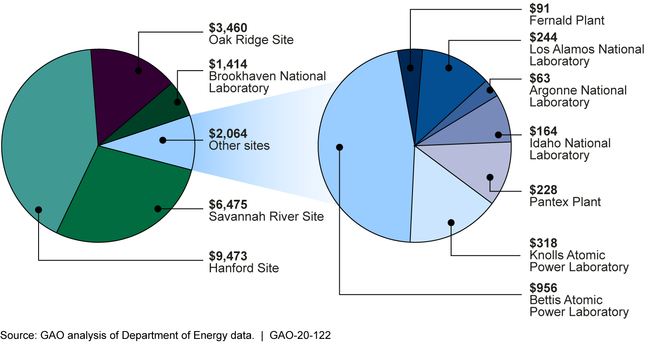

The Department of Energy's (DOE) payments in lieu of taxes (PILT)—payments made to some local communities that host DOE sites—vary considerably across the sites and have generally increased over time. Communities at 11 DOE sites received PILT payments in fiscal year 2017 (the most recent fiscal year for which complete data were available), totaling approximately $23 million (see figure). Payments to communities at the Hanford and Savannah River sites accounted for approximately 70 percent of that total, while payments to six sites combined accounted for less than 5 percent. Total PILT payments have more than doubled since 1994, primarily because of growth in payments to communities at the Hanford and Savannah River sites and because communities at other sites began receiving payments since 1994.

Payments in Lieu of Taxes Grouped by Department of Energy Site in Fiscal Year 2017 (Dollars in Thousands)

DOE intentionally allows for variations of payments across sites so that payments may reflect the revenues communities would have received had the property remained on the tax rolls in the condition in which it was acquired, which DOE officials stated is a goal of PILT. However, DOE's PILT order's lack of requirements has limited DOE's ability to provide adequate assurance that payments consistently meet this and other PILT goals. The PILT order does not require documentation of the key determinants that went into the calculation of payments, or an independent review process to determine whether payment calculations are consistent with PILT goals. The PILT order also lacks specificity about payment determinations in certain scenarios. Without updates to the PILT order to strengthen DOE's internal controls, DOE will continue to lack adequate assurance that payments meet PILT goals.

Why GAO Did This Study

The Atomic Energy Act, as amended, authorizes DOE to make PILT payments to communities that host DOE sites that meet specific criteria. PILT is discretionary financial assistance that provides payments to communities based on the property taxes they would have received had the property remained on their tax rolls.

House Report 115-230 accompanying a bill for the Energy and Water Development and Related Agencies Appropriations Act of 2018 included a provision for GAO to review DOE PILT. This report assesses (1) how PILT payments vary, if at all, by site and over time, and (2) reasons for variations in payments and the extent to which DOE is providing assurance that payments meet PILT goals.

GAO analyzed data on DOE payments to communities that DOE reported as having received PILT payments between 2008 and 2017. GAO compared 2017 data across sites and identified changes in payments to those communities between 1994 and 2017. GAO reviewed PILT's authorizing statute, DOE's PILT order, and PILT documentation. GAO interviewed officials from DOE, communities, and community organizations.

Recommendations

GAO is making three recommendations that DOE update its PILT order to: improve collection and documentation of key determinants of PILT payments, implement a review process, and clarify how communities should calculate payment requests. DOE neither agreed nor disagreed and plans instead to further study PILT. We believe our report supports implementation of these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Energy | The Secretary of Energy should direct DOE's Office of the Chief Financial Officer to revise DOE's PILT order to require DOE to maintain documentation of key determinants of PILT payments for each community to help ensure that payments are consistent with the agreed-upon bases of PILT payments and PILT goals. (Recommendation 1) |

In response to this recommendation, DOE updated its DOE Order in June 2023 to require DOE maintain documentation of key determinants of PILT payments for each community. As a result, DOE will be in a better position to assure that payments meet PILT goals.

|

| Department of Energy | The Secretary of Energy should direct DOE's Office of the Chief Financial Officer to revise DOE's PILT order to require DOE site offices to review key determinants of PILT payments in communities' PILT invoices for accuracy and consistency with the agreed-upon bases of PILT payments and PILT goals and for DOE headquarters to document its review and validation of site office determinations. (Recommendation 2) |

In response to this recommendation, DOE updated its DOE Order 143.1A in June 2023 to require DOE site offices to review key determinants of PILT payments for accuracy and consistency. As a result, DOE will be in a better position to assure that payments meet PILT goals.

|

| Department of Energy | The Secretary of Energy should direct DOE's Office of the Chief Financial Officer to revise DOE's PILT order to provide additional guidance on how communities should calculate their payment requests for their PILT invoices. (Recommendation 3) |

In response to this recommendation, DOE updated its DOE Order 143.1A in June 2023 to require DOE provide additional guidance on how communities should calculate their payment requests for their PILT invoices. As a result, DOE will be in a better position to assure that payments meet PILT goals.

|