Renewable Fuel Standard: Actions Needed to Improve Decision-Making in the Small Refinery Exemption Program

Fast Facts

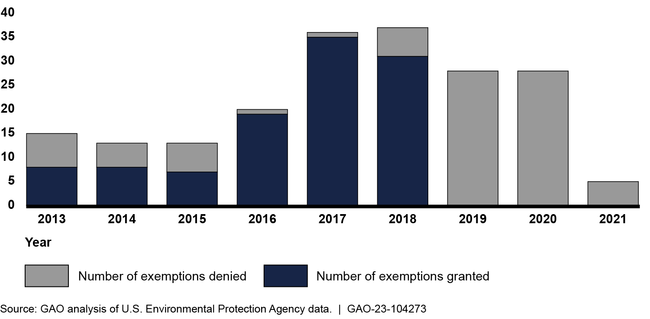

Small refineries can apply for an exemption from the Renewable Fuel Standard, which requires the blending of biofuel into gasoline and diesel. The number of exemptions granted through this program has fluctuated significantly from year to year.

But the Environmental Protection Agency and the Department of Energy don't have the information, policies, or procedures needed to fully ensure that exemption decisions are valid. EPA also routinely missed its statutory deadline for making decisions.

We recommended that EPA and Energy develop policies and procedures for making small refinery exemption decisions, and more.

Highlights

What GAO Found

The U.S. Environmental Protection Agency (EPA) does not have assurance that its decisions about small refinery exemptions under the Renewable Fuel Standard (RFS) are based on valid information. In addition, EPA and the Department of Energy (DOE) do not have policies and procedures specifying how they are to consult about and make exemption decisions.

Information. Small refinery exemption decisions for compliance years 2019 through 2021 were based on an EPA conclusion that small refineries do not experience disproportionate economic hardship from the RFS. This conclusion relies on a potentially flawed assumption—that all parties pay and receive one price for the tradeable credits used to demonstrate compliance with the RFS. GAO found that EPA has not analyzed whether this assumption is valid. GAO's analysis showed that small refineries have paid more on average for compliance credits than large refineries. Without reassessing its conclusion, EPA does not have assurance that its small refinery exemption decisions are based on valid information.

Policies and procedures. EPA has generally documented its decisions. However, EPA has no policies or procedures for how it assesses petitions and makes exemption decisions. Similarly, DOE does not have policies or procedures for how it provides consultation to EPA. Administration of the program has been inconsistent, and the number of exemptions granted and denied has varied from year to year (see fig.). Consequently, agency decisions appear ad hoc, resulting in market uncertainty. This can harm small refineries and renewable fuel producers by undermining their ability to plan for infrastructure upgrades and renewable fuel demand.

Number of Small Refinery Exemptions Granted and Denied, 2013-2021

EPA has routinely missed the 90-day statutory deadline for issuing exemption decisions and does not have procedures to ensure that it meets these deadlines. In 5 of the 9 years GAO analyzed, EPA took more than 200 days to issue a decision for more than half of the petitions submitted. These late decisions diminish the benefit of exemptions, create market uncertainty, discourage investment, and undermine the design of the RFS more broadly.

Why GAO Did This Study

The RFS requires that gasoline and diesel fuels be blended with a minimum volume of renewable fuel. Small refineries can petition EPA annually for an exemption from their RFS obligations based on disproportionate economic hardship. EPA must evaluate small refinery exemption petitions in consultation with DOE.

GAO was asked to review issues related to EPA's and DOE's implementation of the small refinery exemption program. This report examines (1) information, policies, and procedures EPA and DOE use to make decisions about exemptions; and (2) the extent to which exemption decisions are timely. GAO analyzed data and documents related to exemptions from 2013 through 2021 and interviewed agency officials and industry stakeholders.

Recommendations

GAO is making seven recommendations, including that EPA reassess its conclusion that all small refineries recover their RFS compliance costs in the price of the gasoline and diesel they sell, DOE and EPA develop documented policies and procedures for making small refinery exemption decisions, and EPA develop procedures to ensure that it meets deadlines.

DOE agreed with GAO's recommendations. EPA disagreed with one recommendation and partially agreed with the others. GAO maintains that the recommendations are valid, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Environmental Protection Agency | The Administrator of EPA should reassess EPA's conclusion that all small refineries recover their RFS compliance costs in the price of the gasoline and diesel they sell, including by fully examining and documenting RIN market performance and RIN pass-through in all relevant fuel markets. (Recommendation 1) |

While EPA disagreed with this recommendation, EPA did complete an analysis and posted the results on EPA's website in December 2022. EPA considers this recommendation to be fully implemented. EPA's completed analysis partially addresses this recommendation as EPA examined RIN market performance. Both our work and EPA's analysis point to a difference in the prices paid by small and larger refineries for RINs. Both our analysis and EPA's analysis look at average differences in prices paid by smaller companies. EPA's analysis does not fully address our recommendation because, without additional analysis, it is not possible to know if there could be specific market situations or specific small refineries where these differences are more pronounced. Moreover, EPA's analysis does not attempt to determine at what level these differences may represent disproportionate economic hardship for a small refinery. We continue to believe it is important for EPA to fully analyze this difference and its potential causes. This is important both to inform EPA's overall approach to small refinery exemptions and its decision-making regarding specific exemption petitions. As of September 2025, we continue to monitor EPA's efforts to address this recommendation.

|

| Department of Energy | The Secretary of Energy should develop an approach for consulting on small refinery exemption petitions that provides EPA with useful information on disproportionate economic hardship. (Recommendation 2) |

On July 11, 2023, DOE and EPA signed a memorandum of understanding (MOU) on consultation on small refinery exemption petitions. The MOU provides an approach, including a framework, policies, and procedures, for DOE's consultation with EPA, meeting the intent of our recommendation.

|

| Environmental Protection Agency | The Administrator of EPA should identify and communicate what information refineries would need to submit to demonstrate disproportionate economic hardship. (Recommendation 3) |

In commenting on this report, EPA partially concurred with this recommendation and stated it would issue new guidance to address it. On December 26, 2023, EPA stated that after further reviewing the issue, it no longer believes new guidance is needed. We continue to believe there would be value to clarifying what evidence refineries need to submit as part of their application rather than simply stating what refineries need to prove to receive an exemption. As of September 2025, we continue to monitor EPAs efforts to address this recommendation.

|

| Department of Energy | The Secretary of Energy should develop policies and procedures for its consultation with EPA on small refinery exemption petitions. (Recommendation 4) |

On July 11, 2023, DOE and EPA signed a memorandum of understanding (MOU) on consultation on small refinery exemption petitions. This MOU provides a framework for interagency consultation on Renewable Fuel Standard small refinery exemption (SRE) petitions. The MOU documents DOE's responsibilities for implementing the SRE program through consultation and includes the topics DOE and EPA discuss during consultation. This MOU meets the intent of our recommendation, though we are hopeful that DOE will later develop more specific procedures to better address risks of inconsistent consultation.

|

| Environmental Protection Agency | The Administrator of EPA should develop policies and procedures for making small refinery exemption decisions. (Recommendation 5) |

EPA partially concurred with this recommendation and said it would take steps to implement it. EPA stated in June 2025 that it was actively working to develop policies and procedures.

|

| Environmental Protection Agency | The Administrator of EPA should develop policies and procedures to ensure that EPA meets statutory deadlines to issue decisions, including tracking when petitions are considered complete. (Recommendation 6) |

EPA partially concurred with this recommendation and said it would take steps to implement it. EPA stated in June 2025 that it was actively working to develop policies and procedures.

|

| Environmental Protection Agency | The Administrator of EPA should assess the effect of small refinery exemption decision timing on the benefit provided to small refineries, as well as the effect on fuel markets, and reconsider petition requirements, such as that of three quarters of current year financial information. (Recommendation 7) |

In commenting on this report, EPA partially concurred with this recommendation. On December 26, 2023, EPA stated that after further review, it considered this recommendation fully resolved because of a regulatory change it put in place in December 2019. Under the new regulation, EPA projects the gallons exempted for small refineries when setting the requirements, and EPA stated this will reduce the volatility created by the timing of its decisions. However, we disagree that EPA's new regulatory approach will address this issue because it does nothing to address the timing of SRE decisions, nor does it alter the requirement for three quarters of financial information, which pushes decisions late in the year. We continue to believe addressing the timing of SRE decisions is important to reduce financial uncertainty for refineries and the market. As of September 2025, we continue to monitor EPA's efforts to address this recommendation.

|