Department of Defense: Additional Actions to Improve Suspense Account Transactions Would Strengthen Financial Reporting

Fast Facts

Suspense accounts are meant to temporarily record transactions that require more research before they are permanently recorded. The Department of Defense has lacked internal controls over its suspense accounts for decades, leading to large balances and costly write-offs.

The policies and procedures that DOD issued to address these accounts were insufficient, outdated, and inconsistently implemented. Other efforts have reduced account balances but haven't identified the problem's root causes. Large balances could accumulate again.

We made 8 recommendations to address this issue.

DOD financial management has been on our High Risk List since 1995.

Highlights

What GAO Found

Federal agencies use suspense accounts to temporarily hold financial transactions—such as transactions with missing or incomplete documentation—that require further research before they are permanently recorded to the proper accounts in an accounting system. Over the years, both GAO and the Department of Defense (DOD) Office of Inspector General (OIG) have reported that DOD and the Defense Finance and Accounting Service (DFAS) have lacked the controls needed to account for and clear suspense account transactions properly. This has contributed to unreliable financial information as the underlying transactions are not properly recorded in the accounting records.

Although DOD and DFAS have taken steps to align their suspense account policies and procedures with relevant federal guidance, GAO found that they were insufficient, outdated, and inconsistently implemented. For example, in March 2020 DOD issued a policy memorandum requiring its component organizations to clear aged suspense account balances—those more than 30 days old—by June 2020. If components could not appropriately research and clear these balances, components were instructed to remove the balances from suspense accounts by transferring them to other accounts. While these efforts reduced the aged balances by roughly $30 billion, guidance on the specific steps to remove the balances was not provided. The lack of specific guidance contributed to components inconsistently removing aged suspense account balances and increased the risk of transactions not being recorded, reconciled, removed, and documented in a consistent and timely manner. As of June 30, 2020, DOD's suspense account balance was $1.6 billion, of which $366 million was more than 30 days old.

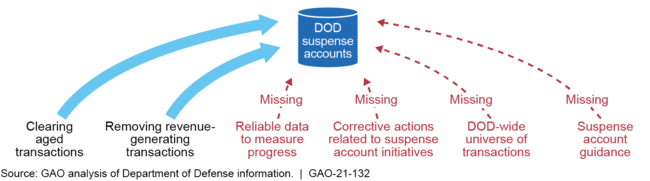

DOD and DFAS have undertaken initiatives to clear certain types of non–suspense account transactions from suspense accounts and reduce suspense account balances. GAO found that these initiatives did not identify and address the root causes of DOD's suspense account control deficiencies.

DOD Actions to Address Deficiencies with Suspense Account Transactions

Not establishing corrective actions to address the long-standing control deficiencies with suspense account transactions affects the reliability of suspense account balances in financial reports, even though the balances are considerably smaller than they were in previous fiscal years. Without such corrective actions, large suspense account balances may once again accumulate and another costly write-off could eventually be required.

Why GAO Did This Study

DOD remains the only major federal agency that has been unable to obtain a financial audit opinion. One contributing factor is DOD's long-standing control deficiency in suspense account transactions.

GAO was asked to review DOD's suspense accounts and determine their impact on DOD's consolidated financial reporting. This report examines the extent to which DOD has (1) established and implemented policies and procedures for recording, reconciling, and clearing suspense account transactions at the DOD consolidated level and (2) addressed identified deficiencies in recording, reconciling, and clearing suspense account transactions that may affect the reliability of DOD's financial information.

GAO reviewed DOD and DFAS policies and procedures, interviewed DOD and DOD OIG officials, and reviewed initiatives related to suspense account transactions.

Recommendations

GAO is making eight recommendations to DOD, including that it update and implement policies and procedures for suspense account transactions and develop and implement DOD-wide guidance for identifying and remediating the root causes of control deficiencies in its suspense account processes. DOD concurred with three of GAO's recommendations, partially concurred with four recommendations, and did not concur with one recommendation. GAO continues to believe that all the recommendations are warranted.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Defense | The Under Secretary of Defense (Comptroller) should finalize the assessment of the applicability of custodial accounts at DOD and, if necessary, update DOD policies to define the use of custodial suspense accounts, in accordance with OMB and Treasury guidance. (Recommendation 1) |

The Department of Defense (DOD) concurred with this recommendation. In response to our recommendation, in August 2021, DOD surveyed its major components and DFAS to determine if they had custodial collections to record in custodial suspense accounts. DOD determined that it was not necessary to define the use of custodial suspense accounts, because the components and DFAS do not currently have custodial collections.

|

| Department of Defense |

Priority Rec.

The Under Secretary of Defense (Comptroller) should update DOD's FMR to clearly define the use of suspense and deposit accounts, in accordance with OMB and Treasury guidance. (Recommendation 2) |

The Department of Defense (DOD) partially concurred with this recommendation. In September 2022, DOD stated that the Office of the Under Secretary of Defense (Comptroller) corrected DOD's FMR, volume 8, by removing the one suspense account that was commingled with deposit accounts. We reviewed the updated FMR and verified that DOD made the updates to clarify the correct use of suspense and deposit accounts. Additionally, DOD assessed the need for suspense account training and determined no new training was necessary.

|

| Department of Defense |

Priority Rec.

The Under Secretary of Defense (Comptroller) should establish a process to provide specific implementing guidance to DFAS and DOD components, including field submitters, when new suspense account policy memorandums are issued. (Recommendation 3) |

In February 2024, the Undersecretary of Defense (OUSD) (Comptroller) issued a policy memorandum establishing a process to provide implementing guidance to Department of Defense (DOD) components and to Defense Finance and Accounting Service (DFAS) sites whenever new suspense account policy is issued. Among other things, the policy memorandum requires OUSD (Comptroller) to review the implications of new suspense account policy and work with DFAS to determine the need to update the DOD Financial Management Regulation to ensure consistent compliance with the new policy. This action should help DOD improve its efforts to clear suspense transactions consistently and timely and improve the reliability of DOD financial reporting of suspense accounts.

|

| Department of Defense | The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should provide specific guidance to the DFAS sites and DOD components on implementing the requirements stipulated in the December 2019 memorandum Policy for Monthly Review of Suspense Transactions and the March 2020 policy memorandum U.S. Department of the Treasury Aged Suspense Account Balances. (Recommendation 4) |

In December 2021, Defense Finance Accounting Service (DFAS) issued an updated policy memorandum, which replaced the December 2019 policy and described specific responsibilities relating to suspense accounts, such as returning any certification statements due to incomplete or missing information and implementing escalation procedures as deadlines approach without certification statements being received. With respect to DOD's March 2020 policy memorandum, DFAS officials informed us that memorandum was a one-time effort to resolve aged suspense account balances and was rescinded on August 11, 2021. The revised DFAS guidance should help improve efforts to clear suspense transaction timely, and improve the reliability of DOD financial reporting of suspense accounts.

|

| Department of Defense |

Priority Rec.

The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should provide guidance on suspense account transactions to DOD components and the DFAS sites to help ensure that they develop consistent policies and procedures that are accurate and up-to-date. (Recommendation 5) |

In February 2024, the Undersecretary of Defense (OUSD) (Comptroller) issued a policy memorandum outlining specific actions the Office of the Undersecretary of Defense (OUSD) (Comptroller) and Defense Finance and Accounting Service (DFAS) sites should take when new suspense account policy or guidance is issued to ensure they are accurate and up to date. Among other things, the policy memorandum requires DFAS to lead discussions and set expectations for updating procedures to align with the new policy of guidance, and to develop specific project plans or milestones to document any steps needed to ensure the procedures related to suspense accounts are consistently updated. These actions should help DOD components and DFAS consistently record transaction information for suspense accounts and improve the reliability of DOD financial reporting of suspense accounts.

|

| Department of Defense | The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should establish a process and associated guidance to (1) prepare a department-wide suspense account universe of transactions at the consolidated level and (2) ensure that the DFAS sites gather consistent information for preparing the suspense account universe of transactions for the DOD components. (Recommendation 6) |

In November 2021, Defense Finance Accounting Service (DFAS) issued guidance requiring its sites to use a new standardized suspense account universe of transactions layout, which will (1) ensure that uniform universe of transactions information is collected for all Department of Defense (DOD) components and (2) allow DFAS to prepare a department-wide universe of transactions. The guidance gives DFAS sites a common set of fields to populate for their universe of transactions submissions, and a definition of the data required for each field. In addition to providing a standardized layout, DFAS provided additional guidance establishing which data fields in the standard universe of transactions layout were mandatory and which were optional. The standardized universe of transactions templates were first used by the DFAS sites, and consolidated into a department wide suspense account universe of transactions, during October 2021.

|

| Department of Defense |

Priority Rec.

The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should develop and implement DOD-wide guidance, applicable to both DFAS sites and DOD components, for assessing, identifying, and remediating the root causes of control deficiencies in DOD's suspense account processes. (Recommendation 7) |

In February 2024, the Office of the Undersecretary of Defense (OUSD) (Comptroller) issued a policy memorandum requiring Department of Defense (DOD) components and Defense Finance and Accounting Service (DFAS) sites to assess, identify, and remediate the root causes of suspense account transactions and to implement solutions to address these root causes, on a regular basis. In addition, in September 2022, DFAS issued guidance requiring DFAS sites to perform monthly reviews of suspense account transactions to identify and remediate the root causes of transactions that are in suspense accounts over 60-days. These actions should help DOD components and DFAS remediate the root causes of control deficiencies with suspense accounts and prevent the accumulation of large suspense account balances in the future.

|

| Department of Defense | The Director of DFAS should develop guidance for DFAS sites to use when developing metrics for measuring the progress of their efforts to address issues with and reduce the balances of suspense accounts. (Recommendation 8) |

The Department of Defense (DOD) concurred with this recommendation. In December 2021, the Defense Finance and Accounting Service (DFAS) issued guidance requiring its sites to, among other things, (1) use approved suspense transaction categories when developing suspense account metrics and (2) ensure that the universe of transactions reconcile to Treasury's Central Accounting Reporting System. The guidance also directs DFAS's Metrics and Initiative office to (1) perform data quality checks to ensure that metrics are accurate and contain all suspense account transactions and (2) produce metrics containing specific attributes prescribed by DFAS. These actions address our recommendation.

|