IRS Referral Programs: Opportunities Exist to Strengthen Controls and Increase Coordination across Overlapping Programs

Highlights

What GAO Found

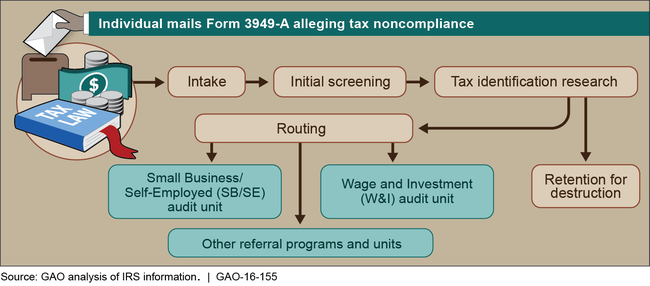

Information referrals from the public alleging tax noncompliance must be submitted on paper forms by mail to the Internal Revenue Service (IRS). These referrals are manually screened by clerical staff and routed by mail to units across IRS for further action, as shown in the figure.

Process for Screening and Routing Information Referrals for Further Review

Ineffective internal controls undercut IRS management of the information referral process. IRS does not have an organizational structure for information referrals with clear leadership for defining objectives and outcomes for measuring cost-effectiveness and results. Without clear leadership, IRS does not know how effectively it is leveraging information referrals to address the tax gap. IRS has incomplete documentation of procedures for the information referral process, increasing the risk of delays and added costs in routing the information for further action. Although one-quarter of the information referrals in fiscal year 2015 were sent for destruction after screening, IRS has not documented procedures for supervisory review of those referrals prior to destruction. Without procedures to address these control deficiencies, IRS is compromised in its ability to know how effectively it is leveraging tax noncompliance information reported by the public.

Fragmentation and overlap across IRS's general information referral process and eight specialized referral programs, such as for reporting identity theft and misconduct by return preparers, can confuse the public trying to report tax noncompliance to IRS. Yet coordination between referral programs is limited, and IRS does not have a mechanism for sharing information on crosscutting issues and collaborating to improve the efficiency of operations across the mix of referral programs. As a result, IRS may be missing opportunities to leverage resources and reduce the burden on the public trying to report possible noncompliance.

Why GAO Did This Study

Reports by the public of suspected underreporting of taxes or other tax violations can help IRS detect millions of dollars in taxes that would otherwise go uncollected. Productive referrals can help address the net $385 billion tax gap—the difference between the amount of taxes paid voluntarily on time and the amount owed. IRS received about 87,000 information referrals in fiscal year 2015.

GAO was asked to assess the overall effectiveness of the information referral process. This report (1) describes IRS's process for screening and routing information referrals; (2) assesses the controls for the information referral screening and routing process; and (3) evaluates the coordination between the information referral process, the Whistleblower Office, and other IRS referral programs. GAO reviewed IRS guidance, processes, and controls for the information referral process, assessed whether IRS's processes followed Standards for Internal Control in the Federal Government , and interviewed IRS officials.

Recommendations

GAO recommends, among other things, that IRS establish an organizational structure that identifies responsibility for defining objectives and for measuring results for information referrals; document procedures for the information referral process; and establish a coordination mechanism across IRS referral programs. IRS agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish, document, and implement an organizational structure identifying responsibility for defining objectives with an appropriate line of reporting for measuring costs and results for information referrals. |

IRS implemented an organizational structure defining responsibilities for the information referral program and established accounting codes to help measure screening costs. The Wage & Investment (W&I) division, which processes paper tax forms, retained the initial clerical intake and screening responsibilities. W&I added a technical screening review for more complex tax issues to reduce routing referrals without specific and credible information. As of August 2020, IRS was moving the clerical intake and technicial screening operations to its Ogden processing center because the Fresno center will close in 2021. W&I Submission Processing headquarters is responsible for maintaining the information referral routing guide. Each IRS unit receiving the referrals is responsible for defining its criteria for screening and routing productive referrals for examination consideration. IRS also established internal accounting codes to measure costs for the clerical intake and technical screening operations as well as further examination screening costs for W&I and the Small Business/Self-Employed (SB/SE) divisions, which receive the majority of information referrals submitted by the public. IRS determined that initial screening operations and further review by those two divisions cost $7.6 million for fiscal year 2017. Continued IRS action on GAO's priority recommendation for an online referral submission would help reduce costs for screening and routing paper referrals. Productive referrals can help reduce the tax gap. For SB/SE and W&I, information referral leads resulted in a higher average tax assessment than other examination sources.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the IRM has internal controls for processing information referrals by establishing, documenting, and implementing supervisory review and segregation of duties for inventory management reporting procedures. |

IRS has taken action to establish and document internal controls for supervisory review and segregation of duties for inventory management reporting procedures. In July 2017, IRS added Internal Revenue Manual (IRM) 3.10.72.19 procedures for the Submissions Processing clerical screening team for supervisory review and segregation of duties. Specifically, no one individual should control all key aspects of a transaction or event, and duties for processing, recording, reviewing transactions, and preparing inventory reports are to be separated among individuals to reduce the risk of error or fraud. In March 2020, IRS developed detailed internal guidelines for inventory management reporting, and the guidance will be published in the 2020 IRM update. As of August 2020, IRS was moving the clerical intake and tax examiner technician screening operations to its Ogden processing center because the Fresno center will close in 2021. Effective transition and implementation of these controls will be important to ensuring reliable information referral intake and routing reports.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the IRM has internal controls for processing information referrals by establishing, documenting, and implementing ongoing monitoring of information referrals retained for destruction, including a mechanism for tracking the reasons referrals were retained prior to destruction. |

IIRS has taken action to establish and document controls for monitoring information referrals retained at intake prior to destruction. In January 2018, IRS updated Internal Revenue Manual (IRM) procedures requiring managers to ensure quality reviews are performed and recorded for information referrals screened by the intake clerks, including referrals retained for destruction. The retention file is to be subject to weekly review, and managers are to monitor and track the reasons for referrals retained prior to destruction. In February 2019, IRS sent an alert reminding local managers and clerical intake staff to follow the information referral routing guide published in the IRM without deviation. To reduce the risk of destroying valid referrals, the April 2019 IRM update specified clerks are to review both the checkbox and narrative sections of the referral form. As of August 2020, IRS was moving the clerical intake and tax examiner technician screening operations to its Ogden processing center because the Fresno center will close in 2021. Effective transition and implementation of the retention file controls will be important to avoid destroying referrals that could help combat tax noncompliance. IRS also took action to establish and document controls over information referrals routed to the Wage and Investment (W&I) and Small Business and Self-Employed (SB/SE) divisions for audit consideration. W&I and SB/SE campus examination units are to retain rejected referrals for 90 days after classification and selected referrals for three years after the examination closing date. IRM procedures specify that W&I and SB/SE campus examination management are to conduct periodic reviews of the rejected information referrals to ensure the fairness and integrity of the classification process. SB/SE field examination also has procedures for tracking and monitoring the inventory of examination leads received, including information referrals reported by the public. A referral coordinator is to review information referrals for examination potential and log whether a referral was selected for examination or not. IRM procedures specify referrals not selected are to be retained for 26 months prior to destruction.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the IRM has internal controls for processing information referrals by establishing, documenting, and implementing procedures for each IRS operating unit receiving information referrals to provide feedback on the number and types of referrals misrouted and on their disposition, and a mechanism to analyze patterns of misroute errors. |

IRS took action to improve the handling and communication about misrouted information referrals. Each IRS unit receiving the referrals is responsible for defining and updating its criteria for screening and routing productive referrals for its further consideration. IRS uses bi-monthly meetings to facilitate communication and feedback from the units receiving information referrals about the number and types of referrals misrouted and on their disposition. The cross-functional team collaborated on new forms for returning misroutes and capturing feedback. Submission Processing new inventory management procedures include tracking of misrouted and other referrals returned by other IRS units. Submission Processing uses the paper referrals returns to provide feedback to its clerical and technical screening staff. As of August 2020, IRS was moving the clerical intake and tax examiner technician screening operations to its Ogden processing center because the Fresno center will close in 2021. Effective implementation of the initial routing controls will help reduce misrouting delays and added costs for re-screening. Continued IRS action on GAO's priority recommendation for an online referral submission would reduce inefficiencies in moving paper referrals between IRS units.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish a coordination mechanism to facilitate communication and information sharing across IRS referral programs on crosscutting tax issues and ways to improve efficiency in the mechanisms for public reporting of possible tax violations. |

As of December 2019, IRS had established a coordination mechanism to help IRS referral programs communicate and share information, as GAO recommended in its February 2016 report. IRS initially established a cross-functional team in February 2016 to comprehensively review IRS's referral programs. Among other things, this team explored aligning all IRS referral programs within an organizational structure to more efficiently coordinate, communicate, and share information across the referral programs. The Deputy Commissioner of Services and Enforcement directed the largest recipient of referrals to facilitate quarterly meetings in order to improve communication and information sharing across multiple IRS referral programs. Three initial meetings were held in 2017 and IRS drafted a charter to formalize the new referral coordination group. The five participating IRS divisions finalized the cross-division committee charter in September 2019, and the first quarterly committee meeting was in November 2019. The cross-division committee is charged with adapting to use the planned online referral system once the new technology is funded and operating. With a broader collaborative mechanism to communicate across referral programs, IRS will be better positioned to assist the public and leverage resources to streamline multiple referral form processes.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should direct the referral programs to establish a mechanism to coordinate on a plan and timeline for developing a consolidated, online referral submission in order to better position IRS to leverage specialized expertise while exploring options to further consolidate the initial screening operations. |

IRS agreed with this recommendation. In March 2023, IRS began using its electronic document upload tool to digitize paper information referrals received. In May 2023, IRS launched an online portal for the public to submit information referrals on potential tax law violations. In October 2025, IRS launched a new landing page on IRS.gov that consolidated online referral submissions for several types of fraud such as reporting potential tax law violations, tax fraud, abusive schemes, and return preparer misconduct. IRS reported that the page was designed to guide users through distinct categories to the correct forms, making the submission of external referrals more straightforward and reducing the burden on users to determine the appropriate forms.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Internal Revenue Manual (IRM) has internal controls for processing information referrals by establishing, documenting, and implementing procedures for maintaining and communicating the information referral screening and routing guidelines to the Image Control Team (ICT) and IRS units receiving information referrals as well as procedures for ICT screening and routing operations. |

IRS expanded its information referral routing guide and published the guidance in the Internal Revenue Manual (IRM). IRM 3.10.72.19. details procedures for the initial clerical screening of Form 3949-A. IRM 3.28.2 covers technical screening review for more complex tax issues. Updates to the information referral routing guide are communicated using the IRS Servicewide Electronic Research Program that provides IRS employees intranet access to the IRM and other IRS information. In 2019, IRS sent an alert reminding clerical intake staff to follow the information referral routing guide in the IRM without deviation. In January 2020, IRS Submission Processing established a process for verifying the routing contacts and addresses at least once annually, and the guidance will be published in the 2020 IRM update. As of August 2020, IRS was moving the clerical intake and tax examiner technician screening operations to its Ogden processing center because the Fresno center will close in 2021. Maintaining and communicating current screening and routing guidelines to staff will be key for effective transition of the information referral intake operations.

|