It's 10 PM--Do You Know Where Your Financial Data Is?

Advancements in technology like the Internet and smartphones are changing how we pay, borrow, and invest.

Financial technology (a.k.a. fintech) products—including payments, lending, wealth management, and others—generally provide benefits to consumers, such as convenience and lower costs.

But there are risks involved with using any new financial product. So, how can you be a savvier consumer?

For April’s Financial Literacy Month, today’s Watchblog explores our recent report on benefits, risks, and protections for fintech users. Listen to our podcast and read on for more.

Benefits of fintech products

New fintech products can offer greater convenience, lower cost, faster services, improved security, and financial inclusion. For example, from your smartphone you can:

- get a loan from an online lender;

- get investment advice from a robo-adviser; or

- view all of your financial accounts together using an account aggregator; or

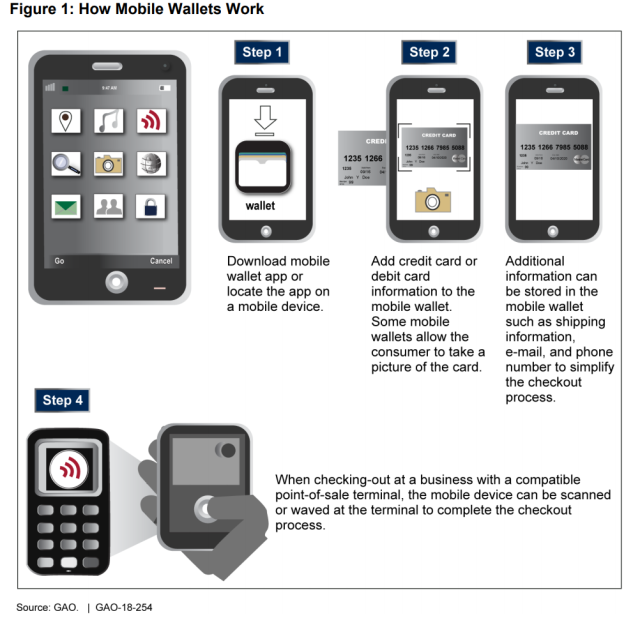

- send dollars or bitcoins to friends using a mobile wallet.

Are your data at risk?

Any financial product that collects sensitive information over the Internet may be vulnerable to cyberattacks. And since some products increase the number of companies involved in a transaction, this also potentially increases the risk of data breaches or fraud.

Innovative financial products may also collect more of your data than traditional products. For example, new lending products may collect information on your educational background and billing history payments, and new payment products may collect information on your transactions. Some companies may also hold your data without disclosing your rights to delete it or prevent it from being shared.

Are you liable for fraud?

If your debit or credit card is stolen or your bank account information is hacked, federal law limits your liability for fraudulent transactions. But, if you use an account aggregator or a virtual currency wallet, you might not be protected if your accounts are hacked.

For example, some banks have said that they may hold you liable for fraudulent transactions if you use an account aggregator to view your bank account. Also, your virtual currency wallet provider may disclaim responsibility for replacing virtual currency that is stolen.

Are your accounts insured?

While your bank account is federally insured up to $250,000 to protect you in case your bank fails, newer products like mobile wallets that store your money or virtual currency may not be insured.

In fact, federal deposit insurance does not apply to virtual currency balances—so you could face losses if your mobile wallet provider goes out of business.

Where can you get more info?

Reading the disclosures, policies, terms, and conditions for the financial products you use can help you understand:

- the data you are sharing and your rights

- your liability for fraudulent transactions

- if your accounts are insured, and for how much

You can also read the consumer guidance provided by your federal and state financial regulators. These agencies provide resources to help consumers understand new products, and where to turn if something goes wrong.

For example, the Federal Communications Commission, the Federal Trade Commission, the Consumer Financial Protection Bureau, and the Securities and Exchange Commission all have resources on data security, as well as on fraud prevention.

To learn more, check out our report on financial technology.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.