Financial Services Industry: Representation of Minorities and Women in Management and Practices to Promote Diversity, 2007-2015

Fast Facts

This testimony looks at trends in the diversity of financial services firms' management and potential talent pools, among other things.

From 2007 through 2015, we found that

Overall minority representation in management increased from 17.3% to 21%

Asian representation increased from 5.4% to 7.7%. Hispanic representation had smaller gains. In contrast, African-Americans representation in management decreased from 6.5% to 6.3%

Women's representation was unchanged at about 45%

An aerial view of a bunch of hands on top of each other.

Highlights

What GAO Found

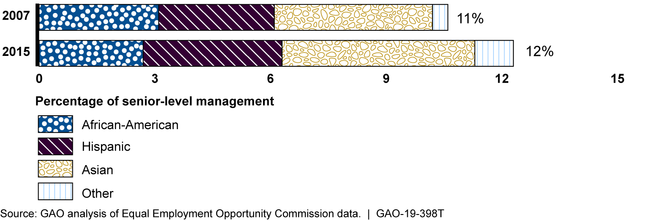

In November 2017, GAO reported that overall management representation in the financial services industry increased marginally for minorities and remained unchanged for women from 2007 to 2015. Similar trends also occurred at the senior-level management of these firms. For example, women represented about 29 percent of senior-level managers throughout this time period. As shown below, representation of minorities in senior management increased slightly, but each racial/ethnic group changed by less than 1 percentage point. The diversity of overall management also varied across the different sectors of the financial services industry. For example, the banking sector consistently had the greatest representation of minorities in overall management, whereas the insurance sector consistently had the highest proportion of women in overall management.

Senior-Level Management Representation of Minorities in the Financial Services Industry, 2007 and 2015

Note: The “Other” category includes Native Hawaiian or Pacific Islander, Native American or Alaska Native, and “two or more races.”

As GAO reported in November 2017, potential employees for the financial services industry, including those that could become managers, come from external and internal pools that are diverse. For example, the external pool included those with undergraduate or graduate degrees, such as a Master of Business Administration. In 2015, one-third of the external pool were minorities and around 60 percent were women. The internal talent pool for potential managers included those already in professional positions. In 2015, about 28 percent of professional positions in financial services were held by minorities and just over half were held by women.

Representatives of financial services firms and other stakeholders GAO spoke to for its November 2017 report described challenges to recruiting and retaining members of racial/ethnic minority groups and women. They also identified practices that could help address those challenges. For example, representatives from several firms noted that an effective practice is to recruit and hire students from a broad group of schools and academic disciplines. Some firms also described establishing management-level accountability to achieve workforce diversity goals. Firm representatives and other stakeholders agreed that it is important for firms to assess data on the diversity of their employees but varied in their views on whether such information should be shared publicly.

Why GAO Did This Study

The financial services industry is a major source of employment that affects the economic well-being of its customers and the country as a whole. As the makeup of the U.S. workforce continues to diversify, many private sector organizations, including those in the financial services industry, have recognized the importance of recruiting and retaining minorities and women in key positions to improve business or organizational performance and better meet the needs of a diverse customer base. However, questions remain about the diversity of the workforce in the financial services industry.

This statement is based on GAO's November 2017 report on changes in management-level diversity and diversity practices in the financial services industry. This statement summarizes (1) trends in management-level diversity in the financial services industry, (2) trends in diversity among potential talent pools, and (3) challenges financial services firms identified in trying to increase workforce diversity and practices they have used to address those challenges.

For more information, contact Daniel Garcia-Diaz at (202) 512-8678 or GarciaDiazD@gao.gov.