Private School Choice: Accountability in State Tax Credit Scholarship Programs

Fast Facts

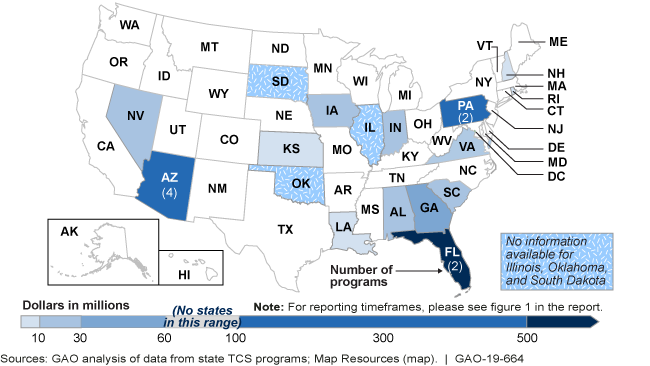

Seventeen states offer state tax credits for donations to organizations that fund scholarships for students to attend private schools. The President’s 2020 budget request proposes new federal tax credits for such donations.

In 2017, scholarship organizations in these states received over $1.1 billion in donations.

We reviewed state requirements for finances, academics, and other topics and found:

All programs limit the percentage of donations that may be used to administer programs (2-20%)

11 programs require academic testing

States with the largest programs vary in how they monitor participating private schools

States with Tax Credit Scholarship Programs as of January 2019, by Donations Received during 2017

United States map showing the following states have programs: NV, AZ, KS, IA, LA, IN, AL, GA, PA, VA, and SC and no information for SD, IL, or OK.

Highlights

What GAO Found

State tax credit scholarship (TCS) programs—programs that offer state tax credits for donations that can fund scholarships for students to attend private elementary and secondary schools—have established various key requirements for the scholarship granting organizations (SGO) that collect donations and distribute awards. For example, all 22 TCS programs in operation as of January 2019 require SGOs to register with or be approved by the state and limit the percentage of donations they can use for non-scholarship expenses. In addition, almost all of these programs—which received over $1.1 billion in donations and awarded approximately 300,000 scholarships in 2017—also require SGOs to undergo annual financial audits or reviews (19 programs). Fewer programs have requirements about SGO fundraising practices (9 programs) or the qualifications of SGO leadership personnel (10 programs), such as restrictions on officials having previous bankruptcies.

States also have various key requirements that apply to private schools that enroll students with TCS scholarships. For example, private schools in most of the 22 programs must follow certain academic guidelines related to curriculum content (18 programs) and instructional time (19 programs), and have staff undergo background checks (18 programs). Schools in fewer programs are required to conduct academic testing (11 programs), ensure their teachers have specified qualifications (12 programs), or undergo an annual audit or financial review (4 programs).

Images of Three Private Schools That Participate in State Tax Credit Scholarship Programs

The three states with the largest TCS programs—Arizona, Florida, and Pennsylvania—implement and oversee their programs in different ways. In all three states, state agencies administer the tax credits while SGOs are generally responsible for managing donations and awarding scholarships; the details of these processes varied based on the requirements of each program. For example, Arizona and Pennsylvania's programs allow donors to recommend that funds go to specific schools, which can affect how SGOs solicit donations and award scholarships. Florida does not permit recommendations. All three states require SGOs to report on operations and undergo annual financial audits or reviews, while the states differ in how participating private schools are overseen. Florida's TCS programs use multiple monitoring methods, while all Arizona programs and one of two Pennsylvania programs generally rely on SGOs to confirm that schools comply with program requirements.

Why GAO Did This Study

All TCS programs are state programs. States develop program policies and requirements, including establishing the roles and responsibilities of SGOs and participating private schools. The President's fiscal year 2020 budget request included a proposal for federal tax credits for donations to state-authorized SGOs. GAO was asked to review key characteristics related to accountability in state TCS programs that can fund K-12 educational expenses.

This report examines (1) key requirements state TCS programs have chosen to establish for SGOs, (2) key requirements for private schools participating in state TCS programs, and (3) how selected states implement TCS programs and assess whether SGOs and participating private schools are following key state requirements.

GAO identified key requirements states may choose to establish related to accountability for SGOs and schools based on relevant research and prior work. GAO also reviewed program documents from all 22 TCS programs to identify whether they had these key requirements as of school year 2018-2019 and then verified this information with state program officials. GAO did not conduct an independent review of state laws and regulations. GAO visited Arizona, Florida, and Pennsylvania, which have the largest TCS programs. In each of these states, GAO reviewed program documents and interviewed officials at state agencies and staff at selected SGOs and private schools (selected to provide variation in size and other characteristics).

For more information, contact Jacqueline M. Nowicki at (617) 788-0580 or nowickij@gao.gov.