Tobacco Taxes: Disparities in Rates for Similar Smoking Products Continue to Drive Market Shifts to Lower-Taxed Options

Highlights

What GAO Found

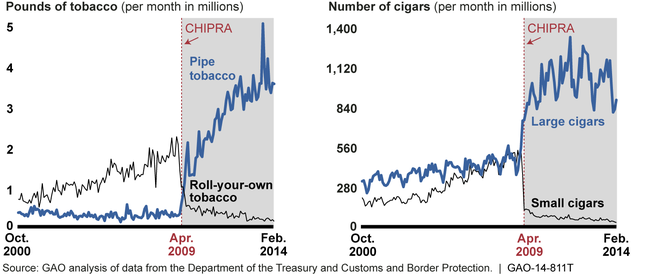

Large federal excise tax disparities among smoking tobacco products, which resulted from the Children's Health Insurance Program Reauthorization Act (CHIPRA) of 2009, created opportunities for tax avoidance and led to significant market shifts toward lower-taxed products by manufacturers, importers, and price-sensitive consumers. From fiscal year 2008, the last year before CHIPRA, to fiscal year 2013, annual sales of domestic and imported pipe tobacco increased from about 5.2 million pounds to 43.7 million pounds, while sales of domestic and imported roll-your-own tobacco declined from about 21.3 million pounds to 3.8 million pounds. Over the same period, annual sales of domestic and imported large cigars increased from about 5.8 billion sticks to 12.4 billion sticks, while sales of domestic and imported small cigars declined from about 5.7 billion sticks to 0.7 billion sticks. According to government, industry, and nongovernmental organization representatives, many roll-your-own tobacco and small cigar manufacturers shifted to the lower-taxed products after CHIPRA to avoid paying higher taxes.

U.S. Sales of Roll-Your-Own and Pipe Tobacco and of Small and Large Cigars, both Domestic and Imported, before and after the Children's Health Insurance Program Reauthorization Act (CHIPRA) of 2009

While revenue collected for domestic and imported smoking tobacco products, including cigarettes, from April 2009 through February 2014, amounted to about $77 billion, GAO estimates that federal revenue losses due to market shifts from roll-your-own to pipe tobacco and from small to large cigars range from about $2.6 to $3.7 billion for the same period. GAO found that the Department of the Treasury (Treasury) has limited options to respond to these market shifts. Differentiating between roll-your-own and pipe tobacco for tax collection purposes presents challenges to Treasury because the definitions of the two products in the Internal Revenue Code do not specify distinguishing physical characteristics and are based on such factors as the use for which the products are suited and their packaging and labeling. GAO also found that Treasury continues to have limited options to address the market shift from small cigars to large cigars—which are differentiated in the Internal Revenue Code only by weight—and faces added complexity in monitoring and enforcing tax payments due to the change in large cigar tax rates.

Why GAO Did This Study

In 2009, CHIPRA increased and equalized federal excise tax rates for cigarettes, roll-your-own tobacco, and small cigars. Although CHIPRA also increased federal excise tax rates for pipe tobacco and large cigars, it raised the pipe tobacco tax to a rate significantly below the equalized rate for the other products, and the large cigar excise tax can be significantly lower, depending on price. Treasury collects federal excise taxes on domestic tobacco products. Customs and Border Protection (CBP) collects federal excise taxes on imported tobacco products.

This testimony highlights and provides selected updates to key findings from GAO's April 2012 report ( GAO-12-475 ) by examining (1) market shifts among smoking tobacco products since CHIPRA, and (2) the impact of the market shifts on federal revenue and Treasury's actions to respond to these shifts. GAO analyzed Treasury and CBP data to identify sales trends for domestic and imported smoking tobacco products and to estimate the effect of the market shifts to lower-taxed products on federal tax revenues.

Recommendations

GAO is not making any new recommendations in this testimony. In its 2012 report, GAO suggested that Congress consider equalizing tax rates on roll-your-own and pipe tobacco and, in consultation with Treasury, consider options for reducing tax avoidance due to tax differentials between small and large cigars. Treasury generally agreed with GAO's conclusions and observations.