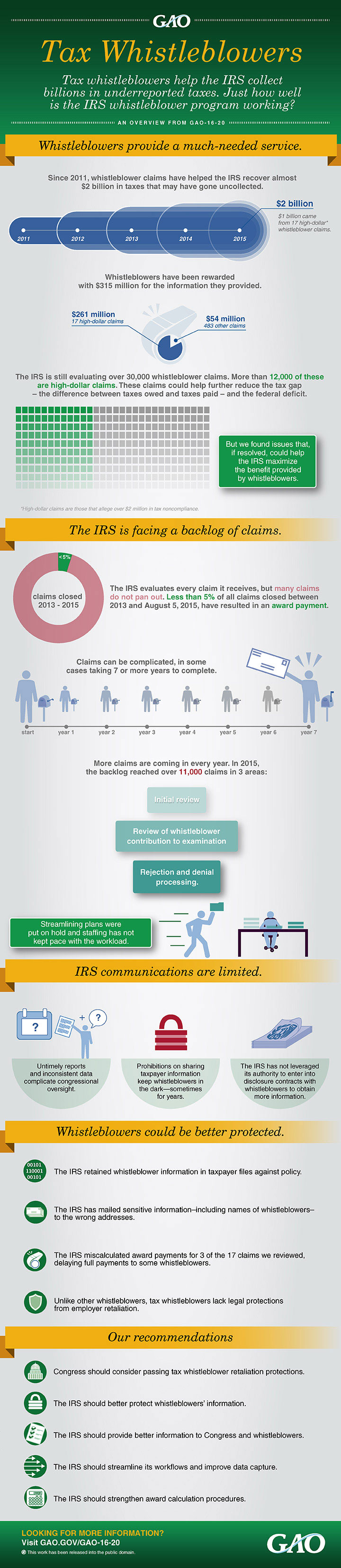

Blowing the Whistle on Underpaid Taxes (infographic)

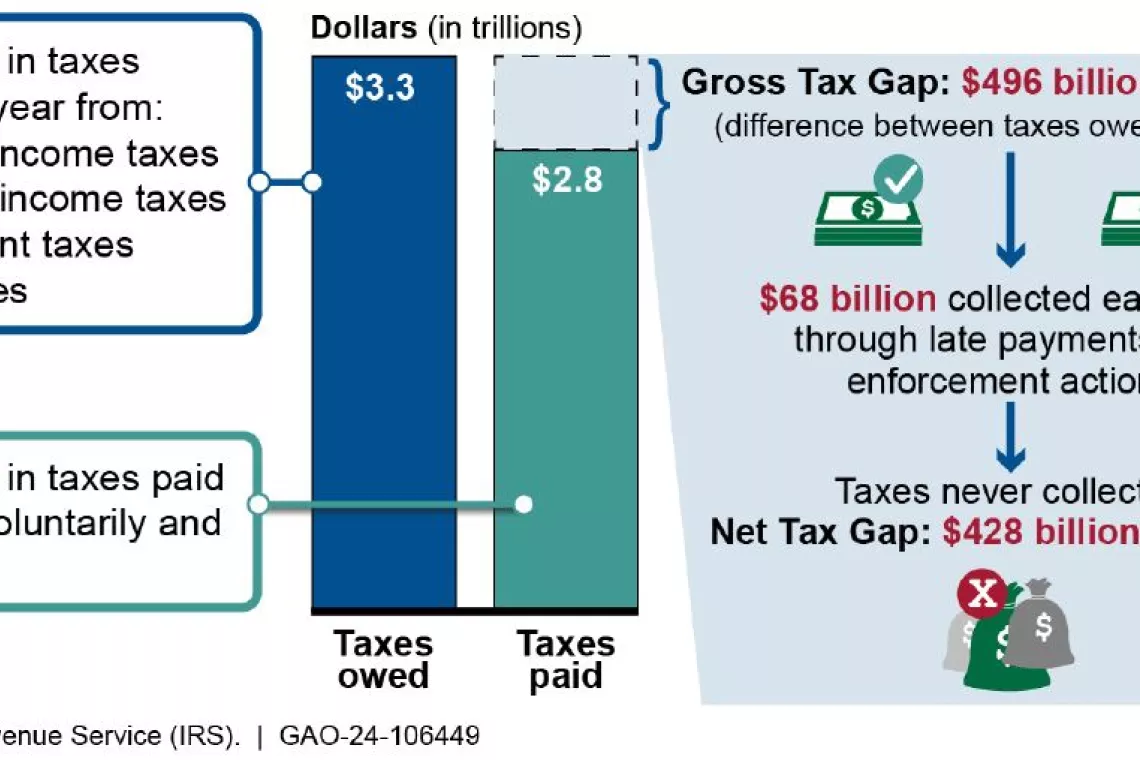

Since 2011, whistleblowers have helped the IRS collect almost $2 billion in taxes that may have otherwise gone uncollected. This money helps reduce the estimated $450 billion tax gap—the difference between taxes owed and those paid on time. Moreover, qualifying whistleblowers can get 15% or more of the collected proceeds.

We recently reviewed the work of the IRS Whistleblower Office, which is responsible for processing thousands of claims each year. Our infographic highlights some of our findings:

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.