Health Insurance: Enhanced Data Matching Could Help Prevent Duplicate Benefits and Yield Substantial Savings

Fast Facts

Federally funded health care programs are susceptible to improper payments and fraud. For example, Health and Human Services estimated $4.9 billion in Medicaid payments for ineligible people in FY 2024.

HHS oversees programs such as Medicaid and health insurance marketplaces. These programs can generally detect when unauthorized people are enrolled in several programs at the same time within a state, but there are challenges across states. We found about $1.6 billion in potential overpayments due to duplicate coverage across selected states.

Better data matching across states could help. Our recommendations address this issue and more.

A medical stethoscope laying on top of USD $100 bills.

Highlights

What GAO Found

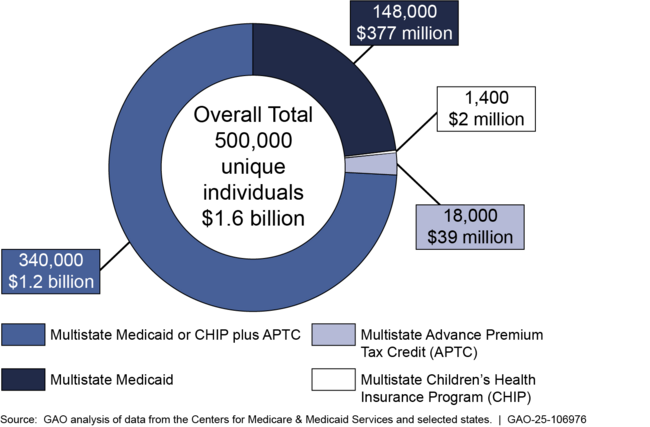

For fiscal year 2023, the federal government and six selected states—California, Georgia, New York, Pennsylvania, Tennessee, and Texas—paid health insurance entities at least $1.6 billion in potential overpayments or fraud for duplicate health care coverage or benefits. The payments were made on behalf of approximately 500,000 individuals who were simultaneously enrolled across multiple states in Medicaid or the Children’s Health Insurance Program (CHIP) or receiving an advance premium tax credit (APTC) across multiple states. These payments were made on behalf of individuals to managed care organizations in the form of capitated payments for Medicaid and CHIP or to health insurance issuers through APTC.

The $1.6 billion in potential overpayments identified in GAO’s analyses may be relatively small compared to the total enrollment numbers, outlays, and expenditures. However, they represent a significant amount of potential overpayments largely stemming from six selected states in GAO’s review. It is also likely that the counts and dollar figures GAO identified were partially attributable to COVID-19-related continuous enrollment conditions for Medicaid and some CHIP enrollees. Specifically, as a condition for receiving temporarily enhanced federal funding during the pandemic, states were required to keep Medicaid and some CHIP beneficiaries continuously enrolled unless an individual requested voluntary termination of eligibility, or the individual ceased to be a resident of the state. Nonetheless, the conditions did not prevent states from disenrolling individuals who were confirmed to no longer be state residents, and duplication of Medicaid, CHIP, or APTC benefits across states for individuals should not have occurred.

Simultaneous Program Enrollment in Medicaid or CHIP for Six Selected States and APTC Nationwide for Fiscal Year 2023

Note: Individual counts may overlap between categories. The overall total reflects aggregated values after removing duplicate individuals across programs and states. Due to rounding, individual counts and dollar amounts may vary slightly from the totals.

Marketplaces’ processes to identify and prevent simultaneous cross-state health care coverage or benefits are limited.

- Marketplaces do not have sufficient processes to identify and prevent simultaneous cross-state APTC benefits—such as preventing duplicate Social Security numbers from being used on multiple marketplace health plans simultaneously. Without designing sufficient processes to identify and prevent duplicate cross-state enrollment within the marketplaces, there is an increased risk that APTC benefits will be improperly paid to multiple health insurance issuers on behalf of the same individual.

- Additionally, marketplaces do not have processes to identify individuals receiving simultaneous cross-state Medicaid or CHIP coverage. Moreover, none of the marketplaces submit qualified health plan enrollment data, including APTC information, to the Public Assistance Reporting Information System (PARIS)—a data-matching service used to identify duplicate cross-state payments—or another data-matching system. Requiring marketplaces to submit such data would enable the Centers for Medicare & Medicaid Services (CMS) and state agencies to use the data to identify enrollee matches between APTC and CHIP or Medicaid, which could then be resolved to verify eligibility or terminate benefits, as appropriate.

Most states Medicaid and CHIP agencies reported that they submit Medicaid and CHIP enrollment data to PARIS for data matching. However, the enrollment populations and frequency of interstate data matching varied among states for both Medicaid and CHIP.

Some states exclude categories of enrollees from their submission, and some do not submit quarterly because it is not required. Until state Medicaid and CHIP agencies are required to submit enrollment data to PARIS or another data-matching system for interstate data matching on a frequent recurring basis, state Medicaid and CHIP agencies will continue to face greater risk of being unaware of potential instances of duplicate cross-state Medicaid and CHIP enrollment.

Why GAO Did This Study

Federally funded health care programs are susceptible to significant improper payments, including fraud. For example, for fiscal year 2024, the Department of Health and Human Services (HHS) estimated $4.9 billion in improper Medicaid payments for ineligible individuals. HHS’s CMS oversees three principal health care programs generally available for eligible persons under 65 years of age: Medicaid, CHIP, and the health insurance marketplaces, through which eligible individuals can purchase health insurance.

To help pay for marketplace health insurance, federal law provides for a premium tax credit to individuals who meet certain income and other eligibility requirements. Individuals can choose to have the marketplace compute an estimated credit that is paid directly to their issuers on their behalf, known as APTC, which lowers their monthly premium payments. However, individuals are generally not eligible for APTC if they qualify for Medicaid or CHIP. Further, individuals should not be simultaneously enrolled in any of these programs in multiple states.

GAO was asked to review issues related to duplicate health care coverage payments in Medicaid, CHIP, and APTC. This report (1) describes instances of payments made for duplicate Medicaid and CHIP coverage in selected states and potentially ineligible APTC benefits nationwide and (2) examines the extent to which CMS and states have designed processes to identify and prevent duplicate cross-state health care coverage in these programs.

GAO conducted data matching of enrollment and payment data to identify duplicate payments made for Medicaid or CHIP in six selected states and APTC benefits nationwide. Among other factors, states were selected based on average monthly CHIP and Medicaid enrollment by state, number of individuals receiving APTC by state, state migration trends, and proximity to one another. GAO also conducted three nationwide surveys of state Medicaid agencies, state CHIP agencies, and state-based marketplaces.

Recommendations

GAO is making three recommendations to CMS. One recommendation is that CMS design or modify controls to help detect and prevent duplicate Social Security numbers from being used on multiple marketplace policies receiving APTC benefiits. Additionally, GAO is recommending that CMS require marketplaces and Medicaid and CHIP agencies to (1) submit all enrollment data to PARIS, or another data-matching system, for interstate matching on a frequently recurring basis and (2) resolve all matches to verify eligiblity or terminate coverage as appropriate. HHS neither agreed nor disagreed with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Centers for Medicare & Medicaid Services | The Administrator for CMS, in coordination with the health insurance marketplaces, should design a process or modify its current one, including the development of policies and procedures, to help detect and prevent duplicate SSNs being used on multiple qualified health plan policies receiving APTC benefits within a marketplace or across the marketplaces simultaneously. (Recommendation 1) |

In its comments on our draft report, HHS neither agreed nor disagreed with this recommendation, but cited actions it will take to address it. We will update the status of this recommendation when HHS provides its 180-day letter (expected in spring 2026).

|

| Centers for Medicare & Medicaid Services | The Administrator for CMS should require that (1) all federally facilitated and state-based marketplaces submit qualified health plan enrollment data, including APTC information to PARIS, or another data-matching system, for interstate matching on a frequently recurring basis, such as quarterly, and (2) federally facilitated and state-based marketplaces resolve matches identified between APTC and CHIP or Medicaid to determine eligibility and terminate coverage, as appropriate. (Recommendation 2) |

In its comments on our draft report, HHS neither agreed nor disagreed with this recommendation, but cited actions it will take to address it. We will update the status of this recommendation when HHS provides its 180-day letter (expected in spring 2026).

|

| Centers for Medicare & Medicaid Services | The Administrator for CMS should require that all state Medicaid and CHIP agencies (1) submit all enrollment data to PARIS, or another data-matching system, for interstate matching on a frequently recurring basis, such as quarterly, and (2) review matches to verify Medicaid or CHIP eligibility and terminate coverage, as appropriate. (Recommendation 3) |

In its comments on our draft report, HHS neither agreed nor disagreed with this recommendation, but cited actions it will take to address it. We will update the status of this recommendation when HHS provides its 180-day letter (expected in spring 2026).

|