Defense Budget: Actions Needed to Improve the Management of Foreign Currency Funds

Highlights

What GAO Found

The Department of Defense (DOD) revised its foreign currency exchange rates (“budget rates”) during fiscal years 2014 through 2016 for each of the nine foreign currencies it uses to develop its Operation and Maintenance (O&M) and Military Personnel (MILPERS) budget request. These revisions decreased DOD's projected O&M and MILPERS funding needs. DOD's revision of the budget rates during these years also decreased the expected gains (that is, buying power) that would have resulted from an increase in the strength of the U.S. Dollar relative to other foreign currencies. DOD did not revise its budget rates in fiscal years 2009 through 2013. For fiscal year 2017, DOD changed its methodology for producing budget rates, resulting in rates that were more closely aligned with market rates. According to officials, that change made it unnecessary to revise the budget rates during the fiscal year.

DOD has taken some steps to reduce costs in selecting foreign currency rates used to pay (that is, disburse amounts) for goods and services, but DOD has not fully determined whether opportunities exist to achieve additional savings. The Army has estimated potential savings of up to $10 million annually by using a foreign currency rate available 3 days in advance of paying for goods or services rather than a more costly rate available up to 5 days in advance. The Army has converted to the use of a 3-day advanced rate. GAO's analysis suggests that DOD could achieve cost savings if the services reviewed and consistently selected the most cost-effective foreign currency rates when paying for their goods and services. Absent a review, DOD is at risk for paying more than it would otherwise be required to conduct its transactions.

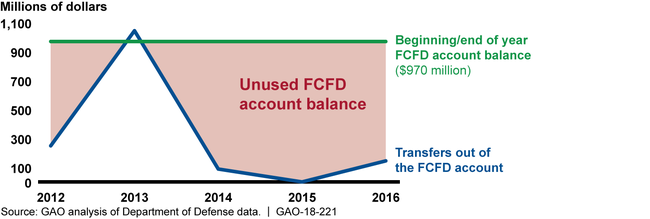

DOD used the Foreign Currency Fluctuations, Defense (FCFD) account to cover losses (that is, less buying power) due to unfavorable foreign currency fluctuations in 6 of the 8 years GAO reviewed. Since 2012, DOD has maintained the FCFD account balance at the statutory limit of $970 million, largely by transferring unobligated balances before they are cancelled from certain DOD accounts into the FCFD. However, DOD has not identified the appropriate FCFD account balance needed to maintain program operations by routinely analyzing projected losses and basing any transfers into the account on those expected losses. Thus, DOD may be maintaining balances that are hundreds of millions of dollars higher than needed, and that could have been used for other purposes or returned to the Treasury Department (see figure).

Foreign Currency Fluctuations Defense (FCFD) Account Balance, Fiscal Years 2012-2016

Why GAO Did This Study

DOD requested about $60 billion for fiscal years 2009 - 2017 to purchase goods and services overseas and reimburse service-members for costs incurred while stationed abroad. DOD uses foreign currency exchange rates to budget and pay (that is, disburse amounts) for these expenses. It also manages the FCFD account to mitigate a loss in buying power that results from foreign currency rate changes.

GAO was asked to examine DOD's processes to budget for and manage foreign currency fluctuations. This report (1) describes DOD's revision of its foreign currency budget rates since 2009 and the relationship between the revised rates and projected O&M and MILPERS funding needs; (2) evaluates the extent to which DOD has taken steps to reduce costs in selecting foreign currency rates to disburse funds to liquidate O&M obligations, and determined whether opportunities exist to gain additional savings; and (3) assesses the extent to which DOD has effectively managed the FCFD account balance. GAO analyzed data on foreign currency rates, DOD financial management regulations, a non-generalizable sample of foreign currency disbursement data, and FCFD account balances.

Recommendations

GAO is making four recommendations, including that DOD review opportunities to achieve cost savings by more consistently selecting the most cost-effective foreign currency rates used for the payment of goods and services, and analyze projected losses to manage the FCFD account balance. DOD generally concurred with the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Defense | The Secretary of Defense should ensure that the Under Secretary of Defense (Comptroller), in coordination with the U.S. Army, Air Force, Navy, and Marine Corps, conduct a review of the foreign currency rates used at disbursement to determine whether cost-saving opportunities exist by more consistently selecting cost-effective rates at disbursement. (Recommendation 1) |

The Department of Defense (DOD) agreed with this action, as GAO recommended in April 2018, and has taken steps to implement the recommendation. In December 2024, DOD provided its corrective action plan stating that the Comptroller had established a working group with the relevant DOD components to research the best methods for determining a consistent rate for disbursement that ensures that all components are utilizing the most cost-effective rate while balancing mission requirements and the time required to process transactions, and the working group's findings are under review. DOD was also in the process of determining whether revisions to Volume 6A, Chapter 7 of the Financial Management Regulation (FMR) with guidance on rates for disbursement would be beneficial. In November 2025, DOD estimated the review of the working group's findings and recommendations would be completed by April 30, 2026. Until DOD finalizes actions to determine how to more consistently select cost-effective rates for disbursement and updates the FMR guidance accordingly, DOD may incur additional costs to convert U.S. dollars for overseas expenditures.

|

| Department of Defense | The Secretary of Defense should ensure that the Under Secretary of Defense (Comptroller) analyze realized and projected losses to determine the necessary size of the FCFD account balance and use the results of this analysis as the basis for transfers of unobligated balances to the account. (Recommendation 2) |

The Department of Defense (DOD) partially concurred with this recommendation. However, as of August 2022, the Department of Defense (DOD) had not taken steps to address this action, as GAO recommended in April 2018. Moreover, as of November 2025, DOD confirmed it had no plans to implement this recommendation. DOD had partially concurred with the recommendation, but in the corrective action plan provided in December 2021, DOD revised its position and stated that it did not concur. DOD has continued to transfer prior year unobligated balances to replenish the FCFD account to its maximum balance of $970 million without using an analysis of realized and projected losses as the basis for its transfers. For example, in July 2024, DOD transferred about $969 million from the FCFD account to O&M and MILPERS accounts to offset foreign currency losses resulting from a revision of the foreign currency rates used for budget execution. In September 2024, it transferred an additional $336.5 million from the FCFD account to cover realized and projected FY 2024 O&M and MILPERS losses resulting from the decline in value of the U.S. dollar relative to select foreign currencies. DOD transferred prior year unobligated balances to the Foreign Currency Fluctuations, Defense account to fully replenish the account to the statutory limit of $970 million by the end of fiscal year 2024. However, DOD did not analyze actual and projected losses to use as a basis for determining the amount it transferred to replenish the account. More specifically, in November 2025, DOD reported that it has no plans to address GAO's recommendation, as keeping the account funded to the statutory limit of $970 million allows the DOD to independently resolve unexpected losses in buying power that may stem from volatile fluctuating rates. However, GAO has noted that the Foreign Currency Fluctuations, Defense account has several characteristics that can help address uncertainty and reduce risk. For example, DOD can make multiple transfers of funds to the account throughout a fiscal year in response to unforeseen foreign currency fluctuations. Without analyzing realized and projected losses to more precisely determine the necessary size of the Foreign Currency Fluctuations, Defense account, DOD may be maintaining the account balance at a higher level than is necessary and missing opportunities to use funds more efficiently.

|

| Department of Defense | The Secretary of Defense should ensure that the Under Secretary of Defense (Comptroller) revise the Financial Management Regulation to include guidance on ensuring that data are complete and accurate, including assignment of responsibility for correcting erroneous data in its Foreign Currency Fluctuations Defense (O&M) reports. (Recommendation 3) |

The Department of Defense (DOD) concurred with this recommendation. In September 2019, DOD updated the Financial Management Regulation to include guidance on correcting erroneous data. The guidance states that the services and the Office of the Under Secretary of Defense (Personnel and Readiness) are responsible for ensuring the completeness and accuracy of their report submissions to the Defense Finance and Accounting Service (DFAS). The Office of the Under Secretary of Defense (Comptroller) conducts a review of the consolidated reports provided by DFAS, and if data correction is required, the component that submitted the original data is responsible for correcting the error. By implementing our recommendation on correcting erroneous data, DOD will be able to more effectively manage foreign currency gains and losses as well as any projected gains or losses for any remaining obligations that have not yet been liquidated through disbursement.

|

| Department of Defense | The Secretary of Defense should ensure that the Secretary of the Army develop a plan with timelines for implementing changes to its General Fund Enterprise Business System to accurately record its disbursements, consistent with DOD Financial Management Regulation guidance. (Recommendation 4) |

The Department of Defense (DOD) concurred with this recommendation. As of July 2023, DOD had planned actions intended to address the recommendation. Specifically, the Secretary of the Army intended to develop a Systems Change Request for how disbursements are recorded in the General Fund Enterprise Business System to be consistent with DOD's Financial Management Regulation. As of July 2023, according to DOD documentation, the Army was determining the extent of work required to fully resolve the recommendation. In July 2023, the Army estimated it would complete its actions by July 2024. In June 2025, DOD provided evidence that the Army had developed and implemented a system change to its accounting system to record foreign currency fluctuations consistent with the guidance in the Financial Management Regulation. They also provided evidence confirming that the system change is functioning as intended. By implementing our recommendation on updating its accounting system to accurately record data, the Army and DOD will be able to more effectively track and manage foreign currency gains and losses.

|