Improper Payments: Fiscal Year 2022 Estimates and Opportunities for Improvement

Fast Facts

In fiscal year 2022, federal agencies made an estimated $247 billion in payment errors—either payments that should not have been made or that were made in the incorrect amount. Overpayments accounted for about $200 billion of the total. But the total doesn't yet include estimates for certain risky programs, like the Pandemic Unemployment Assistance Program and the Supplemental Nutrition Assistance Program.

This report—the first in a series of quarterly reports—summarizes root causes, potential solutions, and other agency data on payment errors. It also covers our related open recommendations for agencies and for congressional consideration.

Highlights

What GAO Found

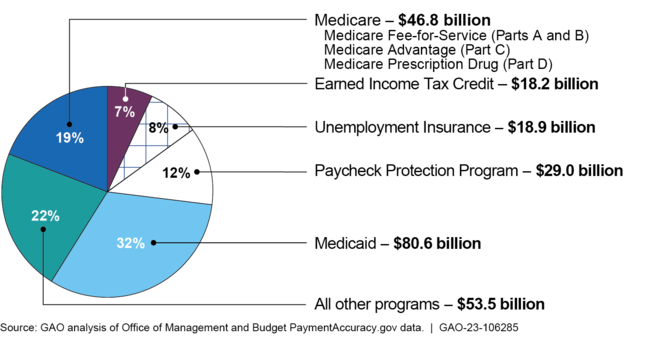

For fiscal year 2022, 18 agencies reported an estimated $247 billion in improper payments across 82 programs. Approximately 78 percent of this total (about $194 billion) was reported by five program areas: (1) Medicaid ($81 billion), (2) Medicare ($47 billion), (3) the Paycheck Protection Program ($29 billion), (4) Unemployment Insurance ($19 billion), and (5) Earned Income Tax Credit ($18 billion). However, the $247 billion total does not include estimates for certain risk-susceptible programs, such as the Department of Labor's Pandemic Unemployment Assistance program and the Department of Agriculture's Supplemental Nutrition Assistance Program.

Programs with the Largest Percentage of Total Reported Government-Wide Estimates of Improper Payments for Fiscal Year 2022

Agencies reported that an estimated $200 billion (over 80 percent) of the $247 billion total was the result of overpayments. Agencies also identified several mitigating strategies to address the root causes of improper payments, such as providing training, changing processes, and proposing statutory changes.

Twelve agencies reported estimated improper payments each fiscal year for 35 programs since fiscal year 2017 using a consistent methodology. Over this period, agencies' estimated improper payment rates have decreased in 19 of these programs, according to fiscal year 2022 reporting. These changes may be attributable to a number of factors, including agency corrective actions, changes in policies, or variability from the estimation process (e.g., margin of error).

GAO has made numerous recommendations to agencies and provided suggestions to Congress to help reduce improper payments. While some steps have been taken in response, more action is needed. Eight agencies that reported improper payment estimates for fiscal year 2022 had open (unaddressed) GAO priority recommendations related to improper payments. As of February 2023, 37 of the 53 such recommendations remained open. In addition, there are 20 open GAO matters for congressional consideration to improve federal financial management.

Why GAO Did This Study

Improper payments—payments that should not have been made or that were made in incorrect amounts—continue to be an area of fiscal concern in the federal government. Since fiscal year 2003, cumulative executive agency improper payment estimates have totaled almost $2.4 trillion.

House Report 117-389, which accompanied the Legislative Branch Appropriations Act, 2023, included a provision for GAO to provide quarterly reports on its ongoing oversight of improper payments.

Among other things, this report summarizes federal agencies' reported improper payment estimates for fiscal year 2022, as well as reported root causes, corrective actions, and reasons for substantial year-over-year changes, and GAO's open priority recommendations and matters for congressional consideration related to reducing improper payments.

GAO summarized (1) improper payment estimates and high-priority program scorecards on PaymentAccuracy.gov, as well as agency financial reports, and (2) open GAO priority recommendations and matters for Congress.

For more information, contact M. Hannah Padilla at (202) 512-5683 or padillah@gao.gov.