Tax Cuts and Jobs Act: Considerable Progress Made Implementing Business Provisions, but IRS Faces Administrative and Compliance Challenges

Fast Facts

According to IRS, the Tax Cuts and Jobs Act of 2017 was the most sweeping tax law change in over 3 decades—with 86 provisions that modified, added to, or repealed business and international taxes.

IRS prioritized and implemented key provisions of the act and provided taxpayer guidance.

But there are challenges to fully implementing the act. For example, tax return data related to some of the new provisions isn’t in a readily usable format. As a result, IRS may not be able to promptly identify and alert taxpayers who aren’t in compliance. We recommended determining which data would be most cost effective to transcribe, and then doing so.

Example of IRS Guidance

Cover of IRS Publication

Highlights

What GAO Found

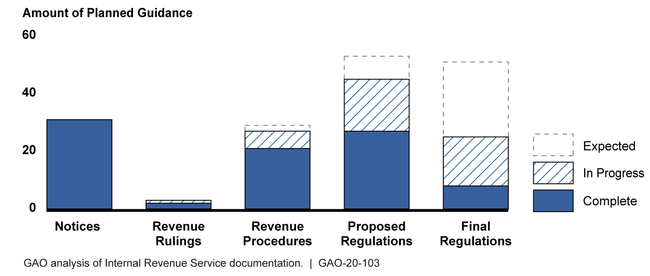

The Internal Revenue Service (IRS) has made considerable progress issuing guidance to taxpayers for Public Law 115-97—commonly known as the Tax Cuts and Jobs Act of 2017 (TCJA)—but has additional work remaining to issue all planned guidance, as shown in the figure.

Internal Revenue Service Implementation of Planned Guidance for Public Law 115-97, Commonly Known as the Tax Cuts and Jobs Act of 2017

Notes: IRS refers to regulations and other information that it considers binding on the IRS—including the types in the figure above—as guidance. This figure displays completed and planned guidance at the end of fiscal year 2019.

To improve efficiency of TCJA guidance development, IRS internally collaborated earlier and more frequently than during more routine tax law changes. IRS officials said the benefits of this enhanced collaboration included faster decision-making on time-sensitive guidance, including regulations. IRS officials agreed enhanced collaboration had value but as of December 2019 had not identified the parameters for when this collaborative approach would be warranted.

IRS may face challenges ensuring compliance with certain TCJA provisions because third-party information reporting is not always available. GAO's past work has found that one of the important factors contributing to the tax gap is the extent to which information is reported to IRS by third parties. Without third-party reporting, IRS will have to rely on resource-intensive audits to enforce certain TCJA provisions, which could be challenging given recent trends of declining audit rates and enforcement staff. GAO has recommendations from March 2019 for IRS to take actions to mitigate hiring risks and reduce skill gaps.

IRS was also unable to update all information technology systems prior to the start of the 2019 tax season due to the magnitude of TCJA changes. As a result, IRS was not able to capture certain tax return information in a format that can be easily analyzed to help with compliance planning activities. One IRS division took steps to convert certain tax return data to a more useable format, but efforts to identify other viable opportunities have not been taken. Without appropriate data for analyses, IRS could face challenges enforcing certain TCJA provisions.

Why GAO Did This Study

According to IRS, TCJA was the most sweeping tax law change in more than three decades, with 86 provisions that modified, added to, or repealed business and international taxes, such as the qualified business income deduction. IRS determined it would take significant effort to implement the law given the limited time-frame and magnitude of the provisions.

GAO was asked to review IRS's implementation of TCJA business and international provisions. Among other reporting objectives, this report examines IRS's (1) progress implementing the provisions, (2) processes to provide guidance, and (3) challenges for effectively administering these provisions.

To address these objectives, GAO analyzed IRS documentation on project management, compliance planning, and regulation development. Additionally, GAO interviewed IRS officials and tax practitioners.

Recommendations

GAO is making five recommendations, including that IRS develop and document procedures for continued enhanced collaboration and convert tax return data to a more useable format for compliance purposes. IRS disagreed; however, GAO believes that these recommendations will benefit guidance development and tax administration.

In prior work, GAO recommended that IRS measure which activities are producing desired hiring outcomes and take steps to reduce skill gaps among revenue agents. IRS agreed with these recommendations and, as of December 2019, plans to report on efforts to close skill gaps by December 2021.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Chief Counsel of the Internal Revenue Service, in coordination with appropriate offices, should identify and document parameters and procedures for applying enhanced collaborative approaches to regulation and other guidance development with IRS Business Operating Divisions. (Recommendation 1) |

As of September 2025, we have requested additional information from IRS on what actions, if any, they have taken to implement this recommendation; for example, whether IRS has taken actions in implementing other legislation (e.g., One Big Beautiful Bill Act) that would fulfill this recommendation. As of September 2024, IRS continued to disagree with this recommendation and said its Chief Counsel Directives Manual provides sufficient guidance and flexibility to allow for enhanced collaboration when appropriate. However, officials also stated that IRS Chief Counsel has continued to collaborate with IRS business units since TCJA implementation. During our audit work, IRS officials told us this collaboration was particularly helpful in implementing TCJA provisions and greatly contributed to IRS's successful implementation. In September 2024, one IRS official echoed the benefits of collaboration between IRS Chief Counsel and IRS business units. By implementing this recommendation, IRS can help ensure that institutional knowledge and beneficial practices from TCJA implementation and other implementation efforts will be documented and effectively leveraged to support implementation of future time-sensitive or complex tax law changes without restricting IRS's flexibility. Documenting procedures would ensure IRS can retain organizational knowledge and mitigate the risk of having that knowledge limited to a few personnel.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop a process to accurately and thoroughly capture implementation status of ongoing projects in accordance with Standards for Internal Control in the Federal Government. (Recommendation 2) |

In February 2020, we reported on the Internal Revenue Service's (IRS) implementation of the law commonly referred to as the Tax Cuts and Jobs Act of 2017 (TCJA). As part of this work, we found errors and inconsistencies in IRS's documentation used to track TCJA implementation, including inaccuracies and conflicting information. As a result, we recommended that IRS develop a process to accurately and thoroughly capture implementation status of ongoing projects in accordance with Standards for Internal Control in the Federal Government. Because IRS is generally no longer implementing TCJA and the office and tracking mechanisms no longer exist, we analyzed IRS's actions to implement recent substantial IRS-related legislation -- the Inflation Reduction Act -- to determine if previous deficiencies we identified were addressed. IRS's efforts to track, oversee, and monitor projects in its Inflation Reduction Act Strategic Operating Plan (IRA SOP) are consistent with and align with the spirit of our recommendation to improve TCJA implementation tracking documentation. For example, IRS officials said and IRS's documentation states that the agency plans to use the same tracking system -- Strategic Implementation Management system (SIMs) -- throughout the lifecycle of the projects, mitigating risks of data reliability problems caused by shifting tracking mechanisms in the midst of implementation. IRS documentation also notes that key project milestones will be captured in SIMs and that IRS plans to use a standard naming convention for them, mitigating risks of unique identifiers being inconsistent throughout the implementation process. Finally, according to IRS documentation, the office responsible for overall IRA SOP oversight will review and validate data with the strategic initiative leads, mitigating the risk for inaccurate data entry in SIMs. Taking these steps to mitigate potential data reliability issues is in line with Internal Control Standards to provide quality data to inform decision making and will help IRS monitor IRA SOP project implementation.

|

| Internal Revenue Service | The Commissioner of Small Business/Self Employed should coordinate with appropriate IRS divisions or offices to identify the costs and benefits of retroactively transcribing taxpayer data resulting from TCJA. (Recommendation 3) |

As of September 2025, we have requested additional information from IRS on what actions, if any, they have taken to implement this recommendation. In past updates, IRS disagreed with this recommendation and did not intend to take action on it. IRS officials said the retroactive transcription of TCJA returns would be a time intensive activity with significant opportunity costs, and that the benefits of retroactive transcription are currently not quantifiable. IRS has several efforts underway and planned to digitize historic paper documents and make the information contained on them searchable to IRS staff. As part of this effort, IRS could consider the costs and benefits of the forms it is digitizing to determine what, if any, would benefit the agency to digitize in a manner that enables IRS to use the data for compliance and enforcement purposes. A high-level analysis of costs and benefits could help IRS management determine what, if any, data would benefit compliance and enforcement efforts. IRS could use readily available existing information (such as the number of returns affected by a certain provision, LB&I and IT cost data on conversion efforts already completed, or the usefulness of past compliance analytics in similar areas) to inform the analysis. In August 2021, LB&I officials said their recent efforts to convert data from PDF forms to a more useable electronic format were resource-intensive and not all the data were usable. However, officials said there are many benefits of having data in a usable format, including having timely data available for analytics and reporting and to develop a compliance strategy. Additionally, IRS staff manually reviewed certain forms associated with one TCJA provision for compliance purposes and SB/SE officials have requested that IRS IT make more information related to this provision available in a more accessible format in the years since TJCA was enacted. In June 2024, IRS officials discussing IRS's digitization efforts stated that data extraction from scanning is very important, as it enables the digital file to be forwarded through the processing pipeline instead of a paper process. If data is not extracted from a scanned paper or PDF form, then IRS employees will have to print out the form later to process it.

|

| Internal Revenue Service | Based on the costs and benefits identified in recommendation 3, the Commissioner of Small Business/Self Employed should determine which TCJA provisions' data should be converted into a more useful electronic format for compliance and enforcement purposes and work with the appropriate offices to obtain the transcribed data, as appropriate. (Recommendation 4) |

As of September 2025, we have requested additional information from IRS on what actions, if any, they have taken to implement this recommendation. In past updates, IRS reported it disagreed with this recommendation and officials said that implementing this recommendation would require identifying the costs and benefits, which they do not plan to take action on. However, IRS officials acknowledged that IRS operating divisions and offices make strategic decisions regarding how best to use TCJA-related return data for compliance and enforcement purposes. We believe that converting data in instances where the benefits outweigh the costs would better position IRS to more effectively and efficiently pursue its mission of ensuring taxpayer compliance. For example, in the case of one TJCA provision, because IRS is not collecting information in an easily accessible format, IRS staff manually reviewed forms to help with compliance efforts. In August 2021, LB&I officials said there are many benefits of having data in a usable format, including having effective selection criteria for compliance efforts and enhancing examining agents' data analysis on cases. In June 2024, IRS officials discussing IRS's digitization efforts stated that data extraction from scanning is very important, as it enables the digital file to be forwarded through the processing pipeline instead of a paper process. If data is not extracted from a scanned paper or PDF form, then IRS employees will have to print out the form later to process it.

|

| Office of the Assistant Secretary of the Treasury (Tax Policy) |

Priority Rec.

The Assistant Secretary of Tax Policy should update Treasury's internal guidance to ensure that Treasury's regulatory impact analyses include examination of the distributional effects of revenue changes when regulations influence tax liability. (Recommendation 5) |

Treasury disagreed with this recommendation. In June 2023, Treasury entered into a new memorandum of agreement with the Office of Management and Budget (OMB) that exempted Treasury's tax regulations from OMB review. In September 2023, Treasury officials said Treasury applies a facts-and-circumstances approach to identifying instances when economic analysis is appropriate. Since that time, Executive Order 14192 directed Treasury and OMB to reinstate the April 2018 Memorandum of Agreement outlining the requirements for OMB review of tax regulations. In March 2025 Treasury officials said that they were coordinating with OMB regarding the executive order's requirement to reinstate the review of tax regulations. We maintain that decisions Treasury and IRS made when developing regulations to implement the Tax Cuts and Jobs Act could potentially impact tax liability by billions of dollars per year, thereby warranting economic analysis. To fully implement this recommendation, Treasury needs to update its internal guidance for conducting impact analyses to include examination of distributional effects of revenue changes when regulations influence tax liability. By excluding analyses of distributional effects due to changes in tax liability, including effects on tax revenue collection, Treasury and IRS risk making regulatory decisions that have significant economic effects without fully understanding the effects of those decisions.

|