Department of Defense: Process Improvements Needed in Recouping Overpayments to Service Members

Fast Facts

The Department of Defense sometimes makes errors and overpays service members. DOD has acknowledged that its collections for overpayments have placed an undue burden on service members and, at times, damaged credit scores and led to garnished wages.

DOD has streamlined its debt collection regulation but key parts of it were incomplete and unclear—and the services didn’t consistently follow it. For example, some service members were not properly notified of their debt or the right to dispute it.

We made 5 recommendations to help ensure DOD's debt collection regulations, policies, and procedures are clear and carried out consistently.

An aerial photo of the Pentagon

Highlights

What GAO Found

Key aspects of the Department of Defense's (DOD) Debt Collection Regulation—which includes rules for recoupment of service member overpayments—are incomplete or unclear. For example, the regulation requires that certain pieces of information be included in the letter notifying service members of DOD-related debts. However, we found that the letter's template in the Debt Collection Regulation is missing two of the required pieces of information, including that any portion of a debt remaining at the time of separation may be collected from the service member's final pay and allowances. Additionally, the regulation does not clearly state whether or when to suspend collection actions during the review process for service members formally disputing their debt. As a result, the military services (Army, Navy, Air Force, and Marine Corps) and the Defense Finance and Accounting Service (DFAS)—which carry out the regulation—do not have clear direction when administering debt collection activities, which has led to inconsistent application. Further, service members may not be fully informed of the rights and protections to which they are entitled.

GAO also found that the military services' debt collection policies and procedures do not consistently follow the DOD Debt Collection Regulation. Specifically, debt notification letters that GAO reviewed did not consistently include all 18 pieces of information required by the DOD Debt Collection Regulation. For example, letters did not explain service members' right to a written decision of a review or their right to inspect and copy records related to the debt. Further, the military services' policies and procedures often were not current, complete, or clear. As a result, some service members may not have been properly notified of their debt, their rights to dispute it, or the potential consequences of inaction, such as involuntary payroll deduction. Unless the military services and DFAS fully incorporate the DOD Debt Collection Regulation into their respective policies and procedures, service members will likely continue to receive inaccurate and incomplete information about their debts and related rights and protections.

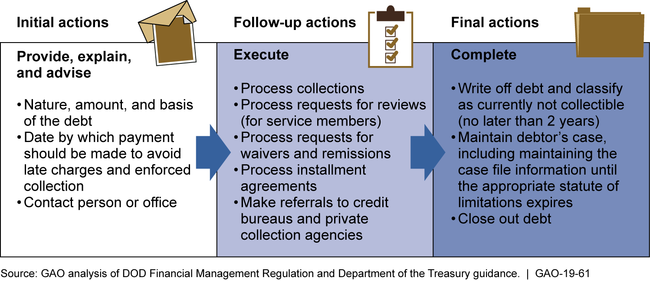

Elements of Department of Defense (DOD) Debt Collection Process for Service Members and DOD Civilian Employees

Why GAO Did This Study

DOD sometimes overpays service members due to errors in administrative processing of pay and allowances, and calculating pay and leave. Nearly 400 Debt Collection Offices in DOD are responsible for the recovery and collection of debts (see figure for basic elements of the debt collection process). DOD has acknowledged that collection actions related to overpayments have placed undue burden on service members and their families, such as financial hardship, garnished wages, and damaged credit scores.

House Report 115-200 accompanying the National Defense Authorization Act for Fiscal Year 2018 included a provision for GAO to study DOD's process for recoupment of service member overpayments. This report evaluates the extent to which (1) the DOD Debt Collection Regulation is clear, and (2) military services' and DFAS policies and procedures follow DOD Debt Collection Regulation. GAO reviewed DOD regulations on debt collection, interviewed DOD officials, and examined non-generalizable samples of debt notification letters sent to serving and separated service members between January 2016 and May 2018.

Recommendations

GAO is making five recommendations to DOD to help ensure its debt collection regulations, policies, and procedures are clear and carried out consistently. DOD concurred with all of the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Defense | The Under Secretary of Defense (Comptroller) should revise the service member debt notification letter template to include all of the information required by DOD Financial Management Regulation Volume 16. (Recommendation 1) |

The Department of Defense (DOD) agreed with this recommendation. In August 2019, the Defense Finance and Accounting Services (DFAS) took action to update the DOD Financial Management Regulation (FMR), Volume 16, Chapter 2, "General Instructions for Collection of Debt Owed to DOD," Figure 2-2 "Military Sample Debt Notification Letter for Overpayment of Pay and/or Allowances" to include all of the information required by the DOD FMR Volume 16. We consider these actions sufficient to close this recommendation as implemented.

|

| Department of Defense | The Under Secretary of Defense (Comptroller), in coordination with DFAS, should revise DOD Financial Management Regulation Volume 16 and the DFAS website to clearly state whether and when collection action should be suspended during the review process for service members who dispute their debt. (Recommendation 2) |

The DOD agreed with this recommendation. In August 2019, DFAS updated the DOD FMR Volume 16, Chapter 4, "Hearing, Informal Disputes, Waivers and Remission of Debt owed by Individuals" to clarify the suspension of collection action during the review process. DFAS also updated it's website accordingly to address the suspension of collection action for service members during the review process. We consider these actions sufficient to close this recommendation as implemented.

|

| Department of Defense | The Under Secretary of Defense (Comptroller) should ensure that cross-references within each chapter related to debt collection functions in the FMR are current, relevant, and updated in a timely fashion. (Recommendation 3) |

The DOD agreed with this recommendation. In August 2019, DFAS updated the DOD FMR Volume 16, Chapter 2, "FMR Revision Process" to address this recommendation, including information that instructs how to update the FMR to help ensure that cross-references within and among chapters are updated in a timely fashion. We consider these actions sufficient to close this recommendation as implemented.

|

| Department of Defense | The Secretary of Defense should direct the Secretaries and Commandant of the military services, and the Director of DFAS where these responsibilities are shared, to review and update outdated debt collection procedures; update service level debt notification letter templates; and clarify debt and due process procedures applicable to the recoupment of DOD overpayment debts from service members for consistency with DOD Financial Management Regulation Volume 16 and other applicable areas of the Financial Management Regulation. (Recommendation 4) |

The DOD agreed with this recommendation. In March 2019, the Under Secretary of Defense (Comptroller), sent a memorandum to the Director of DFAS and the Military Services, directing DFAS to update DOD FMR Volume 16, and the Military Services to ensure their debt collection policies and procedures comply accordingly. DFAS provided the debt collection procedures and debt notification letter templates to the Defense Military Pay Offices directing compliance with the updated FMR, Volume 16. We consider these actions sufficient to close this recommendation as implemented.

|

| Department of Defense | The Secretary of Defense should direct the Secretaries and Commandant of the military services, and the Director of DFAS, to ensure that all of the information required by DOD Financial Management Regulation Volume 16 is included in debt notification letters sent to service members. (Recommendation 5) |

The DOD agreed with this recommendation. In March 2019, the Under Secretary of Defense (Comptroller) directed DFAS to update the DOD FMR Volume 16 to address recommendations in GAO-19-61. In June 2019, DFAS sent updated Debt Notification Letters to the Military Pay Offices and directed that the letters be used immediately. We consider these actions sufficient to close this recommendation as implemented.

|