Foreign Military Sales: DOD Should Strengthen Oversight of Its Growing Transportation Account Balances

Fast Facts

U.S. foreign partners buy billions of dollars of defense items and services annually through the U.S. Foreign Military Sales program. To transport the items they buy, buyers pay fees that should roughly equal what the U.S. government pays to transport the goods.

However, the transportation fee account balances have grown by over 1300%. Because there was no guidance on how to determine whether account balances were too high or too low, the fees weren’t adjusted appropriately.

We made 10 recommendations to DOD to improve how it sets fees and manages the transportation accounts, including setting target ranges for account balances.

Defense items and services are sold under the Foreign Military Sales Program.

Military aircraft

Highlights

What GAO Found

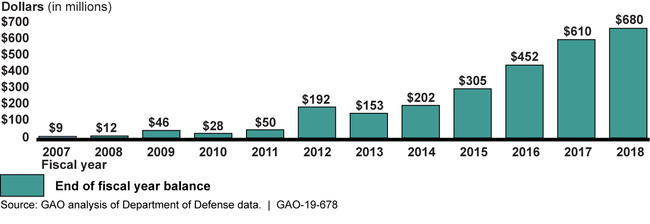

Fees charged by the Department of Defense (DOD) for the transportation of defense items sold through the Foreign Military Sales (FMS) program are intended to approximate DOD's transportation costs over time. However, GAO found that the FMS transportation accounts accrued a combined balance of $680 million by the end of fiscal year 2018. Much of the growth occurred from the end of fiscal year 2011 through fiscal year 2018, when the account grew by approximately $630 million.

Growth in Transportation Account Balances, Fiscal Years 2007 to 2018

The Defense Security Cooperation Agency (DSCA) has developed limited management oversight guidance for the FMS transportation accounts, which has contributed to the substantial balance growth. DSCA internal guidance requires daily and annual reviews of the accounts to monitor for significant changes in account balances and to ensure the accounts maintain a “healthy” level. However, internal guidance does not define a significant change or “healthy” level, such as a target range for the account balances. This has led to inconsistent reviews and limited oversight of the recent balance growth. DSCA also has no internal guidance on how to perform certain aspects of its annual reviews or what information to include in the resulting reports. As a result, DSCA officials have produced reports with incomplete information, such as on the causes for trends in the account balances, undermining DSCA management's ability to make informed decisions about the accounts.

DSCA's processes for setting the FMS transportation fee do not ensure that aggregate fees approximate aggregate costs. For its transportation fee rate reviews, DSCA sends requests to the military departments for historical cost and fee data that lack specificity, such as on timeframes, sampling methodology, and data sources. As a result, DSCA has analyzed data that are not timely or systematically sampled. In addition, military department officials reported difficulty providing the requested data in part because DSCA's guidance did not specify data sources. Consequently, for the most recent review, Air Force and Navy were unable to find sufficient matching cost and fee data for DSCA to consider them usable. Further, DSCA has established no goals for rate reviews and has no written procedures to follow in performing them. These factors together contributed to recent growth in the FMS transportation account balances and will continue to hinder DSCA's ability to make appropriate rate-setting decisions moving forward.

Why GAO Did This Study

The FMS program is one of the primary ways the U.S. government supports its foreign partners, by annually selling them billions of dollars of items and services. According to DOD, the FMS program is intended to operate on a “no profit, no loss” basis, with purchasers not charged excessive fees and fee revenue covering operating costs. Foreign partners can arrange for their own transportation of FMS items or pay DOD a transportation fee to cover the costs of DOD transporting them. The fees are collected into transportation accounts in the FMS Trust Fund.

House Report 114-537 and Senate Report 114-255 included provisions that GAO review DSCA's management of FMS fees. This report examines (1) the balances of the FMS transportation accounts for fiscal years 2007 through 2018, (2) DSCA's management oversight of the accounts, and (3) DSCA's processes for setting transportation fees. GAO analyzed DOD data and documents, and interviewed DOD officials.

Recommendations

GAO is making 10 recommendations to DOD, including six recommendations to strengthen DSCA's oversight of the transportation accounts—such as by clarifying internal guidance—and four recommendations to improve its transportation fee setting processes. DOD concurred with all of the recommendations and identified actions it plans to take to address them.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA clarify internal guidance for daily account reviews by specifying criteria for the level (such as percentage or dollar amount) of change in transportation account balances that would require DSCA to contact DFAS for further examination. (Recommendation 1) |

DSCA concurred with this recommendation and has implemented corrective actions to address it. In response to GAO's recommendation, in October 2020, DSCA updated its standard operating procedure for daily transportation account reviews. These procedures set a threshold level for detecting abnormal transaction values, currently set at 10 percent of the account's value. If one of the accounts is found to have exceeded this threshold in the daily change of its account balance, the procedures direct the DSCA analyst performing the review to request supporting documentation from DFAS explaining the related transactions and share that documentation with DSCA management. Specifying this threshold level should help DSCA ensure consistent and early detection of any potential funding issues in the FMS transportation accounts.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA establish a methodology to calculate a target range, with desired upper and lower bounds, for FMS transportation account balances that could be used to better inform DSCA's account reviews. (Recommendation 2) |

DSCA concurred with this recommendation and has implemented corrective actions to address it. In response to GAO's recommendation, in April 2020, DSCA finalized internal guidance for how to establish upper and lower control levels for these accounts. The internal guidance indicates that unique levels should be set for each of the 8 transportation fee accounts based on statistical analysis of historical account balances, collections, and expenditures data, while the exact methodology should be revisited annually to ensure effectiveness. DSCA also set the upper and lower control levels for the 8 accounts for fiscal year 2020 and directed staff to monitor accounts against these levels in other internal guidance. Having such upper and lower control levels should better inform DSCA leadership to help prevent both excessive growth in the transportation accounts and insufficient funds to pay for transportation bills.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA modify the internal guidance for the annual review process to include the specific steps DSCA officials should take in preparing the annual report, including ensuring that they incorporate rigorous analysis into the annual reports. (Recommendation 3) |

DSCA concurred with this recommendation and has implemented corrective actions to address it. In response to GAO's recommendation, in April 2020, DSCA finalized internal guidance establishing procedures for the annual reviews that include specific analysis DSCA officials should follow when reviewing the accounts to prepare the annual report. For example, the internal guidance directs DSCA officials to use linear regression of normalized historical data to indicate whether or not the account is increasing or decreasing more than would be expected, or remaining relatively stable. Following this new guidance for the annual reports should help improve the reliability and quality of information provided to DSCA management for their use in decision making about the FMS transportation fee accounts.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA develop internal guidance related to the redistribution of funds between the FMS trust fund fee accounts. Such internal guidance could include criteria for when to consider redistributing funds between accounts and for when to return those funds, how to analyze the amount of any redistributions needed, and how to clearly report any redistributions to DSCA management. (Recommendation 4) |

DSCA concurred with this recommendation and implemented corrective actions to address it. In response to GAO's recommendation, in February 2021, DSCA issued internal guidance on the redistribution of funds between the FMS fee accounts. This internal guidance specifies that DSCA will assess the need for redistributions between accounts as part of the annual review process for each fee account, and describes the processes for requesting and approving the redistribution of funds. DSCA's internal guidance also specifies that DSCA management will review redistributions semiannually to determine when redistributions should be returned to the originating account. By issuing specific internal guidance on redistributions between the FMS fee accounts, DSCA helps ensure it will routinely assess the need to redistribute or return any funds between accounts as part of its annual review process, thereby supporting the equity of the fees DSCA charges FMS purchasers.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA assess whether funds redistributed from the administrative account to the transportation account should be moved back to the FMS administrative account and document this decision. If the Director of DSCA determines that the funds should be moved back to the FMS administrative account, the Director should ensure the movement of funds in accordance with this decision. (Recommendation 5) |

DSCA concurred with this recommendation and has implemented corrective actions to address it. In response to GAO's recommendation, in August 2019, DSCA wrote a memorandum to notify the Office of the Under Secretary of Defense (Comptroller) of DSCA's intention to return the $130 million to the FMS administrative account. In the memorandum, DSCA documented its determination that the main transportation fee account no longer needed these funds because of its healthy balance level. In November 2019, DSCA received approval for the funds return and directed the Defense Finance and Accounting Service (DFAS) to return them. DFAS returned these funds as directed during the same month. As a result, DSCA management will be better informed in its rate setting for both fees in future.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA develop internal guidance for the steps that DSCA, in combination with DFAS, should undertake when a Building Partner Capacity-specific transportation account closes to help ensure that any remaining unused funds are transferred to the miscellaneous receipts of the U.S. Treasury in accordance with DOD officials' stated intention to do so. (Recommendation 6) |

DSCA concurred with this recommendation and implemented corrective actions to address it. In response to GAO's recommendation, in November 2020, DSCA issued a memo with internal guidance related to closing BPC transportation accounts and returning any unexpended funds to the U.S. Treasury. The guidance states DSCA will close BPC transportation accounts when all appropriations within the account have cancelled, and that it will direct DFAS to deposit any unliquidated balances in the miscellaneous receipts of the U.S. Treasury. DSCA also made corresponding updates to its management manual and DOD's financial management regulation. This internal guidance will enable DSCA to properly return any unused funds to the U.S. Treasury.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA create specific internal guidance for how and from where data should be obtained to be used for its transportation fee rate reviews and the timeframes the data should cover to ensure DSCA has a systematic sample upon which to base its rate setting decisions. This updated internal guidance should be based on consultations with the military departments, DFAS, and U.S. Transportation Command (TRANSCOM) on which sources of transportation cost and fee data are the most reliable and comparable for use in its FMS transportation fee rate reviews. (Recommendation 7) |

In DSCA's letter responding to this report, DSCA concurred with this recommendation and implemented corrective actions to address it. In response to GAO's recommendation, in October 2021, DSCA issued internal guidance for how to conduct reviews of the FMS transportation fee rate. Specifically, this guidance described where different types of data for the rate review should be obtained and specified the timeframe that the historical data used for the rate review should cover. To help inform this guidance with information on the best available sources of transportation cost and fee data, DSCA consulted with members of the FMS Transportation Working Group, including officials from the military departments, the Defense Contracting Management Agency, and TRANSCOM. By issuing specific internal guidance to guide these reviews, DSCA has strengthened its rate setting process, which should enhance its ability to manage account balances and make timely decisions to ensure the FMS transportation fee rate is set to cover related transportation costs while not overcharging FMS purchasers.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA develop specific internal guidance to follow when performing transportation fee rate reviews. Such internal guidance could specify when these reviews should occur; a process to obtain management commitment to complete a review before DSCA requests that the military departments compile data for it; and a process for performing the reviews that includes developing clear, documented goals and an appropriate level of analysis to best ensure that DSCA's analysis meets those goals. (Recommendation 8) |

In DSCA's letter responding to this report, DSCA concurred with this recommendation and implemented corrective actions to address it. In response to GAO's recommendation, in October 2021, DSCA issued internal guidance for conducting reviews of the FMS transportation fee rate. This guidance includes direction on how frequently rate reviews should be conducted and conditions under which rate reviews could be undertaken more frequently. The guidance also provides DSCA officials conducting the review with direction on how to conduct the review, including what information to request from the military departments and steps to take to analyze the data once received. For any reviews undertaken before the 5-year review, the guidance also indicates that specific criteria should be laid out for what the review will focus on, and that buy-in for it should be obtained from the membership of the Transportation Working Group, including officials from the military departments, the Defense Contracting Management Agency, and U.S. Transportation Command. By issuing specific internal guidance for conducting these rate reviews, DSCA helps ensure it will strengthen its rate setting process, which should enhance its ability to manage account balances and make timely decisions about the FMS transportation fee rate.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA conduct a review of the current structure of the FMS transportation fee rate, in consultation with other relevant DOD agencies, to determine if other rate structures could better balance considerations related to administrative burden, equity, efficiency, and revenue adequacy. (Recommendation 9) |

In response to this GAO recommendation, DSCA took a number of actions, including holding multiple meetings of the FMS Transportation Working Group, which contains other relevant DOD agencies, to discuss the structure of the FMS transportation fee rate and whether any modifications to the rate structure could better balance the fee rate's administration, equity, efficiency, and revenue adequacy. After discussion at many monthly meetings during which a variety of potential options were considered, at a June 2025 meeting, the working group decided that the considered options would not be accurate enough to ensure adequate revenue given limited information available about actual transportation costs on shipments. DSCA's discussions of the fee rate with the Transportation Working Group improved their understanding of the transportation fee rate's function and processes, and DSCA committed to continue to review the fee rate structure over time in case better options may be available in future.

|

| Department of Defense | The Secretary of Defense should ensure that the Director of DSCA clarify internal guidance for the military departments on how to calculate the estimated actual transportation prices to charge FMS purchasers for certain items, such as by specifying a calculation methodology. This updated internal guidance should be based on consultations with the military departments, TRANSCOM, and any other relevant DOD components on which sources of data and which calculation methodologies would be most accurate. (Recommendation 10) |

DSCA concurred with this recommendation and implemented corrective actions to address it. In response to GAO's recommendation, in December 2020, DSCA revised its internal transportation policy. The updated policy provides additional guidance to DOD components on calculating estimated transportation costs, such as by using average costs for frequent destinations, and how components should update these costs annually. DSCA revised its policy in consultation with the military departments, and the policy formally incorporates TRANSCOM as part of the rate setting process. By providing additional guidance on calculating estimated transportation costs, in coordination with relevant stakeholders such as TRANSCOM, DSCA will help DOD components use consistent cost estimation procedures and better approximate transportation costs for FMS purchasers.

|