Carbon Credits: Limited Federal Role in Voluntary Carbon Markets

Fast Facts

Companies or people may choose to offset their emissions of carbon dioxide and other greenhouse gases by purchasing carbon credits through voluntary carbon markets. The credits are generated from projects meant to reduce or remove emissions, such as planting forests. However, stakeholders have raised concerns about whether carbon credits produce the environmental benefits they claim.

Overall, the federal government plays a small role in such markets. This Q&A discusses further steps federal agencies could take to promote market integrity, such as certifying credits. But there isn’t consensus about what role federal oversight should play.

Projects to plant forests can generate carbon credits

Highlights

What GAO Found

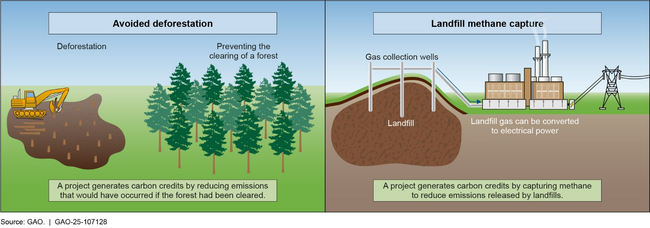

Voluntary carbon markets allow entities, such as companies, to offset their emissions of greenhouse gases (e.g., carbon dioxide) by voluntarily purchasing carbon credits. These credits are generated from projects intended to reduce or remove greenhouse gas emissions. Such projects include activities to reduce deforestation or improve forest management, changes in energy production and use practices, and greenhouse gas destruction.

Examples of Projects That Reduce Emissions

Overall, the federal government has had a limited role in voluntary carbon markets. Over the past 2 years, various federal agencies, such as the Commodity Futures Trading Commission and the Department of the Treasury, have undertaken efforts to provide some oversight or guidance related to these markets. In addition, certain federal agencies have participated in these markets through supporting the production and use of carbon credits and as potential purchasers of carbon credits. These efforts could change as government priorities evolve.

There was not a consensus among the eight experts GAO interviewed around specific additional steps that the federal government could take to promote integrity in the voluntary carbon markets, if it chooses to do so. For example, five of the experts discussed the option of a federal agency regulating and certifying the quality of carbon credits and these experts held different views about the extent to which a federal agency should take on this role, if at all. In addition, a 2023 National Academies report and a 2008 GAO report identified tradeoffs between federal oversight to promote integrity in voluntary carbon markets and costs associated with carbon credits.

Why GAO Did This Study

Voluntary carbon markets provide a potentially lower-cost way for purchasers of carbon credits to voluntarily compensate for their emissions, compared with reducing their emissions directly.

However, these markets raise questions among some observers about whether carbon credits produce the environmental benefits they claim and issues relating to their limited transparency. Such vulnerabilities may be affecting the growth and integrity of the markets, according to a 2024 report by an international body that brings together the world’s securities regulators.

GAO was asked to examine federal efforts related to voluntary carbon markets. This report describes aspects of these markets, roles and efforts of federal agencies regarding these markets, and steps the federal government could take to promote the markets’ integrity, if it chooses to do so.

To describe aspects of voluntary carbon markets, GAO reviewed prior GAO reports on carbon offsets from 2008, 2009, and 2011; International Organization of Securities Commissions reports on voluntary carbon markets from 2023 and 2024; and relevant studies identified through a literature review.

To identify federal roles and efforts related to voluntary carbon markets and understand how these efforts are intended to improve the integrity of voluntary carbon markets, GAO reviewed relevant laws, regulations, and agency guidance and documents and interviewed agency officials.

To examine steps the federal government could take to promote integrity in voluntary carbon markets, GAO reviewed a 2023 National Academies of Sciences, Engineering, and Medicine report, Accelerating Decarbonization in the United States: Technology, Policy, and Societal Dimensions and prior GAO reports. GAO also interviewed subject matter experts.

For more information, contact J. Alfredo Gómez at gomezj@gao.gov.