Stolen SNAP Benefits Cost Beneficiaries Millions

Millions of Americans face food insecurity each year. The federal Supplemental Nutrition Assistance Program (known as SNAP or formerly food stamps) helps low-income Americans by providing benefits to buy food.

SNAP is the largest federally funded nutrition assistance program—providing about $96 billion in assistance. But hundreds of millions of dollars may be stolen from SNAP recipients' accounts each year, representing federal dollars diverted from their intended purpose.

Today’s WatchBlog post looks at our new report about how theft is being committed and what’s being done to stop it.

Image

How are SNAP benefits being stolen?

People who receive SNAP benefits now get them as a monthly deposit loaded onto an Electronic Benefit Transfer (EBT) card—like a debit card. These cards can be used at participating grocery or retail stores to buy food.

And just like when your debit card numbers get stolen, thieves access accounts electronically without the account-owner’s knowledge or consent. Once they have access, thieves use stolen account info to drain recipients’ accounts.

There are several ways they can do this:

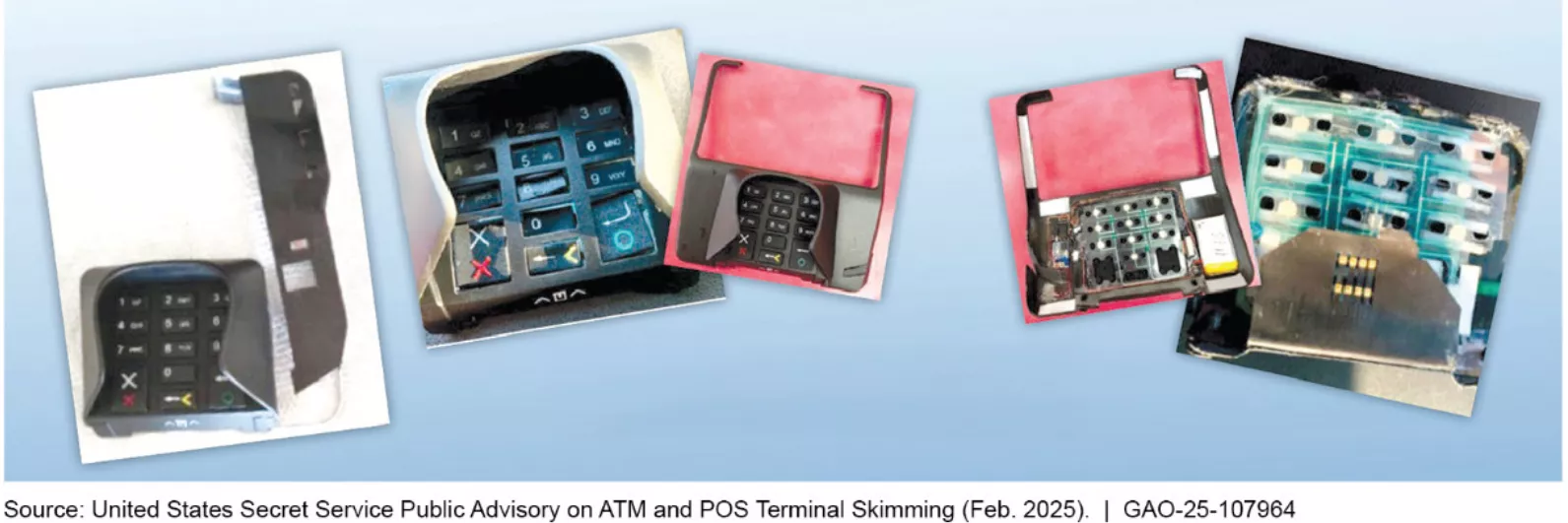

- Card skimming. Thieves use an illegal skimming device to copy personal account information when a recipient swipes their card during a transaction.

- Card cloning. Thieves transfer stolen card info on blank magnetic strip cards and then use the “cloned” cards to steal benefits for in-person or online purchases.

- Phishing. Scams via text, email, or phone gather key EBT card information from vulnerable recipients.

- Bot attacks. Bots make repeated inquiries and use online vulnerabilities to access key card information—such as card balances, valid PIN numbers, and more—from retailers participating in SNAP.

- Stolen numbers. Thieves use numbers assigned to authorized retailers to access payment networks that process SNAP transactions. Once they have access, thieves use stolen account info to drain recipients’ accounts.

Skimming Devices Used at Stores to Steal Account Information from SNAP EBT Cards

Image

Most SNAP benefits cards do not have theft-prevention features, such as microchips, that are standard on commercial debit cards. While chips can’t totally prevent fraud, they are a good deterrent and can help protect cards from skimming devices. State SNAP agencies aren’t currently required to add microchips to EBT cards.

How much has been stolen? Although the full extent of theft is unknown, states reported replacing more than $320 million in stolen benefits between October 2022 and December 2024. During that period, state SNAP agencies provided funds to replace stolen benefits when recipients reported a theft that could be substantiated.

But some recipients may not have known they could file a claim. And the law limited recipients’ filing to two claims per year. As a result, the estimate of losses may not truly reflect the full extent of theft. And, after December 2024, states can no longer replace stolen SNAP benefits with federal funds.

Who is stealing benefits? The thieves range from individuals to organized crime groups operating across the globe who can use stolen benefits to help fund illicit activities.

What’s being done to stop SNAP benefit theft?

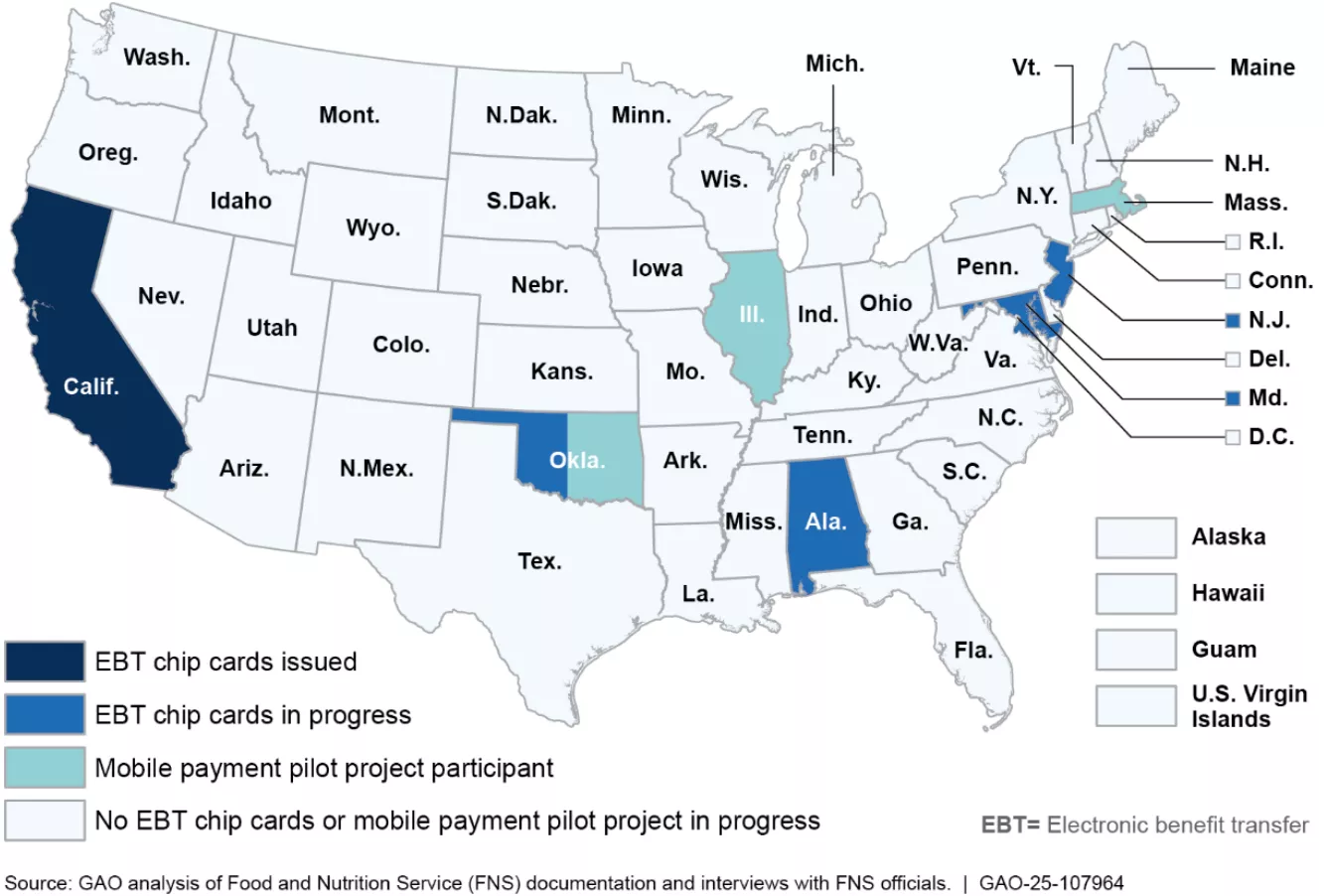

While SNAP is a Department of Agriculture (USDA) federal program, it’s run by state SNAP agencies. These agencies have taken steps to prevent SNAP benefit theft, based on USDA recommendations. For example, California has modernized its SNAP EBT cards to better align with credit and debit card security standards. And six other states have ongoing SNAP EBT card modernization projects.

SNAP recipients may also be able to lock their EBT cards to prevent unauthorized transactions. Some recipients can block specific transactions or receive alerts when a purchase is made.

But many of these security measures require SNAP recipients to proactively act on their own. And that can affect how widely these measures are used.

States with SNAP EBT Card Modernization Efforts, As of May 2025

Image

As more states transition to EBT chip cards, they may also introduce contactless payments, such as tap-to-pay or mobile pay technology. For example, California has included tap-to-pay on its newly issued chip cards.

In addition, USDA has several other efforts underway to address benefit theft. For example, the department has pilot programs that will allow state SNAP agencies automatically block certain types of potentially fraudulent transactions like out-of-state or online transactions.

While these efforts could improve security, they are not without their challenges. For example, retailers that accept SNAP benefits may need to upgrade some computer terminals to process SNAP chip cards. This could be expensive, particularly for larger retailers that could pay upwards of $750,000 to upgrade a network of terminals.

To learn more about SNAP benefit theft and what’s being done to protect recipients, check out our full Q&A report.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

- Got a question or comment? Email us at blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.