Private School Choice: Requirements for Students and Donors Participating in State Tax Credit Scholarship Programs

Highlights

What GAO Found

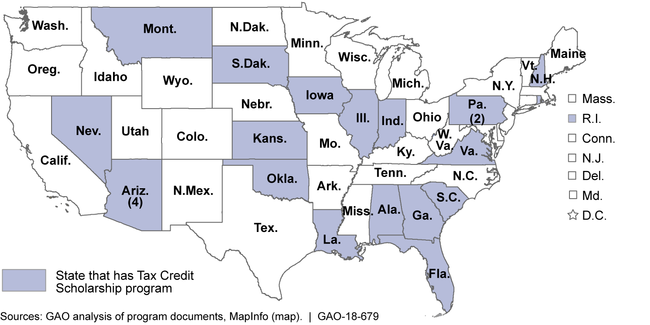

In 2018, there were 22 tax credit scholarship (TCS) programs authorized across 18 states, which provide state tax credits for individual and business donations that fund scholarships for students to attend elementary and secondary private schools (see figure).

Tax Credit Scholarship Programs by State, Authorized as of January 2018

Note: Each state has one program, except for Pennsylvania and Arizona, which have two and four programs, respectively. Alaska and Hawaii are not included in the map because neither has a program. Florida authorized a second program which was set to go into effect on July 1, 2018 and that program is outside the scope of GAO's review.

To determine the eligibility of students for these scholarships, most TCS programs use household income and have various approaches to determine scholarship award amounts. Income limits vary widely among programs, ranging from approximately $32,000 to $136,500 per year for students from a four-person household in school year 2017-2018. Programs have different requirements for how students can use their scholarships and different methods for calculating scholarship amounts. More than half of the programs (13 of 22) allow students to use their scholarship money for costs like transportation and books in addition to tuition, whereas the remaining programs (9 of 22) require scholarships funds to be used for tuition only. Average scholarship awards in school year 2016-2017 ranged from $500 to $5,468 per student among the 16 programs that published or provided GAO with such information.

The effect of TCS donations on donors' tax liability depends on program characteristics and donors' financial circumstances. Specifically, half of the 22 programs allow eligible donors to claim 100 percent of their donations as state tax credits, meaning that for each dollar donated, state taxes owed are reduced by a dollar, up to any maximum set by the state. The remaining 11 programs allow donors to claim from 50 to 85 percent of their donations as state tax credits. Programs often specify a maximum tax credit that may be claimed each year by a donor, by all donors combined, or both. Individual donors may also reduce their federal tax liabilities through the federal deduction for charitable contributions, depending on their financial circumstances and applicable tax provisions.

Why GAO Did This Study

TCS programs offer state tax credits to individuals or businesses that donate to scholarship funds for students to attend private elementary and secondary schools. Through these credits, donors may reduce the amount they owe in state taxes by the full or a partial amount of their donation, depending on each program's rules. Designing a TCS program requires that many decisions be made, such as which students will be eligible to receive scholarships and the effect donations will have on donors' state taxes. GAO was asked to review key characteristics of TCS programs.

This report examines (1) state TCS programs' policies regarding student eligibility and scholarship awards, and (2) how donating to a TCS program could affect the amount of state and federal taxes owed by donors.

For both objectives, GAO reviewed publicly-available documents about student eligibility and tax provisions for all 22 programs authorized as of January 2018 and verified the accuracy of the information with state program officials. GAO did not conduct an independent legal review of state laws and regulations. GAO also interviewed federal officials and reviewed relevant federal guidance and policy documents.

For more information, contact Jacqueline M. Nowicki at (617) 788-0580 or nowickij@gao.gov.