Manufactured Housing: Further HUD Action is Needed to Increase Available Loan Products

Fast Facts

Manufactured housing—prefabricated, factory built homes—can be an affordable option for lower-income homebuyers. But some borrowers may not qualify for mortgages and might have to turn to other kinds of financing with less favorable rates and terms.

Several federal agencies, Fannie Mae, and Freddie Mac have created new or modified existing loan programs to help manufactured home borrowers. But while the Department of Housing and Urban Development has planned program improvements, it doesn't have a timeline for putting them in place. We recommended it do so.

A manufactured house being transported on a California highway in 2018

Highlights

What GAO Found

Manufactured housing, prefabricated factory-built homes, can be financed with personal property or mortgage loans. The Departments of Housing and Urban Development (HUD), Veterans Affairs, and Agriculture administer loan guarantee programs for manufactured housing. Federal entities also participate in the secondary market to provide housing finance options. Ginnie Mae guarantees securities backed by federally insured mortgages, and Fannie Mae and Freddie Mac (enterprises) purchase mortgages that are not federally guaranteed and securitize them (package them into securities and sell them to investors).

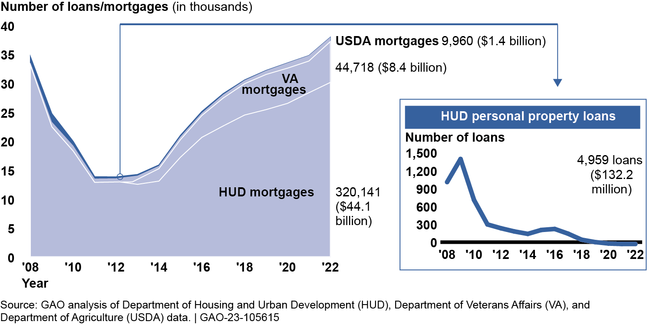

Federal agency financing of manufactured homes increased for mortgages but not for personal property loans in recent years (see figure). Few personal property loans were made because these loans are capped at an amount lower than the average purchase price of a manufactured home. The limited secondary market for personal property loans also may deter lenders from making them.

Federally Guaranteed Mortgage Loans and Personal Property Loans for Manufactured Housing, Fiscal Years 2008–2022

Notes: Based on available agency data. HUD provided calendar year data for personal property loans and fiscal year data for mortgage loans. VA and USDA provided fiscal year data. VA did not track loans for manufactured housing before 2013.

Several federal entities have supported increasing financing options for manufactured housing. For instance, VA and USDA developed new or modified existing loan programs to assist borrowers. The enterprises expanded eligibility requirements and increased purchase targets to help increase the availability of financing. HUD also has taken some steps to address long-standing requirements to improve the financing and securitization of manufactured housing, but has not fully implemented several proposed changes. Implementing these changes and establishing time frames and milestones for its actions would better assure that HUD could promote the availability and affordability of manufactured homes.

Why GAO Did This Study

The U.S. has a shortage of affordable housing, particularly for low- and medium-income households. Manufactured housing is a source of affordable housing. However, some stakeholders have raised questions about the limited options for financing manufactured housing.

GAO was asked to review the federal role in supporting the financing of manufactured housing. Among its objectives, this report examines (1) trends in the use of federal financing for manufactured housing and (2) federal efforts to assess and improve financing options.

GAO examined federal housing data, reviewed regulations, analyzed information on federal financing products, conducted a literature review, and interviewed federal entity officials and lenders, industry groups, and other stakeholders.

Recommendations

GAO is making two recommendations—one each to the Federal Housing Administration and Ginnie Mae (entities in HUD)—to implement planned changes to increase financing options for manufactured homes, including identifying options for greater securitization of mortgage and personal property loans, and establish time frames and milestones for actions. FHA and Ginnie Mae agreed with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Housing and Urban Development | The Secretary of Housing and Urban Development should ensure that the Commissioner of FHA implement planned changes to provide additional financing options for manufactured homes, including identifying options for greater securitization of manufactured home mortgages and personal property loans and establishing time frames and milestones for the actions. (Recommendation 1) |

In October 2024, HUD was taking steps to implement planned changes to provide additional financing options for manufactured homes. For example, HUD was in the process of finalizing rules related to indexing and loan limits for manufactured homes. HUD also had plans to implement some technology updates to address risk identification for these products. By implementing its efforts to address additional financing options, HUD is working towards having better assurance that their loan programs appropriately promote the availability of affordable manufactured homes. In September 2025, HUD provided a status update on HUD's planned actions and noted that further actions in response to the recommendation were pending the administration's determination of priorities. We will continue to follow up on the status.

|

| Department of Housing and Urban Development | The Secretary of Housing and Urban Development should ensure that the President of Ginnie Mae implement planned changes to provide additional financing options for manufactured homes, including identifying options for greater securitization of manufactured home mortgages and personal property loans and establishing time frames and milestones for the actions. (Recommendation 2) |

As of October 2024, HUD and Ginnie Mae were taking steps to implement planned changes to provide additional financing options for manufactured homes. For example, HUD was in the process of finalizing rules related to indexing and loan limits for manufactured homes. Ginnie Mae drafted a Term Sheet of potential enhancements to identify program and policy updates, feasibility, and priorities. Ginnie Mae also planned to coordinate with FHA on Title I program enhancements and dependencies impacting Ginnie Mae's Manufactured Housing program. By implementing its efforts to address additional financing options, HUD and Ginnie Mae are working towards having better assurance that their loan programs appropriately promote the availability of affordable manufactured homes. In September 2025, HUD and Ginnie Mae provided a status update on HUD and Ginnie Mae's planned actions and noted that further actions in response to the recommendation were pending the administration's determination of priorities. We will continue to follow up on the status.

|