Financial Audit: Bureau of the Fiscal Service’s FY 2025 and FY 2024 Schedules of Federal Debt

Fast Facts

Treasury’s Fiscal Service issues debt to borrow money for federal operations and reports the debt on financial statements called the Schedules of Federal Debt.

As of September 30, 2025, the federal debt was $37.6 trillion—up $2.2 trillion from FY 2024. Interest on the debt in FY 2025 increased to $1.2 trillion.

We audit and issue opinions annually on the Schedules and on related internal controls (e.g., processes to reasonably assure that transactions are properly authorized and recorded).

In FY 2025, we found the Schedules were reliable and that controls over financial reporting were effective.

Highlights

What GAO Found

GAO found (1) the Bureau of the Fiscal Service’s Schedules of Federal Debt for fiscal years 2025 and 2024 are fairly presented in all material respects and (2) Fiscal Service maintained, in all material respects, effective internal control over financial reporting relevant to the Schedule of Federal Debt as of September 30, 2025. GAO’s tests of selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt disclosed no instances of reportable noncompliance for fiscal year 2025.

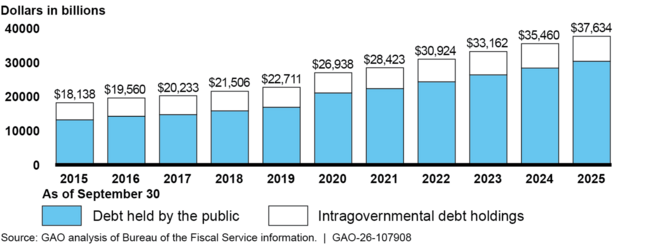

Over the past 10 years, from fiscal year 2015 through fiscal year 2025, total federal debt managed by Fiscal Service has increased from $18.1 trillion to $37.6 trillion.

Total Federal Debt Outstanding, September 30, 2015, through September 30, 2025

Note: A small amount of total federal debt is not subject to the debt limit.

During fiscal year 2025, total federal debt increased by about $2.2 trillion, with about $2.0 trillion of the increase in debt held by the public. Debt held by the public is increasing mainly because the federal government continues to spend more than it collects in revenue, resulting in annual budget deficits that must be financed through borrowing. The budget deficit for fiscal year 2025 was $1.8 trillion. Additionally, interest on debt held by the public has increased significantly, nearly doubling over the last 3 fiscal years, from about $500 billion in fiscal year 2022 to about $1.0 trillion in fiscal year 2025.

On June 3, 2023, the Fiscal Responsibility Act of 2023 was enacted, suspending the debt limit through January 1, 2025. Effective January 2, 2025, the statutory debt limit was set at $36.1 trillion. Extraordinary measures began on January 21, 2025, to prevent the U.S. government from defaulting on its obligations. Extraordinary measures continued until Monday, July 7, 2025, after the debt limit was increased on July 4, 2025, by $5.0 trillion to $41.1 trillion.

The current approach to the debt limit has created uncertainty and disruptions in the Treasury securities market and has increased borrowing costs. In early 2025, the Congressional Budget Office projected that federal deficits will exceed $2 trillion annually over the next decade and remain historically large for the following 30 years under current law. The federal government remains on an unsustainable long-term fiscal path.

Why GAO Did This Study

GAO audits the consolidated financial statements of the U.S. government. Because of the significance of the federal debt to the government-wide financial statements, GAO audits Fiscal Service’s Schedules of Federal Debt annually to determine whether, in all material respects, (1) the schedules are fairly presented and (2) Fiscal Service management maintained effective internal control over financial reporting relevant to the Schedule of Federal Debt. Further, GAO tests compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt.

Federal debt managed by Fiscal Service consists of debt held by the public and intragovernmental debt holdings. Debt held by the public primarily represents the amount the federal government has borrowed to finance cumulative cash deficits and is held by investors outside of the federal government. Intragovernmental debt holdings represent federal debt owed by the Department of the Treasury to other federal government accounts that typically have an obligation to invest their excess annual receipts (and interest earnings) over disbursements in federal securities.

Recommendations

GAO continues to recommend that Congress and the administration develop a strategy to address the government’s unsustainable fiscal path, and that the strategy include considering approaches to the debt limit that link decisions about the level of debt with spending and revenue decisions at the time those decisions are made.

In commenting on a draft of this report, Fiscal Service concurred with GAO’s conclusions.