Older Workers: Employment Rates Rebounded and Personal Finances Remained Steady Following Pandemic

Fast Facts

How did older workers fare in the pandemic?

The unemployment rate for workers aged 55-64 peaked at 12.6% in April 2020. It returned to pre-pandemic level of 2.2% by April 2023.

Older workers' personal finances—retirement account balances, for example—remained steady during the pandemic.

The number of workers at or near full retirement age claiming Social Security benefits initially dropped but then rose above pre-pandemic levels in late 2020.

Experts suggested options to support older workers, such as identifying barriers to their employment, and improving existing job-search resources for them.

Highlights

What GAO Found

Across demographic groups, labor market outcomes for older workers were generally resilient in the COVID-19 pandemic's wake, with older workers' employment outcomes returning to pre-pandemic levels after an initial spike in unemployment. The unemployment rate for workers aged 55–64 peaked at 12.6 percent in April 2020 and had returned to its pre-pandemic level of 2.2 percent by April 2023, according to GAO's analysis of Current Population Survey data from 2017 to 2023. Further, older workers were more likely to report that they were unemployed because they had lost their job or been laid off, and they were also more likely to have exited the labor force by retiring. Younger workers (aged 25–54) were more likely to report that they were unemployed because a temporary job had ended or because they left a job. GAO found that existing differences by demographic group generally persisted, such as more highly educated older workers having higher labor force participation.

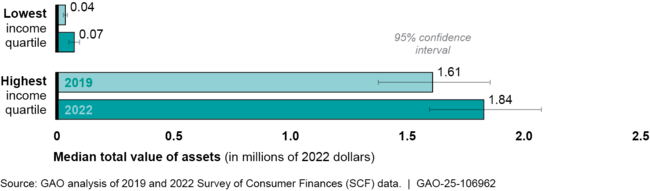

During the pandemic, older workers' personal finances generally remained relatively steady. The rate of Social Security retirement benefit claims by workers who were near the full retirement age decreased during the first 3 months of the pandemic, according to GAO's analysis of Social Security Administration data. In late 2020, the rate of benefit claiming for those near full retirement age increased, eventually exceeding pre-pandemic levels, according to GAO's analysis. The prevalence of households aged 55 or over that had retirement accounts, and the value of those accounts, held relatively steady between 2019 and 2022, according to GAO's analysis of Survey of Consumer Finances data. However, differences persisted in the value of assets held by income quartile (see figure), as well as by some demographic groups, including differences by education, race, and gender.

Estimated Median Total Value of Assets Held by Older Households (Aged 55–64), by Income Group

The 25 experts who responded to GAO's written questionnaire generally favored policy options that could most effectively boost older workers' employability. Among the options favored by 12 or more experts was a policy option suggesting that the Department of Labor identify and report on the legal, regulatory, logistical, or other barriers to the employment of older workers. Experts also favored a policy option that the Department of Labor offer targeted support, such as improving the agency's existing job-search assistance programs for older job seekers.

Why GAO Did This Study

The COVID-19 pandemic caused significant nationwide economic disruptions. Older adults, particularly those close to or already in retirement, may have faced a greater financial burden because they did not have sufficient time to rebuild retirement savings.

The CARES Act includes a provision for GAO to monitor federal efforts in response to the pandemic. This report describes: (1) how trends in older workers' employment status and duration varied from 2017-2023 and demographic differences among worker subpopulations; (2) how older workers' personal finances, including Social Security benefit claiming rates, changed; and (3) what policy options experts identified that could enhance the outcomes of discouraged or unemployed older workers.

GAO used Current Population Survey monthly data from 2017 to 2023 to analyze labor force participation rates and employment trends for older and younger workers. Using the most recent data available, GAO examined retirement account balances and total assets held by older households using Survey of Consumer Finances data and analyzed claims for retirement benefits using Social Security Administration administrative data. GAO also sent a written questionnaire to 32 experts, asking them to identify policies likely to help discouraged or unemployed older workers.

For more information, contact Kris Nguyen at nguyentt@gao.gov.