Foreign Military Sales: Controls Should Be Strengthened to Address Substantial Growth in Overhead Account Balances

Fast Facts

U.S. foreign partners buy billions of dollars of defense equipment and services each year through the U.S. Foreign Military Sales program. The program charges fees to purchasers to cover the U.S. government's cost of operating the program.

As the value of these sales has increased, the balances in the 2 main fee accounts have grown in excess of 950% and now top $5 billion. We found that the substantial growth in these accounts was due to insufficient management controls.

We made 6 recommendations to DOD to help improve controls, and suggest that Congress consider allowing the FMS program to use these funds to pay for more program expenses.

This is a photograph of a military jet aircraft flying over the coast line.

Highlights

What GAO Found

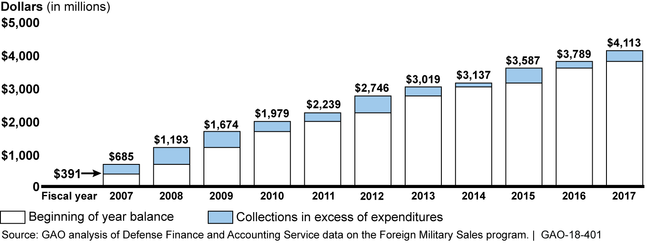

The Foreign Military Sales (FMS) administrative account balance grew by over 950 percent from fiscal years 2007 to 2017—from $391 million to $4.1 billion—due in part to insufficient management controls, including the lack of timely rate reviews. The Defense Security Cooperation Agency (DSCA) has some controls to manage the account balance. For example, DSCA has established a method for calculating a minimum desired balance to ensure it has sufficient funds to complete FMS cases despite uncertain future sales. At the end of fiscal year 2017, the account balance was $2.7 billion above this minimum. DSCA, however, has completed rate reviews less frequently than directed by its policy. Moreover, DSCA has not adopted the best practice of setting an upper bound for the account that would, along with the minimum level, provide a target range for the account balance. By not performing timely rate reviews or setting an upper bound, DSCA has limited its ability to prevent excessive balance growth. GAO modeling indicates that, even with a planned fee rate reduction to 3.2 percent, the account balance would likely remain above its minimum level through fiscal year 2024, including if annual expenditures increased by 15 percent more than expected. As such, the account has the potential to pay for additional expenses. These could include expenses first excluded by statute in 1989 at a time when the account balance was negative and which have since been paid from other appropriated funds. DOD told GAO it is willing to revisit these exclusions.

Administrative Account Balance Growth, Fiscal Years 2007 to 2017

The FMS contract administration services (CAS) account grew from fiscal years 2007 to 2015 from $69 million to $981 million, due in part to insufficient management controls, including not setting an upper bound. The balances for fiscal years 2016 and 2017 overstated the amount of funds available due to a systems issue and limited related oversight. Since 2014, DSCA has implemented some controls for the CAS account, such as regular reviews of the account balance, but weaknesses remain. In particular, DSCA does not plan to follow its internal guidance to conduct the next CAS fee rate review within 5 years. DSCA also has inconsistently calculated the desired minimum level for the account. Finally, DSCA has not set an upper bound for the account to help officials follow internal guidance that directs them to determine when the balance is excessive and a fee rate reduction should be considered. As a result, DSCA is limited in its ability to make timely, appropriate decisions on the fee rate.

Why GAO Did This Study

The FMS program is one of the primary ways the U.S. government supports its foreign partners, by providing them with defense equipment and services. The program charges FMS customers overhead fees to cover the U.S. government's operating costs. They include the administrative fee for costs such as civilian employee salaries and facilities, and the CAS fee for the cost of contract quality assurance, management, and audits. In 1989, Congress excluded from administrative expenses certain costs associated with military personnel who work on the FMS program as well as unfunded civilian retirement and other benefits. As of May 2018, the administrative fee rate is 3.5 percent, and the CAS fee rate is 1.2 percent.

House Report 114-537 and Senate Report 114-255 included provisions that GAO review DSCA's collection and management of these fees. This report examines, for fiscal years 2007 to 2017, the balance of and controls over (1) the administrative account and (2) the CAS account. GAO analyzed Department of Defense (DOD) data and documents, modeled projections for the administrative account, and interviewed DOD officials.

Recommendations

Congress should consider redefining what it considers an allowable expense to be charged from the administrative account. GAO is making six recommendations to help DSCA improve its controls over both accounts, including completing more timely reviews and establishing a desired range for balance levels. DOD generally concurred.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider redefining what can be considered an allowable expense to be charged from the administrative account. (Matter for Consideration 1) | While some legislative action had been taken that would have addressed this Matter during prior Congresses, if enacted, no related legislation has been proposed or enacted during the 118th Congress, as of February 2025. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Defense Security Cooperation Agency | The Director of DSCA should take steps to ensure that comprehensive reviews of the administrative fee rate are completed at least every 5 years. (Recommendation 1) |

DSCA concurred with this recommendation, noting that the agency's intention had been to complete these reviews every 5 years. In response to GAO's recommendation, DSCA has implemented corrective actions to address it. In particular, in June 2020, DSCA updated the Security Assistance Management Manual to specify further the required frequency for administrative fee rate reviews. In addition to stating that these fee rate reviews should be performed every 5 years, the updated internal guidance specifies that the fee rate review will include the previous 60 months of rate data, and as a result will begin on the month following the end of month reconciliation of the 60th month. Further, the guidance states that the timing for the administrative fee rate review could be accelerated or delayed based on the financial health of the administrative fee account, but that any delays would need to be justified and signed by the Director of DSCA. The specificity of this guidance and the need for any delays to be justified and approved by the Director should help to ensure that future reviews are completed in a timely manner. Timely reviews should help the administrative fee rate to be set appropriately and for any fee changes that may be needed to be smaller corrections, limiting the impact that large fee rate changes would have on customers' ability to budget.

|

| Defense Security Cooperation Agency | The Director of DSCA should define a method for calculating an upper bound of a target range for the administrative account that could be used to guide the agency's reviews of administrative account balances and decision making in setting the fee rate. (Recommendation 2) |

DSCA concurred with this recommendation and has implemented corrective actions to address it. In response to GAO's recommendation, in April 2019, DSCA updated the Security Assistance Management Manual to include procedures for creating an upper bound for the administrative account, which DSCA refers to as an upper control. In particular, this internal guidance states that DSCA will recalculate the upper control annually by multiplying by five the obligation ceiling set for the administrative account in that fiscal year's Department of State, Foreign Operations, and Related Programs Appropriation Act. The internal guidance also states that the upper control should be used, in combination with DSCA's minimum (safety) level for the account, to alert the agency to a dramatic change that may require a response such as an earlier than planned comprehensive review of the administrative fee rate. DSCA also calculated an upper control for fiscal year 2019 against which it could monitor the administrative account balance.

|

| Defense Security Cooperation Agency | The Director of DSCA should direct the Defense Contract Management Agency (DCMA) and the Defense Finance and Accounting Service to work together to ensure timely correction of the fiscal years 2016 and 2017 DCMA contract administration services (CAS) reimbursement issues. (Recommendation 3) |

In its agency response to this report, DSCA concurred with this recommendation. In October 2018, DSCA issued a memorandum to DCMA and DFAS requesting that these agencies submit a corrective action plan to DSCA to correct the fiscal years 2016 and 2017 DCMA reimbursement issues. In response, DCMA reconciled the fiscal year 2016 reimbursement issues, and their final resolution was approved in January 2021. In February 2022, DCMA also completed a corrective action plan to address the fiscal year 2017 reimbursement discrepancies through in-depth analysis, review, and reconciliation. In response, DCMA and DSCA worked together to compare their books for DCMA's fiscal year 2017 CAS expenses, and approved the final reconciliation in April 2022. As a result, DCMA has been properly reimbursed for its CAS services and DSCA knows the accurate CAS fee account balance for its oversight purposes.

|

| Defense Security Cooperation Agency | The Director of DSCA should take steps to ensure that comprehensive reviews of the CAS fee rate are completed at least every 5 years. (Recommendation 4) |

In its agency response to this report, DSCA partially concurred with this recommendation, noting that the agency agreed that CAS fee rate reviews should be completed every 5 years, but explaining unique circumstances that led DSCA to prefer more time before its next review. In response to GAO's recommendation, DSCA has implemented corrective actions to address it. In particular, in June 2020, DSCA updated the Security Assistance Management Manual to specify further the required frequency for CAS fee rate reviews. In addition to stating that these fee rate reviews should be performed every 5 years, the updated internal guidance specifies that the fee rate review will include the previous 60 months of rate data, and as a result will begin on the month following the end of month reconciliation of the 60th month. Further, the guidance states that the timing for the CAS fee rate review could be accelerated or delayed based on the financial health of the CAS fee account, but that any delays would need to be justified and signed by the Director of DSCA. The specificity of this guidance and the need for any delays to be justified and approved by the Director should help to ensure that future reviews are completed in a timely manner. Timely reviews should help the CAS fee rate to be set appropriately and for any fee changes that may be needed to be smaller corrections, limiting the impact that large fee rate changes would have on customers' ability to budget.

|

| Defense Security Cooperation Agency | The Director of DSCA should clarify internal guidance to ensure consistency in the calculation of the CAS account's minimum (safety) level. (Recommendation 5) |

DSCA concurred with this recommendation and has implemented corrective actions to address it. In response to GAO's recommendation, DSCA updated its Managers' Internal Control Program guidance for fiscal year 2020 to align with current practices for the calculation of the safety level. Specifically, the updated guidance states that at the end of each fiscal year DSCA should calculate the safety level by adding prior year outstanding obligation authority, two years of CAS budget projections, and a third year of budget projections that includes an adjustment factor. The guidance also explains that the adjustment factor should be determined based on reviewing the rate of change in obligation authority over the previous five years, relevant inflation factors, and FMS sales trends. This updated guidance will allow the safety level to be updated in a consistent manner, thereby providing management with better information to evaluate changes in the CAS account and to make adjustments as needed.

|

| Defense Security Cooperation Agency | The Director of DSCA should define a method for calculating an upper bound of a target range for the CAS account that could be used to guide the agency's reviews of CAS account balances and decision making in setting the fee rate. (Recommendation 6) |

DSCA concurred with this recommendation and has implemented corrective actions to address it. In response to GAO's recommendation, in April 2019, DSCA updated the Security Assistance Management Manual to include procedures for creating an upper bound for the CAS account, which DSCA refers to as an upper control. In particular, this internal guidance states that DSCA will recalculate the upper control annually based on a combination of prior year outstanding obligation authority, two years of CAS budget projections, and three additional years of budget projections that include an adjustment factor. DSCA then further clarified how this level should be calculated in its Managers' Internal Control Program guidance for fiscal year 2020, such as by more specifically describing how to determine the adjustment factor to apply. As DSCA's guidance states, this upper control will be used, in combination with DSCA's minimum (safety) level for the account, to alert the agency to a dramatic change that may require a response such as an earlier than planned comprehensive review of the CAS fee rate.

|