Reverse Mortgages: FHA Needs to Improve Monitoring and Oversight of Loan Outcomes and Servicing

Fast Facts

Reverse mortgages allow seniors to convert part of their home equity into payments from a lender while still living in their homes. Seniors run the risk of defaulting and losing their homes if they don’t continue to pay taxes and meet other conditions.

Defaults increased from 2% of loan terminations in 2014 to 18% in 2018, mostly due to borrowers failing to meet occupancy requirements or pay taxes or insurance.

The Federal Housing Administration could do a better job evaluating the performance of its reverse mortgage program and overseeing the companies that service the loans. We made 9 recommendations to improve FHA’s oversight of the program.

Woman on a porch with her dog

Highlights

What GAO Found

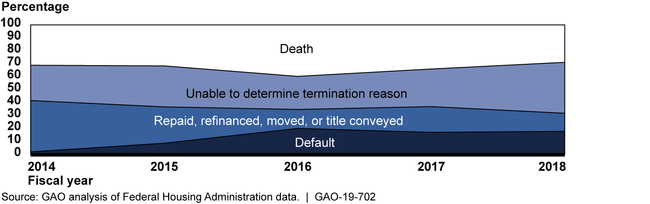

The vast majority of reverse mortgages are made under the Federal Housing Administration's (FHA) Home Equity Conversion Mortgage (HECM) program. In recent years, a growing percentage of HECMs insured by FHA have ended because borrowers defaulted on their loans. While death of the borrower is the most commonly reported reason why HECMs terminate, the percentage of terminations due to borrower defaults increased from 2 percent in fiscal year 2014 to 18 percent in fiscal year 2018 (see figure). Most HECM defaults are due to borrowers not meeting occupancy requirements or failing to pay property charges, such as property taxes or homeowners insurance. Since 2015, FHA has allowed HECM servicers to put borrowers who are behind on property charges onto repayment plans to help prevent foreclosures, but as of fiscal year-end 2018, only about 22 percent of these borrowers had received this option.

Reported Home Equity Conversion Mortgage Termination Reasons, Fiscal Years 2014–2018

FHA's monitoring, performance assessment, and reporting for the HECM program have weaknesses. FHA loan data do not currently capture the reason for about 30 percent of HECM terminations (see figure). FHA also has not established comprehensive performance indicators for the HECM portfolio and has not regularly tracked key performance metrics, such as reasons for HECM terminations and the number of distressed borrowers who have received foreclosure prevention options. Additionally, FHA has not developed internal reports to comprehensively monitor patterns and trends in loan outcomes. As a result, FHA does not know how well the HECM program is serving its purpose of helping meet the financial needs of elderly homeowners.

FHA has not conducted on-site reviews of HECM servicers since fiscal year 2013 and has not benefited from oversight efforts by the Consumer Financial Protection Bureau (CFPB). FHA officials said they planned to resume the reviews in fiscal year 2020, starting with three servicers that account for most of the market. However, as of August 2019, FHA had not developed updated review procedures and did not have a risk-based method for prioritizing reviews. CFPB conducts examinations of reverse mortgage servicers but does not provide the results to FHA because the agencies do not have an agreement for sharing confidential supervisory information. Without better oversight and information sharing, FHA lacks assurance that servicers are following requirements, including those designed to help protect borrowers.

Why GAO Did This Study

Reverse mortgages allow seniors to convert part of their home equity into payments from a lender while still living in their homes. Most reverse mortgages are made under FHA's HECM program, which insures lenders against losses on these loans. HECMs terminate when a borrower repays or refinances the loan or the loan becomes due because the borrower died, moved, or defaulted. Defaults occur when borrowers fail to meet mortgage conditions such as paying property taxes. These borrowers risk foreclosure and loss of their homes. FHA allows HECM servicers to offer borrowers foreclosure prevention options. Most HECM servicers are supervised by CFPB. GAO was asked to review HECM loan outcomes and servicing and related federal oversight efforts. Among other objectives, this report examines (1) what FHA data show about HECM terminations and the use of foreclosure prevention options, (2) the extent to which FHA assesses and monitors the HECM portfolio, and (3) the extent to which FHA and CFPB oversee HECM servicers. GAO analyzed FHA loan data and FHA and CFPB documents on HECM servicer oversight. GAO also interviewed agency officials, the five largest HECM servicers (representing 99 percent of the market), and legal aid groups representing HECM borrowers.

Recommendations

GAO makes eight recommendations to FHA to, among other things, improve its monitoring and assessment of the HECM portfolio and oversight of HECM servicers, and one recommendation to CFPB to share HECM servicer examination information with FHA. FHA and CFPB generally agreed with the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Housing Administration | The FHA Commissioner should take steps to improve the quality and accuracy of HECM termination data. These steps may include updating the termination reasons in the HERMIT system or updating the HERMIT User Guide to more clearly instruct servicers how to record termination reasons. (Recommendation 1) |

FHA implemented this recommendation by updating how default codes and termination reasons are recorded in the HERMIT system. For example, FHA revised its HERMIT termination codes to improve the accuracy and completeness of termination reasons entered by servicers, and so that default codes and termination codes were unique and not overlapping. FHA also made corresponding changes to its HERMIT User Guide.

|

| Federal Housing Administration | The FHA Commissioner should establish, periodically review, and report on performance indicators for the HECM program—such as the percentage of terminations due to borrower defaults, the proportion of active HECMs with delinquent property charges, the amount of servicer advances, and the percentage of distressed borrowers who have received foreclosure prevention options—and examine the impact of foreclosure prevention options in the forthcoming HECM program evaluation. (Recommendation 2) |

As of September 2021, FHA established metrics for its reverse mortgage portfolio and evaluated foreclosure prevention options.

|

| Federal Housing Administration | The FHA Commissioner should develop analytic tools, such as dashboards or watch lists, to better monitor outcomes for the HECM portfolio, such as reasons for HECM terminations, defaults, use of foreclosure prevention options, or advances paid by servicers on behalf of HECM borrowers. (Recommendation 3) |

In fiscal year 2021, FHA began utilizing a HECM dashboard that is updated monthly and, according to agency officials, is used to brief the FHA Commissioner. The dashboard includes data on metrics such insurance claims, tax and insurance defaults, repayment plans, and corporate advances for property taxes and insurance.

|

| Federal Housing Administration | The FHA Commissioner should evaluate FHA's foreclosure prioritization process for FHA-assigned loans. Such an analysis should include the implications that the process may have for HECM borrowers, neighborhoods, and FHA's insurance fund. (Recommendation 4) |

FHA took steps broadly consistent with our recommendation. In fiscal year 2021, FHA began using note sales as its primary disposition option for defaulted FHA-assigned loans. This decision was consistent with an analysis by FHA's Office of Asset Sales that found (1) FHA-assigned loans (and the associated properties) remain in FHA's custody for long periods and have high holding costs and (2) note sales help maximize recoveries on the loans.

|

| Federal Housing Administration | The FHA Commissioner should develop and implement procedures for conducting on-site reviews of HECM servicers, including a risk-rating system for prioritizing and determining the frequency of reviews. (Recommendation 5) |

FHA implemented this recommendation by issuing a HECM Servicing Review Guide in February 2020, completing reviews of the three largest HECM servicers in fiscal year 2020, and developing a targeting methodology in September 2020 that includes a risk-rating system for prioritizing and determining the frequency of future reviews.

|

| Federal Housing Administration | The FHA Commissioner should work with CFPB to complete an agreement for sharing the results of CFPB examinations of HECM servicers with FHA. (Recommendation 6) |

Consistent with our recommendation, FHA and CFPB completed a memorandum of understanding in January 2021 allowing the agencies to share information with respect to HECM servicers.

|

| Consumer Financial Protection Bureau | The CFPB Director should work with FHA to complete an agreement for sharing the results of CFPB examinations of HECM servicers with FHA. (Recommendation 7) |

Consistent with our recommendation, CFPB and FHA completed a memorandum of understanding in January 2021 allowing the agencies to share information with respect to HECM servicers.

|

| Federal Housing Administration | The FHA Commissioner should collect and record consumer inquiries and complaints in a manner that facilitates analysis of the type and frequency of the issues raised. (Recommendation 8) |

Consistent with our recommendation, FHA started using a different and more robust system to collect and record consumer inquiries and complaints about HECMs (FHA also uses the system to collect and record forward mortgage inquires and complaints). Staff from FHA's Resource Center are responsible for monitoring and reporting from the system. The system facilitates analysis of the type and frequency of issues raised by HECM borrowers. Additionally, the system consolidates HECM complaints into roughly 30 categories, allowing FHA staff and management to more easily analyze them.

|

| Federal Housing Administration | The FHA Commissioner should periodically analyze available internal and external consumer complaint data about reverse mortgages to help inform management and oversight of the HECM program. (Recommendation 9) |

Consistent with our recommendation, FHA began using a different system to collect and record consumer complaints about HECMs and uses that system to generate monthly reports for FHA senior management. Additionally, FHA has worked with its Resource Center-the entity that collects consumer inquires-to monitor and analyze complaints related to HECM borrowers and properties. For example, FHA officials said they have begun to analyze trends in complaints by mortgage servicer. Lastly, FHA has periodically analyzed HECM consumer complaint data from the Consumer Financial Protection Bureau.

|