Fraud in Federal Programs: FinCEN Should Take Steps to Improve the Ability of Inspectors General to Determine Beneficial Owners of Companies [Reissued with revisions on Jun. 9, 2025]

Fast Facts

When it's unclear who controls a company that's participating in federal programs, there's greater risk of fraud. For example, we reported on a scheme where a company owner obscured his identity to claim a contract set aside for disabled veterans. Other cases include hidden foreign ties.

A 2024 law directed some companies to report "beneficial ownership" information to the Treasury Department. Law enforcement and inspectors general can request access to it.

Inspectors general we surveyed identified ways to make this information more useful, such as better facilitating its use in data analytics. Our recommendation addresses this issue and more.

Revised June 9, 2025 to correct pages 10 and 55-57 (Background and Appendix III). The corrected Background section should read: “For the OIGs with law enforcement authority…” The corrected Appendix III, Table 2 under column “OIG has law enforcement authority (yes/no)” should read: “Architect of the Capitol – Yes; Government Publishing Office – Yes; Library of Congress – Yes.” Table 2 source line should also include: “Legislative Branch Inspectors General Independence Act of 2019.” Added Table 2 note should read: “GAO’s OIG, while overseeing a federal agency, was excluded to maintain independence."

Highlights

What GAO Found

When information is unclear about the identity of the person who ultimately owns or controls a company that is participating in federal programs or operations, there is a heightened risk of procurement-, grant-, and eligibility- related fraud. Offices of Inspectors General (OIG) told GAO that they face challenges using the currently available federal, state, and commercial data sources to identify the “beneficial owners” of companies as part of their fraud detection and response efforts.

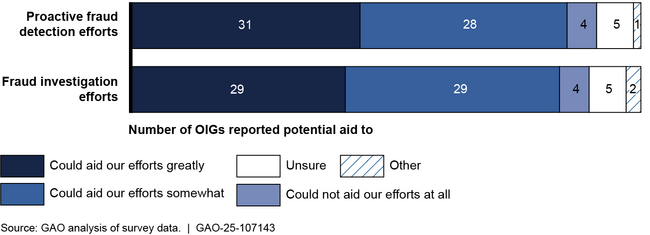

A law that took effect in January 2024 directed certain companies to report their beneficial ownership information to a company registry administered by the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN). FinCEN has begun rolling out a process to allow law enforcement agencies, including select OIGs, to request access. Some OIGs told GAO that they have received information about the company registry, but they were unclear on which OIGs would have access to the data and exactly how company registry data can be used. Nevertheless, most OIGs who responded to GAO's survey reported that access to company registry data could be useful to their offices' fraud detection and response efforts (see fig.).

Usefulness of Beneficial Ownership Information to Fraud Detection and Investigation Efforts, According to Offices of Inspectors General (OIG) Survey Responses

OIGs identified several potential limitations in using company registry data. For example, FinCEN has not yet specified capabilities for bulk downloads of the data, but OIGs noted that such capability could facilitate data matching between the company registry and other data sources. In March 2025, Treasury announced plans to narrow the scope of reporting to foreign companies only. Beneficial ownership risk remains, however. With this change, registry information available to OIGs is more limited. Communicating with OIGs could help clarify the information available, OIGs' access, and how the data can be used. FinCEN officials said they are open to discussions with OIGs on these issues. Communication with OIGs during the registry rollout would better position FinCEN to identify and address challenges related to the fraud detection and response needs of the OIG community. Further, these efforts support FinCEN's strategic goal to significantly improve the ability to mitigate illicit finance risk by increasing law enforcement and other authorized users' access to beneficial ownership information.

Why GAO Did This Study

Fraud across federal programs is a significant and persistent problem. Some of this fraud is perpetrated by private companies obscuring beneficial ownership information when they compete for government contracts or apply for federal benefits. OIGs conduct oversight through audits and investigations, which include issues related to beneficial ownership.

GAO was asked to review how beneficial ownership information may aid OIGs in their fraud detection and response efforts. This report describes the types of federal program fraud associated with beneficial ownership information, provides OIGs' perspectives on using the company registry, and assesses FinCEN's actions to communicate with OIGs.

GAO reviewed relevant laws and agency documentation, interviewed officials from FinCEN and the Council of the Inspectors General on Integrity and Efficiency (CIGIE), conducted a roundtable discussion with seven OIGs, and surveyed 72 OIGs to obtain their views on how the registry could affect their efforts to combat fraud.

Reissued with revisions on Jun. 9, 2025

Revised June 9, 2025 to correct pages 10 and 55-57 (Background and Appendix III). The corrected Background section should read: “For the OIGs with law enforcement authority…” The corrected Appendix III, Table 2 under column “OIG has law enforcement authority (yes/no)” should read: “Architect of the Capitol – Yes; Government Publishing Office – Yes; Library of Congress – Yes.” Table 2 source line should also include: “Legislative Branch Inspectors General Independence Act of 2019.” Added Table 2 note should read: “GAO’s OIG, while overseeing a federal agency, was excluded to maintain independence."Recommendations

GAO recommends that FinCEN communicate with OIGs, via CIGIE, regarding OIGs' company registry access and use. FinCEN had no comment on the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should ensure that the Director of FinCEN communicates with CIGIE on OIGs' use of company registry for fraud detection and response during the registry rollout. Specifically, FinCEN should communicate with CIGIE regarding OIGs' (1) access to the company registry, (2) use of company registry data beyond criminal investigations, and (3) reported limitations in using company registry data. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|