Employee Benefits Security Administration: Enforcement Efforts to Protect Participants' Rights in Employer-Sponsored Retirement and Health Benefit Plans

Fast Facts

The Employee Benefits Security Administration is charged with protecting the benefits of about 154 million participants in employer-sponsored retirement and health benefit plans.

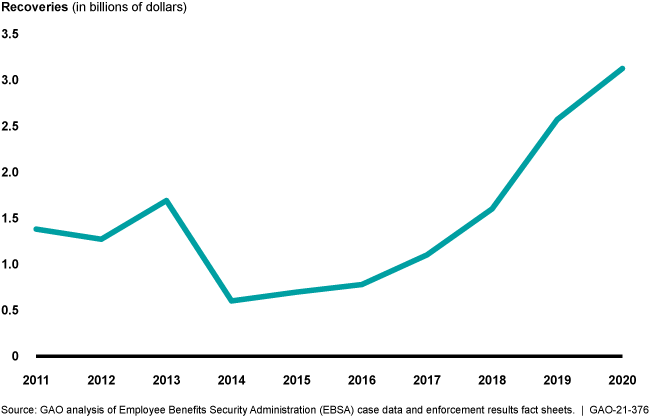

The agency investigates benefit plan violations, such as financial misconduct in retirement plans and wrongly denied medical claims. In FY 2020, the agency recovered over $3 billion for participants and plans.

In 2013, the agency began to prioritize cases with the potential to affect many people and recover significant assets. As it did so, cases decreased and amounts recovered increased. The agency has also taken steps to help plans adapt to COVID-19 legislation.

Employee Benefits Security Administration Monetary Recoveries, FY 2011-2020

Highlights

What GAO Found

The Department of Labor's (DOL) Employee Benefits Security Administration's (EBSA) enforcement focuses on encouraging retirement and health plans to comply with the Employee Retirement Income Security Act of 1974, as amended, and restoring benefits that were improperly withheld from plan participants. To identify violations, EBSA investigates benefit plans and their service providers. Over two-thirds of investigation leads are identified by EBSA staff. EBSA prioritizes investigating cases that may result in large recoveries or affect many participants, such as restored retirement plan contributions or payment for incorrectly denied medical claims. When agreement cannot be reached, investigators can refer civil cases to DOL's Office of the Solicitor for civil litigation. Criminal cases are referred to Department of Justice. In fiscal year 2020, almost 84 percent of investigations were civil and more than 16 percent were criminal, resulting in over $3 billion in payments to participants and plans.

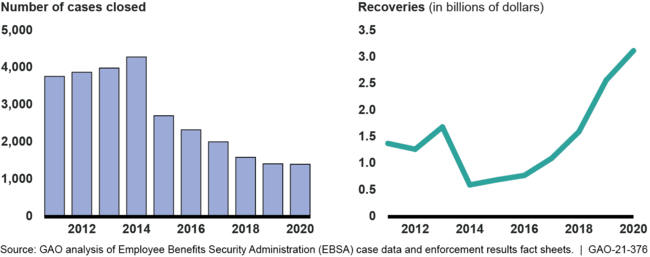

EBSA uses a range of strategies to improve its investigative processes and seeks to ensure enforcement quality through training and oversight. For example, EBSA makes efforts to target investigations for greater impact, such as a 2013 change to prioritize cases with the potential to affect many participants and recover significant assets. As EBSA pursued more complex and technical investigations, the number of closed cases decreased, while monetary recoveries increased (see figure). To ensure investigation quality, EBSA provides training, documents procedures, and reviews open and closed cases to evaluate whether investigation procedures have been followed.

Number of EBSA Investigations Closed and Monetary Recoveries, Fiscal Years 2011-2020

The COVID-19 pandemic created a number of immediate and long-term challenges for EBSA and benefit plans. For example, according to stakeholders, plans were initially concerned about how to implement provisions in the Families First Coronavirus Response Act and the CARES Act, but those concerns were addressed as the agency issued FAQs and notices. Similarly, EBSA officials reported that court closures temporarily slowed criminal cases, but as virtual hearings increased, litigation resumed. Stakeholders and EBSA officials also described potential long-term challenges, including difficulties locating the many participants who may have left a job due to the pandemic and may be unaware they left behind retirement funds.

Why GAO Did This Study

Millions of Americans rely on employer benefits for their health care and future financial security. Private sector retirement plans are a key source of income for many retirees and employer-sponsored group health plans cover over one-half of all Americans. Consequently, effective oversight and enforcement are critically important to ensure the integrity of the private employee benefit system, especially in light of the economic and health effects of COVID-19 on American workers and their families. EBSA is charged with protecting the rights of participants in employer-sponsored benefit plans. As of fiscal year 2020, this included about 154 million participants in 722,000 retirement plans and 2.5 million health plans with combined assets of over $10.7 trillion.

This report examines (1) how EBSA manages its enforcement process, (2) EBSA's strategies to improve investigative processes and ensure enforcement quality, and (3) the immediate and long-term challenges of COVID-19 for EBSA and private sector retirement and health plans. GAO analyzed EBSA data and documents; and federal laws, regulations, and guidance, including the CARES Act and the Families First Coronavirus Response Act. GAO interviewed officials from EBSA's national office and three regional offices, selected for variation in investigations, and locations as well as stakeholders from nine organizations knowledgeable about benefits compliance requirements, the employer-sponsored benefit industry, and participants' benefit plan experiences.

For more information, contact Tranchau (Kris) T. Nguyen at (202) 512-7215 or nguyentt@gao.gov.