Dodd-Frank Regulations: Consumer Financial Protection Bureau Needs a Systematic Process to Prioritize Consumer Risks

Fast Facts

Some companies that offer financial products and services—such as credit cards and loan servicing—may engage in practices that pose financial risks to consumers. For example, companies may obscure the costs of a product or use lending practices that can trap consumers in a cycle of debt.

The Consumer Financial Protection Bureau (CFPB) is responsible for watching out for consumers. CFPB monitors complaints, analyzes market data, and conducts outreach to inform its regulations and other functions.

While CFPB collects a wide range of market intelligence, we made a recommendation to help it identify the most significant risks to consumers.

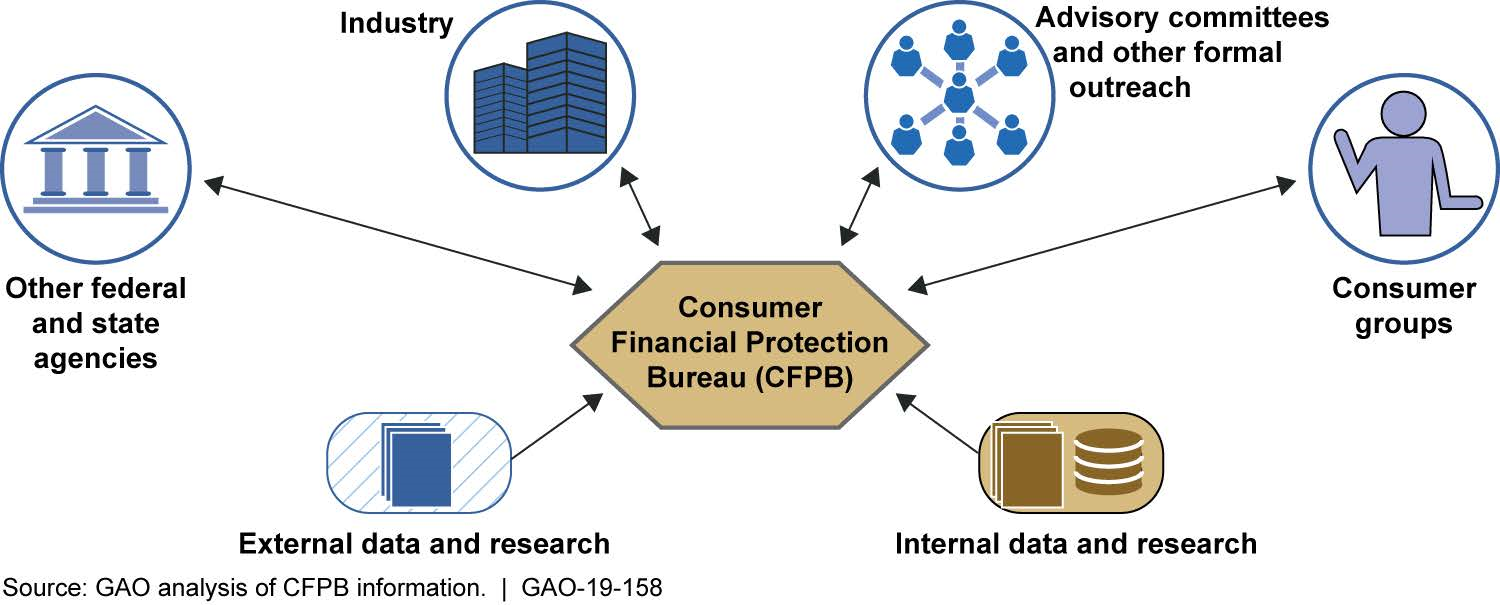

Information Sources for CFPB's Routine Market Monitoring

This is an illustration showing the Consumer Financial Protection Bureau's sources of information.

Highlights

What GAO Found

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), the Consumer Financial Protection Bureau (CFPB) has routinely monitored the consumer financial markets to identify potential risks to consumers related to financial products and services. CFPB monitors consumer complaints, analyzes market data, and gathers market intelligence from external groups (see figure for sources of CFPB’s monitoring). CFPB has used risk-monitoring findings to inform its rulemakings, supervision, and other functions. In 2015, CFPB initiated a bureau-wide process for using market data and other information to set policy priorities related to addressing risks to consumers. However, CFPB has not yet decided whether it will continue to use this process to set priorities. CFPB currently lacks a systematic, bureau-wide process for prioritizing financial risks to consumers and considering how it will use its tools—such as rulemaking, supervision, and consumer education—to address them. Federal internal control standards state that management should use quality information to achieve agency objectives and that it should also identify, analyze, and respond to risks related to achieving those objectives. Implementing a bureau-wide prioritization process could help to ensure that CFPB effectively focuses its resources on the most significant financial risks to consumers and enhances its ability to meet its statutory consumer protection objectives.

Information Sources for BCFP's Routine Risk Monitoring

CFPB has taken steps to retrospectively assess its significant rules within 5 years of these rules becoming effective, as required by the Dodd-Frank Act. CFPB developed and applied criteria to identify three rules as significant and requiring a retrospective assessment. For these three rules, CFPB created assessment plans, issued public requests for comment and information, and reached out to external parties for additional data and evidence. In October 2018, CFPB issued its first assessment report on a rule related to cross-border money transfers. Among other things, the report found that certain trends, such as increasing volume of these transfers, continued after the rule took effect. CFPB expects to complete the other two assessments by the January 2019 deadline.

Why GAO Did This Study

Recommendations

GAO recommends that CFPB implement a systematic process for prioritizing risks to consumers and considering how to use its available policy tools—such as rulemaking, supervision, enforcement, and consumer education—to address these risks. CFPB did not agree or disagree with the recommendation but agreed with the importance of having processes in place to prioritize and address consumer financial risks.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Consumer Financial Protection Bureau | The Director of CFPB should implement a systematic process for prioritizing risks to consumers and considering how to use the bureau's available policy tools—such as rulemaking, supervision, enforcement, and consumer education—to address these risks. Such a process could incorporate principles from the prior One Bureau process, such as an assessment of the extent of potential harm to consumers in financial markets, to prioritize the most significant risks. (Recommendation 1) |

Closed – Implemented

In spring 2020, CFPB concluded a policy prioritization exercise led by its Office of Strategy and the results were presented to the CFPB Director at the time. The exercise leveraged the structure and expertise of CFPB's Cross-Bureau Working Groups in assessing risks to consumers and considering how the risks were to be addressed through the Bureau's policy tools. As of fall 2021, it had not repeated or planned another prioritization exercise and had not yet formally decided on an ongoing systematic approach to prioritizing and addressing risks to consumers. In September 2023, CFPB provided information and documents that the Bureau had implemented such an approach. Through bi-weekly meetings, the relevant CFPB divisions provide information on identified consumer financial risks to the Assistant Director of the Office of Policy Planning and Strategy (PPS) within the Director's Office, who is responsible for working with divisions to determine the appropriate response across all of CFPB's available tools and as needed, to raise risks to the Director. The establishment of these meetings allows CFPB to regularly evaluate identified risks and prioritize their importance based on various factors, such as changing market conditions and consumer concerns.

|