Compacts of Free Association: Actions Needed to Prepare for the Transition of Micronesia and the Marshall Islands to Trust Fund Income

Fast Facts

The U.S. is providing $3.6 billion in economic assistance to the nations of Micronesia and the Marshall Islands from 2004 through 2023. This assistance has increasingly been provided in the form of contributions to trust funds for each nation, and is intended to boost their self-sufficiency. After the assistance ends, the trust funds should generate revenue from investments.

But we found the trust funds may not provide disbursements in some years or sustain their value after 2023.

We made 6 recommendations, including that the U.S. Interior Department take steps to address the risks to the funds' ability to provide income after 2023.

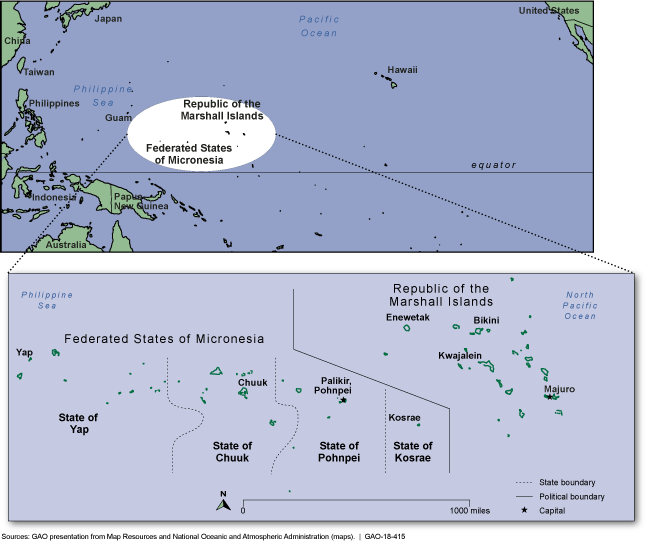

The Federated States of Micronesia and Republic of the Marshall Islands

One map shows the island nations in the Pacific, northeast of Australia. The other shows the islands that make up each state.

Highlights

What GAO Found

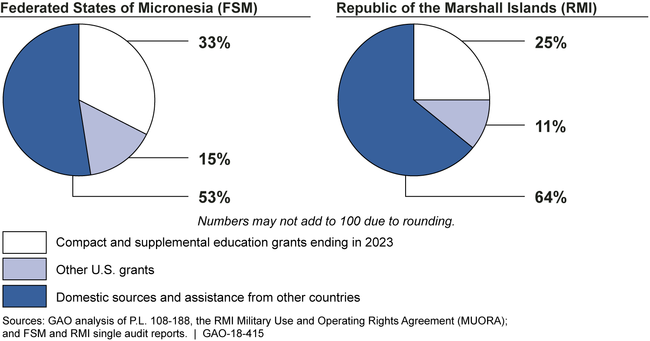

The Federated States of Micronesia (FSM) and the Republic of the Marshall Islands (RMI) continue to rely on U.S. grants and programs, including several that are scheduled to end in 2023. U.S. compact sector and supplemental education grants, both scheduled to end in 2023, support a third of the FSM's and a quarter of the RMI's expenditures. Agreements providing U.S. aviation, disaster relief, postal, weather, and other programs and services are scheduled to end in 2024, but some agencies may provide programs and services similar to those in the agreements under other authorities. FSM and RMI eligibility for some other U.S. grants and programs is expected to continue after 2023.

FSM and RMI Total Expenditures of Government Revenues, Fiscal Year 2016

Disbursements from the compact trust funds face risks that the trust fund committees have not addressed. GAO found that the trust funds are increasingly likely to provide no annual disbursements in some years and to not sustain their value. Potential strategies such as reduced trust fund disbursements or additional contributions from the countries or other sources could help address these risks. Changing the trust fund disbursement policies could also address these risks but may require revising the trust fund agreements with each country. However, the trust fund committees have not prepared distribution policies, required by the agreements, which could assist the countries in planning for the 2023 transition to trust fund income. The committees also have not prepared the required fiscal procedures for oversight of the disbursements or addressed differences between the timing of their annual determination of the disbursement amounts and the FSM's and RMI's annual budget cycles.

The FSM and RMI did not implement planned budget reductions to address decreasing compact grants owing to increased revenues from other sources that offset the grant decreases. Current FSM and RMI infrastructure plans address the 2023 transition, while health and education plans focus on strategic goals. Both countries have established new compact planning committees to identify future challenges and develop plans for the 2023 transition to trust fund income.

Why GAO Did This Study

In 2003, the United States approved amended compacts of free association with the FSM and RMI, providing a total of $3.6 billion in economic assistance in fiscal years 2004 through 2023 and access to several U.S. programs and services. Compact grant funding, overseen by the Department of the Interior, generally decreases annually. However, the amount of the annual decrease in grants is added to the annual U.S. contributions to the compact trust funds, managed by joint U.S.-FSM and U.S.-RMI trust fund committees. Trust fund earnings are intended to provide a source of income after compact grants end in 2023, but GAO and others have previously found that the trust funds may not provide sustainable income.

GAO was asked to examine preparations for the transition in 2023. This report examines (1) the use and role of U.S. funds and programs in FSM and RMI budgets, (2) projected trust fund disbursements and potential strategies to address risks to those disbursements, and (3) FSM and RMI plans to prepare for grant decreases and the transition to trust fund income. GAO reviewed compact agreements, audit reports, and U.S. law; modeled trust fund performance under existing conditions and using potential strategies; and reviewed FSM and RMI plans. GAO visited each country and interviewed FSM, RMI, and U.S. officials.

Recommendations

GAO recommends that Interior work with the compact trust fund committees to develop distribution policies and fiscal procedures for the funds and to address disbursement timing. Interior concurred with the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Interior |

Priority Rec.

The Secretary of the Interior should ensure that the Director of the Office of Insular Affairs, as Chairman of the FSM compact trust fund committee, works with other members of the committee to develop a distribution policy for the FSM compact trust fund, as required by the compact trust fund agreement, that takes into account potential strategies that could address risks to the fund's ability to provide a source of income after fiscal year 2023. (Recommendation 1) |

Interior concurred with our report's recommendations and set a target date for implementation of October 1, 2023. In May 2023, U.S. negotiators reached preliminary agreement with the FSM to amend and extend various FSM compact provisions and agreements, including the Trust Fund Agreements. In March 2024, Congress passed, and the President signed, legislation approving the amended compact. The new Trust Fund Agreement no longer requires a distribution policy and trust fund distributions have been restructured. The new distribution structure takes into account factors, including available compact trust fund balances and the fund's historic rate of return, that should mitigate risks to the fund's ability to provide a source of income after 2023.

|

| Department of the Interior |

Priority Rec.

The Secretary of the Interior should ensure that the Director of the Office of Insular Affairs, as Chairman of the FSM compact trust fund committee and of the FSM Joint Economic Management Committee, works with other members of the committees to develop the fiscal procedures required by the compact trust fund agreement. (Recommendation 2) |

Interior concurred with our report's recommendations and stated that discussions to address them were ongoing within the trust fund committees. In May 2023, U.S. negotiators reached preliminary agreement with the FSM to amend and extend various FSM compact provisions and agreements, including the Trust Fund Agreements. In March 2024, Congress passed, and the President signed, legislation approving the amended compact. The new Trust Fund Agreement includes fiscal procedures that address financial management, financial reporting, and procurement, among other things. Establishing such fiscal procedures will help ensure accountability for the trust fund disbursements.

|

| Department of the Interior |

Priority Rec.

The Secretary of the Interior should ensure that the Director of the Office of Insular Affairs, as Chairman of the FSM compact trust fund committee, works with other members of the committee to address the timing of the calculation of compact trust fund disbursements. (Recommendation 3) |

In May 2018, GAO reported that the timing of the trust fund committee's calculation of the amounts available for annual disbursement to the FSM under the Trust Fund Agreement did not align with the FSM's budget and planning timelines. The trust fund disbursement amount was to be calculated at the end of the prior fiscal year. As a result, the FSM would have to budget for the coming fiscal year without knowing the amount to be disbursed, complicating their annual budget and planning processes. Interior concurred with our report's recommendations and stated that discussions to address them were ongoing within the trust fund committees. Interior set a target date for implementation of the recommendation of October 1, 2023. In May 2023, U.S. negotiators reached preliminary agreement with the FSM to amend and extend various FSM compact provisions and agreements, including the Trust Fund Agreements. In March 2024, Congress passed, and the President signed, legislation approving the amended compact. The new Trust Fund Agreement changes the timing of the available funds for distribution to March 31-the middle of the prior fiscal year. As a result, the FSM will be better able to budget and plan for the available funds from compact trust fund distributions.

|

| Department of the Interior |

Priority Rec.

The Secretary of the Interior should ensure that the Director of the Office of Insular Affairs, as Chairman of the RMI compact trust fund committee, works with other members of the committee to develop a distribution policy for the RMI compact trust fund, as required by the compact trust fund agreement, that takes into account potential strategies that could address risks to the fund's ability to provide a source of income after fiscal year 2023. (Recommendation 4) |

Interior concurred with our report's recommendations and set a target date for implementation of October 1, 2023. In October 2023, U.S. negotiators reached preliminary agreement with the RMI to amend and extend various RMI compact provisions and agreements, including the Trust Fund Agreements. In March 2024, Congress passed, and the President signed, legislation approving the amended compact. The new Trust Fund Agreement no longer requires a distribution policy and trust fund distributions have been restructured. The new distribution structure takes into account the available compact trust fund balance and designates a fixed percentage of the fund's historic balances as available for distribution, which should mitigate risks to the fund's ability to provide a source of income after 2023.

|

| Department of the Interior |

Priority Rec.

The Secretary of the Interior should ensure that the Director of the Office of Insular Affairs, as Chairman of the RMI compact trust fund committee and of the RMI Joint Economic Management and Financial Accountability Committee, works with other members of the committees to develop the fiscal procedures required by the compact trust fund agreement. (Recommendation 5) |

Interior concurred with our report's recommendations and stated that discussions to address them were ongoing within the trust fund committees. In October 2023, U.S. negotiators reached preliminary agreement with the RMI to amend and extend various RMI compact provisions and agreements, including the Trust Fund Agreements. In March 2024, Congress passed, and the President signed, legislation approving the amended compact. The new Trust Fund Agreement includes fiscal procedures that address financial management, financial reporting, and procurement, among other things. Establishing such fiscal procedures will help ensure accountability for the trust fund disbursements.

|

| Department of the Interior |

Priority Rec.

The Secretary of the Interior should ensure that the Director of the Office of Insular Affairs, as Chairman of the RMI compact trust fund committee, works with other members of the committee to address the timing of the calculation of compact trust fund disbursements. (Recommendation 6) |

In May 2018, GAO reported that the timing of the trust fund committee's calculation of the amounts available for annual disbursement to the RMI under the Trust Fund Agreement did not align with the RMI's budget and planning timelines. The trust fund disbursement amount was to be calculated at the end of the prior fiscal year. As a result, the RMI would have to budget for the coming fiscal year without knowing the amount to be disbursed, complicating their annual budget and planning processes. Interior concurred with our report's recommendations and stated that discussions to address them were ongoing within the trust fund committees. Interior set a target date for implementation of the recommendation of October 1, 2023. In October 2023, U.S. negotiators reached preliminary agreement with the RMI to amend and extend various RMI compact provisions and agreements, including the Trust Fund Agreements. In March 2024, Congress passed, and the President signed, legislation approving the amended compact. The new Trust Fund Agreement changes the timing of the available funds for distribution to March 31-the middle of the prior fiscal year. As a result, the RMI will be better able to budget and plan for the available funds from compact trust fund distributions.

|