Bank Secrecy Act: Agencies and Financial Institutions Share Information but Metrics and Feedback Not Regularly Provided

Fast Facts

The Bank Secrecy Act requires financial institutions to report information to the federal government that law enforcement can use to investigate potential crimes, like money laundering.

Industry representatives told us that generating reports on suspicious activity can be labor intensive, and that they would like more feedback on whether the reports they submitted were useful.

We found the Treasury Department and some law enforcement agencies measured things like how many reports produced investigations. However, these metrics were not consistently communicated.

We made 4 recommendations, including for regular feedback.

Department of the Treasury building

Highlights

What GAO Found

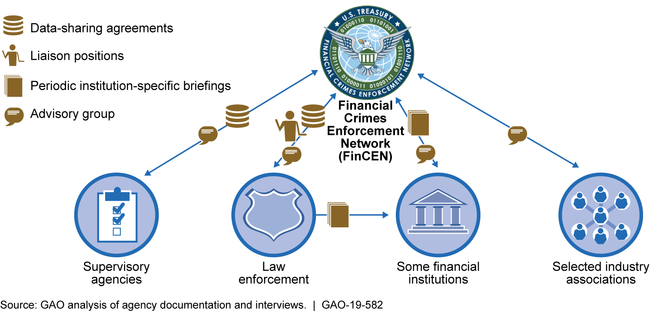

The Financial Crimes Enforcement Network (FinCEN)—within the Department of Treasury—supervisory agencies (such as banking, securities, and futures regulators), and law enforcement agencies collaborate on implementing Bank Secrecy Act/anti-money laundering (BSA/AML) regulations, primarily through cross-agency working groups, data-sharing agreements, and liaison positions.

Key Bank Secrecy Act/Anti-Money Laundering Collaboration Mechanisms

FinCEN and law enforcement agencies provided some metrics and institution-specific feedback on the usefulness of BSA reporting (such as suspicious activity reports) to the financial industry but not regularly or broadly.

- FinCEN and some agencies have metrics on the usefulness of BSA reports. One law enforcement agency annually publishes aggregate metrics on BSA reports that led to investigations and indictments. But FinCEN did not consistently communicate available metrics; it generally did so on an ad-hoc basis such as through published speeches. In 2019, FinCEN began a study to identify measures on the value and usefulness of BSA reporting—to be completed by the end of 2019. By consistently communicating currently available metrics (summary data), and any later identified by the study, FinCEN may assist financial institutions in more fully understanding the importance of their efforts.

Industry associations GAO interviewed noted financial institutions would like to receive more institution-specific feedback on the usefulness of their BSA reporting; they also identified suspicious activity reports as labor-intensive. In 2017, FinCEN began providing such feedback and some law enforcement agencies have ongoing efforts to provide institution-specific briefings. But these efforts have not been regularly made and involved relatively few institutions. Additional and more regular feedback, designed to cover different types of financial institutions and those with significant financial activity, may enhance the ability of the U.S. financial industry to effectively target efforts to identify suspicious activity and provide quality BSA reporting.

Why GAO Did This Study

Illicit finance activity, such as terrorist financing and money laundering, can pose threats to national security and the integrity of the U.S. financial system. FinCEN is responsible for administering BSA and has delegated examination responsibility to supervisory agencies. FinCEN also is to collect and disseminate BSA data. BSA requires that financial institutions submit reports, which may be used to assist law enforcement investigations. Industry perspectives on BSA reporting have included questions about its usefulness.

This report examines, among other objectives, how FinCEN and supervisory and law enforcement agencies (1) collaborate and (2) provide metrics and feedback on the usefulness of BSA reporting. GAO reviewed related laws and regulations; agency documentation; examination and enforcement action data; and interviewed FinCEN, supervisory agencies, and a nongeneralizable selection of six law enforcement agencies and seven industry associations.

Recommendations

GAO makes four recommendations, including that FinCEN review options to consistently communicate summary data and regularly provide institution-specific feedback on its BSA reporting. FinCEN concurred with the recommendation on summary data and agreed with the spirit of the recommendation on feedback. FinCEN raised concerns with the need for the two other recommendations. GAO continues to believe the recommendations have merit, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Financial Crimes Enforcement Network | The Director of FinCEN, after consulting with the Commodity Futures Trading Commission (CFTC), should consider prioritizing the inclusion of the primary SRO conducting BSA examinations in the futures industry in the Bank Secrecy Act Advisory Group (BSAAG) on a more consistent basis and also making the primary futures industry association a concurrent member. (Recommendation 1) |

Although FinCEN disagreed with this recommendation, it took actions consistent with the intent of the recommendation--more consistent futures industry participation in BSAAG, particularly by the primary SRO conducting BSA examinations. We reported in August 2019 that officials from the primary futures SRO expressed concern that they were not a regular member of BSAAG. After a 5-year period of not being a BSAAG member, they were invited to be a member again in March 2018 and were accepted for a 3-year membership term. FinCEN again selected the primary futures SRO as a BSAAG member in 2021, with another 3-year term expiring in 2024. In 2021, FinCEN also considered an application by the primary futures industry association, and although it was denied, encouraged the association to apply again in the future. FinCEN officials said that they anticipate continued engagement with the futures industry but, per its policy, cannot commit to maintaining the membership of any specific BSAAG member.

|

| Financial Crimes Enforcement Network | The Director of FinCEN, after consulting with CFTC, should take steps to explore providing direct BSA data access to the National Futures Association. (Recommendation 2) |

While FinCEN disagreed with this recommendation, both FinCEN and CFTC staff confirmed that FinCEN had advised CFTC staff on the areas the National Futures Association should include as part of a request for direct BSA data access. Specifically, FinCEN consulted with CFTC staff by detailing the information needed for FinCEN to process NFA's request for database access. NFA submitted its data access request to FinCEN in December 2020.

|

| Financial Crimes Enforcement Network | The Director of FinCEN should review options for FinCEN to more consistently and publicly provide summary data on the usefulness of BSA reporting. This review could either be concurrent with FinCEN's BSA value study or through another method. (Recommendation 3) |

Since this report was issued, the National Defense Authorization Act for Fiscal Year 2021 (NDAA) placed several new requirements on the Department of Justice (DOJ) and FinCEN relating to providing summary data on the usefulness of BSA reports. Specifically, section 6201 requires DOJ to annually submit summary statistics on agencies' use of BSA reporting. We believe that implementing this provision would be consistent with the intent of our recommendation, but with DOJ, rather than FinCEN, responsible for producing summary statistics. As we reported in August 2022 (in GAO-22-105242) FinCEN also believes that implementing this provision could address gaps in data collection identified in its study, and allow the agency to provide additional feedback on the usefulness of BSA reporting. Further, as part of the BSA value study FinCEN completed in 2020, it requested comprehensive data from agencies on the value of BSA reporting and found that agencies collected these data inconsistently or not at all and concluded that FinCEN would need standardized data sets on the use of BSA reports for such an assessment. By completing the BSA value study assessment of summary data on the usefulness of BSA reporting and the shift in responsibility to DOJ to annually submit summary statistics on the use of BSA reporting, we consider this recommendation closed as implemented.

|

| Financial Crimes Enforcement Network | The Director of FinCEN should review options for establishing a mechanism through which law enforcement agencies may provide regular and institution-specific feedback on BSA reporting. Options should take into consideration providing such feedback to cover different types of financial institutions and those with significant financial activity. This review could either be part of FinCEN's BSA value study or through another method. (Recommendation 4) |

Since this report was issued, the National Defense Authorization Act for Fiscal Year 2021 (NDAA) placed several new requirements on FinCEN relating to feedback on the use of BSA reports. Sections 6203 and 6206 require FinCEN to provide additional feedback to financial institutions on the usefulness of BSA reports and to share threat pattern and trend information. In August 2022, we reported that FinCEN had taken steps to provide institution-specific feedback through existing mechanisms and had taken steps to enhance these mechanisms, such as by developing region-based FinCEN Exchanges. FinCEN also plans to expand feedback on the use of BSA reports by implementing another requirement of the NDAA--the creation of a domestic liaison office. FinCEN officials stated this office would be dedicated to outreach and help fulfill NDAA requirements for engagement with individual institutions. Officials said efforts related to section 6203 of the NDAA would be the responsibility of the office's director. By reviewing options for establishing feedback mechanisms and planning to implement the domestic liaison office to help address providing institution-specific feedback, this recommendation is closed as implemented.

|