Veterans Benefits: Actions VA Could Take to Better Protect Veterans from Financial Exploitation

Fast Facts

Wartime veterans with limited means age 65 or older and veterans with certain disabilities are eligible for VA’s pension benefit. Those who need help with daily activities, such as bathing, may receive higher payments. These veterans, with an average age over 80, are among the most vulnerable to financial exploitation.

Scams that target them include selling bad investment advice and charges for services that should be free. VA does not centrally collect and analyze information, such as complaints made against companies, that could help counter these scams and help law enforcement.

We made 4 recommendations, including that VA collect this information.

Military tags on an American flag

Highlights

Why This Matters

Veterans with disabilities who receive benefits from the Department of Veterans Affairs (VA) can be tempting targets for exploitation and scams. Veterans and their survivors who need help performing everyday activities, like bathing and dressing, can receive increased pension benefits known as aid and attendance.

Key Takeaways

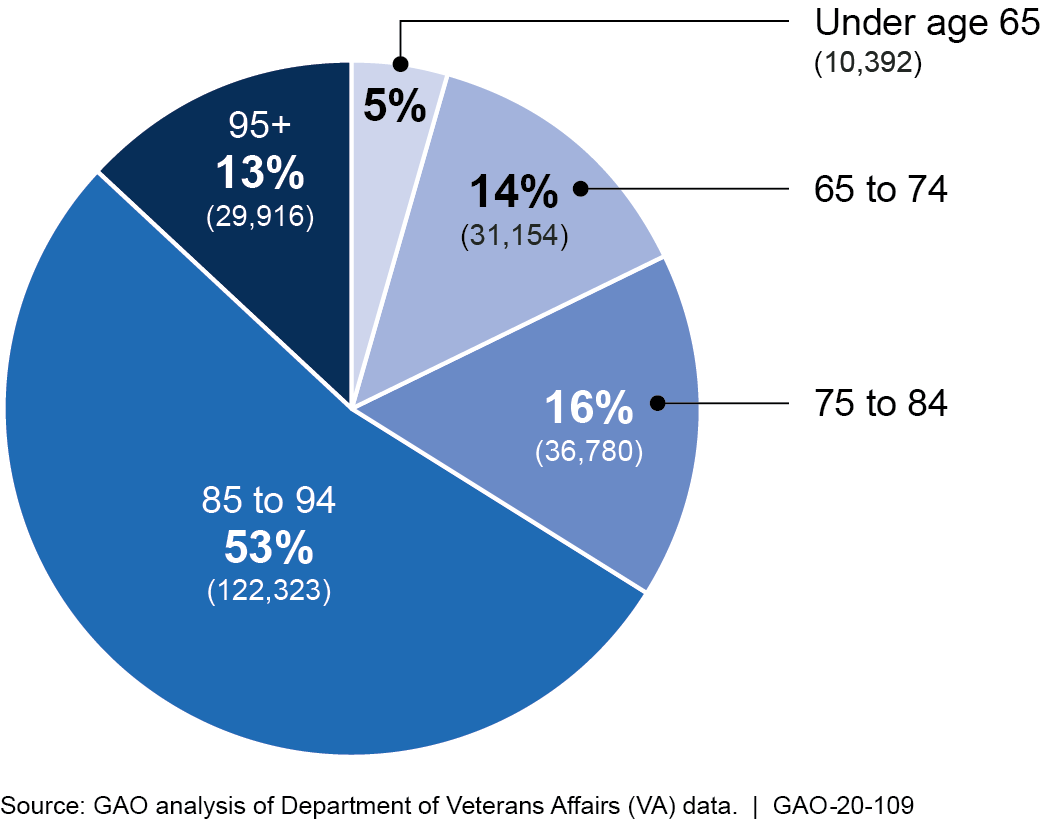

VA paid $3.2 billion in total pension benefits to 232,000 recipients of aid and attendance in fiscal year 2018. Most recipients were over 80.

Scams that target them include:

- being overcharged for home care, or charged for services they did not receive, and

- getting bad investment advice from financial services organizations.

VA does not centrally collect and analyze information, such as complaints made against companies, that could show the prevalence of these scams, help VA target outreach to veterans, and help law enforcement go after scammers.

Other threats to veterans include:

- VA’s applications do not warn them about exploitation or scams: For example, forms do not warn veterans that they cannot be charged fees for filing claims.

- Misdirected benefit payments: VA does not always verify direct deposit information on applications, which could lead to payments being stolen. In contrast, the Social Security Administration verifies this information by reviewing individuals’ checks or account statements.

Age of Veterans and Survivors Receiving Aid and Attendance as of October 2018

Recommendations

We made four recommendations to VA, including that it collect better information on potential financial exploitation, post warnings on applications, and examine if it should take more steps to verify veterans' direct deposit information. VA agreed in principle with the need to collect better information, but its proposed actions do not fully address our concerns. VA agreed with the other three recommendations.

How GAO Did This Study

We reviewed VA guidance and practices for addressing threats; interviewed VA officials, veterans groups, and other organizations and federal agencies that address financial exploitation about protecting elderly or disabled veterans; and interviewed VA staff who process aid and attendance claims.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Veterans Affairs | The Under Secretary for Benefits should systematically solicit and collect information on potential financial exploitation from VA's Pension Management Centers and other relevant VA components, including VA's Office of General Counsel, and assess this information to inform plans to address the potential exploitation of veterans receiving pension benefits. Such plans could also address the broader population of veterans with disabilities. (Recommendation 1) |

VA took several steps to address this recommendation. In February 2020, VA updated its policy manual, instructing Pension Management Centers to send copies of any OIG fraud referrals to VA's Fraud, Waste, and Abuse (FWA) Incident Team. This team plans to use the information to identify trends in potential fraud, and recommend changes to VA laws, policies, or procedures, as needed. VA also plans to use this data to coordinate with other Government agencies and offices to help prevent financial exploitation. Additionally, VA started hosting quarterly meetings in September 2020 to formalize information collection on threats to veterans, including those that may not rise to the level of fraud. According to VA, different components are participating, including VBA's Pension and Fiduciary Service, the FWA team, and VA's Office of General Counsel. VA plans to use information collected in these meetings to inform changes to VA policies and procedures. By addressing this recommendation, VA's actions should help ensure that it better understands threats to veteran and develops effective responses.

|

| Department of Veterans Affairs | The Under Secretary for Benefits should place additional warnings on paper and electronic documents, including on benefit applications, regarding fees which veterans cannot be charged. (Recommendation 2) |

As of August 2021, VA updated its paper and downloadable application forms to include information on the types of fees that attorneys and representatives may charge when helping complete a claim for pension benefits. Additionally, VA's web-based application includes a link to similar information. VA's actions will help ensure that claimants are not charged improper fees.

|

| Department of Veterans Affairs | The Under Secretary for Benefits should clarify guidance to claims processors regarding the definition and examples of questionable medical expenses in pension claims. (Recommendation 3) |

VA published updated guidance for claims processors that better defines what is a questionable expense, and provides several examples. This updated guidance should help claims processors understand when to request additional documentation, and potentially when to flag suspicious claims.

|

| Department of Veterans Affairs | The Under Secretary for Benefits should explore the costs and benefits of additional steps claims processors could take to verify that the direct deposit information provided by claimants on their applications is for the appropriate party. (Recommendation 4) |

As of February 2021, VA has updated a number of its forms to require applicants to verify their direct deposit information by including a voided personal check or a deposit slip. This includes the application for pension benefits as well as for disability compensation, Dependency and Indemnity Compensation, and VA education benefits. This change will help ensure that VA benefits are delivered to the correct individuals and not intentionally misdirected.

|