Homeownership During A Recession

The current economic recession caused by the COVID-19 pandemic could make it more difficult for some people to purchase their first home, or for out-of-work homeowners to pay their mortgages.

The last recession—the Great Recession (2007-2011)—led to nearly a decade of decline in the national homeownership rate. The recession caused millions of homeowners to lose their homes and begin renting.

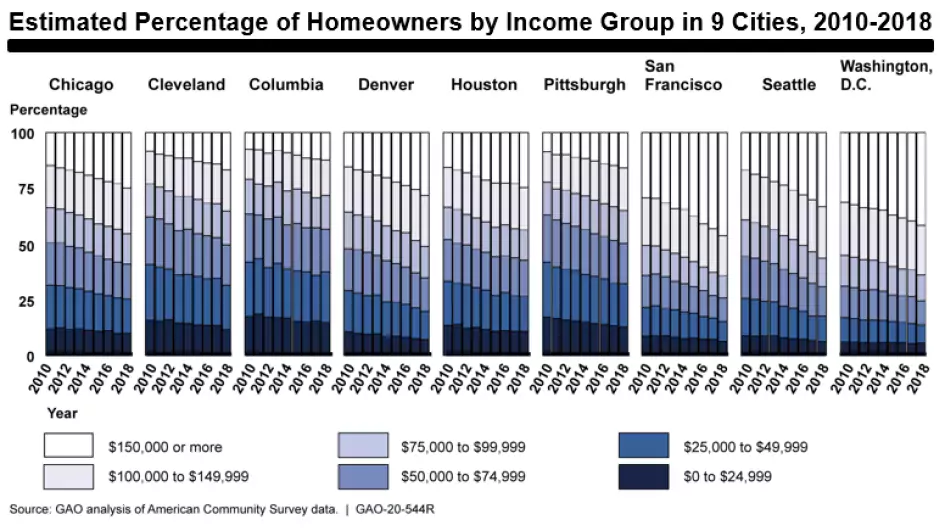

We recently reported on homeownership trends in 9 major American cities between 2010-2018—Chicago; Cleveland; Columbia, South Carolina; Denver; Houston; Pittsburgh; San Francisco; Seattle; and Washington, D.C.

Similar trends could occur during the current recession. Today’s WatchBlog explores.

Home prices and supply

The cost of buying a home went up in all 9 cities following the Great Recession. Prices increased significantly in some cities (e.g., Denver, San Francisco, and Seattle) and to a lesser degree in others (e.g., Chicago and Cleveland).

By 2018, the cities with greatest price increases also had severe constraints on housing supply.

Notes: First quarter 2010 = 100. Index is seasonally adjusted and adjusted for inflation using the Bureau of Labor Statistics Consumer Price Index for All Urban Consumers: All Items Less Shelter in U.S. City Average.

Types of homeowners

We found that homeowners during this period were increasingly older, more diverse, and had higher incomes. For example:

- Most cities saw growth in homeownership among households aged 60 and older, often with corresponding decreases among younger owners.

- The percentage of minority homeowners increased in most cities. However, White households still accounted for the highest percentage of homeowners in all cities.

- Cities like Chicago, Houston, and Washington, D.C. saw an increase in the percentage of Asian and Hispanic homeowners. However, no city saw an increase in the percentage of Black homeowners.

- The percentage of homeowners that reported annual incomes of $150,000 or more (the highest income category reported by the U.S. Census) increased in all 9 cities.

Lower homeownership rates among some groups could be due to higher student loan or household debt, the inability of relatives to assist with down payments, or losing a home to foreclosure. These factors, among many others, are likely to affect home ownership during the current pandemic and in the future.

Update: This graphic was updated on July 30. The original graphic did not match the graphic title.

Note on graphic: Because the American Community Survey reports income information in categories, we did not adjust for inflation. Estimates in this figure have a margin of error of ± 2 percentage points or less at the 95 percent confidence level.

The current recession

The COVID-19 pandemic and recession will likely have a similarly significant impact on the domestic housing market. As discussed in our recent blog posts on the CARES Act and rental housing, the federal government has taken steps to mitigate the economic effects of COVID-19 by providing mortgage relief to homeowners.

To learn more about the housing market, check out our new report.

Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.