Reverse Mortgages: FHA's Oversight of Loan Outcomes and Servicing Needs Strengthening

Fast Facts

Reverse mortgages allow seniors to convert part of their home equity into payments from a lender while still living in their homes. Seniors run the risk of defaulting and losing their homes if they don’t continue to pay taxes and meet other conditions.

We testified that defaults increased from 2% of loan terminations in 2014 to 18% in 2018, mostly due to borrowers failing to meet occupancy requirements or pay taxes or insurance.

The Federal Housing Administration could do a better job evaluating the performance of its reverse mortgage program and overseeing the companies that service the loans. We made 9 recommendations in a related report.

Woman on a porch with her dog

Highlights

What GAO Found

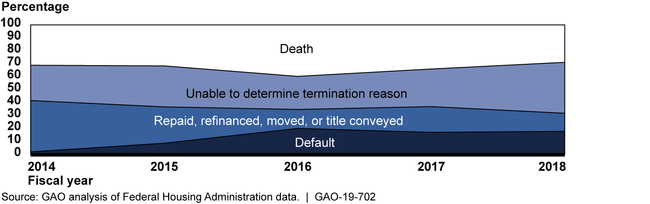

The vast majority of reverse mortgages are made under the Federal Housing Administration's (FHA) Home Equity Conversion Mortgage (HECM) program. In recent years, a growing percentage of HECMs insured by FHA have ended because borrowers defaulted on their loans. While death of the borrower is the most commonly reported reason why HECMs terminate, the percentage of terminations due to borrower defaults increased from 2 percent in fiscal year 2014 to 18 percent in fiscal year 2018 (see figure). Most HECM defaults are due to borrowers not meeting occupancy requirements or failing to pay property charges, such as property taxes or homeowners insurance. Since 2015, FHA has allowed HECM servicers to put borrowers who are behind on property charges onto repayment plans to help prevent foreclosures, but as of fiscal year-end 2018, only about 22 percent of these borrowers had received this option.

Reported Home Equity Conversion Mortgage Termination Reasons, Fiscal Years 2014–2018

FHA's monitoring, performance assessment, and reporting for the HECM program have weaknesses. FHA loan data do not currently capture the reason for about 30 percent of HECM terminations (see figure). FHA also has not established comprehensive performance indicators for the HECM portfolio and has not regularly tracked key performance metrics, such as reasons for HECM terminations and the number of distressed borrowers who have received foreclosure prevention options. Additionally, FHA has not developed internal reports to comprehensively monitor patterns and trends in loan outcomes. As a result, FHA does not know how well the HECM program is serving its purpose of helping meet the financial needs of elderly homeowners.

FHA has not conducted on-site reviews of HECM servicers since fiscal year 2013 and has not benefited from oversight efforts by the Consumer Financial Protection Bureau (CFPB). FHA officials said they planned to resume the reviews in fiscal year 2020, starting with three servicers that account for most of the market. However, as of August 2019, FHA had not developed updated review procedures and did not have a risk-based method for prioritizing reviews. CFPB conducts examinations of reverse mortgage servicers but does not provide the results to FHA because the agencies do not have an agreement for sharing confidential supervisory information. Without better oversight and information sharing, FHA lacks assurance that servicers are following requirements, including those designed to help protect borrowers.

Why GAO Did This Study

This testimony summarizes the information contained in GAO's September 2019 report, entitled Reverse Mortgages: FHA Needs to Improve Monitoring and Oversight of Loan Outcomes and Servicing (GAO-19-702).

For more information, contact Alicia Puente Cackley at (202) 512-8678 or cackleya@gao.gov.