Troubled Asset Relief Program: Lifetime Cost

Fast Facts

Treasury's Troubled Asset Relief Program was created to help stabilize the U.S. financial system, restart economic growth, and prevent avoidable foreclosures during the 2008 financial crisis. TARP was originally authorized to purchase or guarantee up to $700 billion in assets to assist financial institutions and markets, businesses, and individuals.

As of September 30, 2023, when all TARP-funded programs were fully wrapped up, the total amount spent was $443.5 billion.

After repayments, sales, dividends, interest, and other income, the lifetime cost of TARP-funded programs was $31.1 billion.

Highlights

What GAO Found

In October 2008, Congress passed the Emergency Economic Stabilization Act of 2008 (EESA) in response to the financial crisis. EESA established the Office of Financial Stability (OFS) within the Department of the Treasury and created the Troubled Asset Relief Program (TARP). TARP-funded programs were designed to assist financial institutions and markets, businesses, homeowners, and consumers.

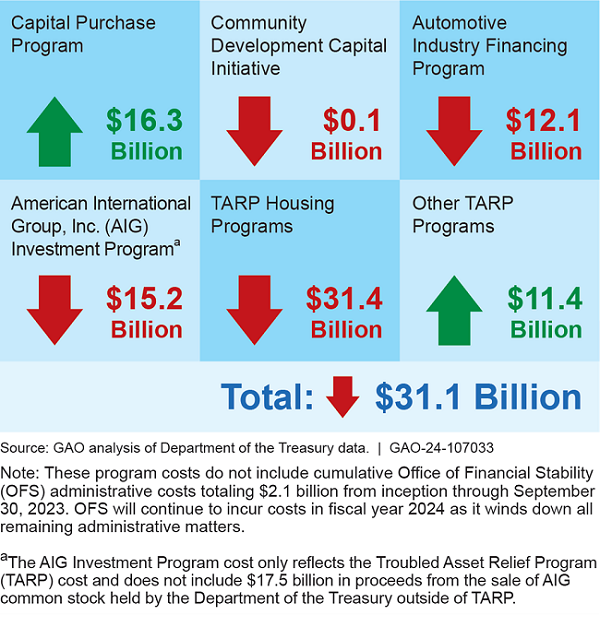

EESA originally authorized TARP to purchase or guarantee up to $700 billion in assets. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 reduced that amount to $475 billion. By the time all TARP-funded programs concluded, on September 30, 2023, the total amount disbursed was $443.5 billion. However, after repayments, sales, dividends, interest, and other income, the lifetime cost of TARP-funded programs was $31.1 billion, significantly less than its original authorization (see figure). Further, while there will be no effect on the net cost, TARP has over $14.2 billion in unused funds that it will return to Treasury at the end of fiscal year 2025.

Lifetime Cost of TARP-Funded Programs

OFS established several programs under TARP to help stabilize the U.S. financial system, restart economic growth, and prevent avoidable foreclosures. For example:

- The Capital Purchase Program (CPP) was launched in October 2008 to help stabilize the financial system by providing capital to viable financial institutions. Through CPP, Treasury disbursed a total of $204.9 billion to 707 institutions in 48 states, Puerto Rico, and the District of Columbia. After repayments, sales, dividends, and interest, however, the program resulted in a net gain of $16.3 billion.

- The Community Development Capital Initiative (CDCI) was created in February 2010 to help certified community development financial institutions and the communities they serve cope with the effects of the financial crisis. Though CDCI disbursed a total of $570.1 million, the final cost of the program—after repayments, sales, dividends, and interest—was $67.5 million.

- The Automotive Industry Financing Program (AIFP) was launched in December 2008 to help prevent the collapse of General Motors and Chrysler, which would have significantly disrupted the U.S. auto industry. AIFP disbursed $79.7 billion in loans and equity investments. After repayments, sales, dividends, and interest, the program cost a total of $12.1 billion.

- The American International Group, Inc. (AIG) Investment Program was intended to prevent the disorderly failure of AIG, which the U.S. government concluded would have caused catastrophic damage to the nation's financial system and economy. Starting in November 2008, Treasury used TARP funds to invest $67.8 billion in AIG, helping to secure its liquidity. After repayments, sales, dividends, interest, and other income related to AIG, TARP's ultimate cost was $15.2 billion. However, Treasury also received non-TARP shares of AIG, and the $17.5 billion in proceeds it received from the sale of these shares not only offset the TARP costs but resulted in a net gain for Treasury.

- OFS launched two housing programs—Making Home Affordable and the Hardest Hit Fund—to help struggling homeowners avoid foreclosure and stabilize the housing market. In addition, TARP provided support to the Federal Housing Administration Refinance Program, designed to assist borrowers whose homes were worth less than the remaining amounts due on their mortgage loans. Under the terms of these programs, recipients were not required to repay the government for funds they received. In total, these programs assisted more than 3.3 million homeowners and supported neighborhood improvement efforts at a final cost of $31.4 billion.

- Various additional TARP-funded programs disbursed $59.1 billion and resulted in a net gain of $11.4 billion.

Why GAO Did This Study

EESA provided GAO with broad oversight authority to track actions related to TARP. GAO audited TARP's financial statements annually, including the costs of the individual programs, since the program's inception. For the entire 15-year duration of TARP, GAO issued unmodified (clean) opinions on its financial statements. In addition, GAO performed many other audits of TARP-funded programs and made over 70 recommendations for corrective action, most of which Treasury implemented. With the conclusion of TARP in September 2023, GAO can now summarize the ultimate cost of the program.

For more information, contact Cheryl Clark at (202) 512-3406 or ClarkCE@gao.gov.