Retirement Security: BLS Should Explore Ways to Improve the Accuracy, Timeliness, and Relevance of Its Cost-of-Living Measurements

Fast Facts

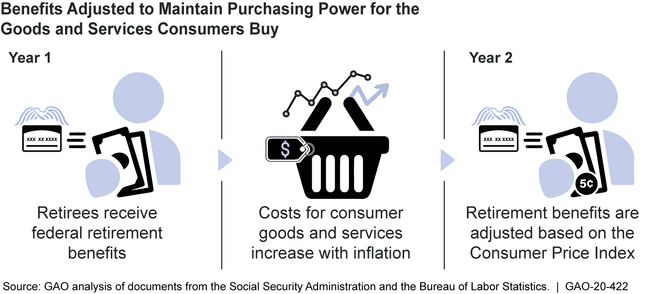

Federal retirement programs often have Cost-of-Living-Adjustments (COLAs) to ensure benefits keep pace with inflation. This includes Social Security for more than 60 million older Americans, workers with disabilities, and their families. These COLAs are typically based on consumer price indexes for certain groups of Americans.

The Bureau of Labor Statistics (BLS) produces these indexes, but it hasn’t evaluated whether its data accurately reflect what these groups pay, where they shop, and what they purchase. We recommended that BLS evaluate the data they use, as well as explore using other data, to improve its indexes.

Woman looking at cost-of-living information on the Social Security website

Highlights

What GAO Found

The U.S. Bureau of Labor Statistics (BLS) faces accuracy, timeliness, and relevancy challenges developing consumer price indexes (CPI) for subpopulations of blue-collar workers and older Americans. For example, the CPI for these workers is used to adjust federal retirement benefits for inflation, including Social Security. BLS has not evaluated the extent to which its existing data are adequate to produce CPIs that reflect what these subpopulations pay, where they shop, and what they purchase. Officials cite budgetary reasons for not having done this, but there may be cost-efficient methods for evaluating the adequacy of these data. Without an evaluation, federal retirement benefits could be subject to adjustment based on potentially inaccurate information. Additionally, BLS has made limited use of certain data already collected by the federal government—such as National Accounts data on U.S. production and consumption—that could be used to increase the accuracy, timeliness, and relevancy of CPI calculations that reflect the mix of goods and services consumers purchase. Without adequately exploring the potential of using these data, BLS may be missing an opportunity to improve its CPIs.

Reports about the retirement systems in the 36 Organisation for Economic Co-operation and Development countries indicate that most use their primary measures of inflation to adjust government retirement benefits. In addition, all three of GAO's case study countries (Australia, New Zealand, and the United Kingdom, or U.K.) have a variety of CPIs, including for subpopulations, and they filled information gaps in their CPIs with National Accounts and other data. For example, Australia and the U.K. use National Accounts data annually to update their calculations of the mix of goods and services consumers buy, thereby making the CPIs more relevant and accurate. All three countries also collaborated with stakeholders—such as other agencies—to implement changes, for example by gathering input on the design of subpopulation CPIs.

Why GAO Did This Study

In the United States, federal retirement programs typically include cost-of-living adjustments based on a CPI that measures inflation for a subpopulation of workers. This includes Social Security, which provides benefits for more than 60 million older Americans, workers with disabilities, and their families. As the life expectancy of Americans continues to increase, more Americans will be subject to these adjustments, so it is critical for them to be accurate.

GAO was asked to review U.S. and international efforts to measure the cost of living for older populations. This report examines (1) key issues that BLS faces in measuring the cost of living for older Americans; and (2) the experiences of other countries that developed alternate methods of adjusting retirement benefits. GAO reviewed pertinent literature; assessed BLS efforts to measure inflation; conducted case studies in three countries—Australia, New Zealand, and the U.K.—with a variety of CPIs, which GAO selected based on expert referral and document review; and interviewed agency officials and experts.

Recommendations

GAO recommends that BLS explore cost-efficient ways to evaluate the data currently used to produce subpopulation indexes, and explore the use of National Accounts data to produce more accurate, timely, and relevant CPIs. BLS agreed with the first recommendation but disagreed with the other. GAO continues to believe both recommendations are warranted, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Labor | The Secretary of Labor should ensure that BLS explores cost-efficient ways to evaluate the data sources currently used to produce subpopulation indexes, such as by engaging more directly with other stakeholders or seeking input from its advisory groups and other knowledgeable entities about approaches to expand data collection in a cost-efficient manner. (Recommendation 1) |

The Department of Labor agreed with this recommendation. By June 2021, DOL had researched improvements to the subpopulation index methodology and presented current and planned work related to subpopulation index methodology to a Committee on National Statistics of the National Academies of Sciences, Engineering, and Medicine panel studying cost-of-living indexes. In May 2022, that committee similarly recommended that BLS investigate data to improve subpopulation index calculation. In its Fiscal Year 2023 Congressional Budget Justification, BLS requested funds to inform the requirements for subpopulation indexes. As of August 2023, BLS met with stakeholders on several occasions to discuss data sources and methods to develop a new subpopulation index, the CPI by Income. While BLS met the intent of this recommendation, we hope that the work on the CPI by Income will inform the data sources and methods used in BLS's other subpopulation indexes, particularly the CPI-W, which is used to adjust federal benefits for numerous programs, including Social Security.

|

| Department of Labor | The Secretary of Labor should ensure that BLS explores the use of already collected National Accounts data to produce more accurate, timely, and relevant CPIs. (Recommendation 2) |

In 2023, the Department of Labor (DOL) took steps to improve the accuracy, timeliness, and relevance of CPIs by changing its methodology to use more up-to-date expenditure weights. Previously, most CPIs relied on expenditure weights based on Consumer Expenditure Survey data that are up to 4 years out-of-date, in part because they used 2 years of Consumer Expenditure Data. DOL now calculates CPI expenditure weights based on 1 year of Consumer Expenditure Survey data, which means they can reflect more recent consumer spending patterns. In addition to our recommendation, a National Academies panel similarly recommended using National Accounts data in expenditure weight calculations. DOL initially disagreed with our recommendation, stating that the National Accounts data are not a replacement for Consumer Expenditure Survey data. We agreed that the National Accounts data are not a wholesale replacement for the Consumer Expenditure Survey data, but encouraged them to explore ways to produce more up-to-date expenditure weights. While DOL ultimately decided not to use National Accounts data, the changes DOL made meet the intent of our recommendation because they result in more up-to-date expenditure weights.

|