Coal Mine Reclamation: Federal and State Agencies Face Challenges in Managing Billions in Financial Assurances

Fast Facts

After mining, a coal company is required to restore the land it disturbed, e.g., by regrading or replanting. The federal government requires coal companies to get bonds to assure their payment for these activities.

Federal law permits coal mine operators in some cases to guarantee these costs on the basis of their own finances, a practice known as self-bonding, rather than by securing a bond through another company or providing collateral.

Some stakeholders told us that self-bonds are riskier now than before, citing industry bankruptcies and lower coal demand.

We recommended that Congress consider amending the law to eliminate self-bonding.

Surface Coal Mining

This is a photo of heavy equipment in use at a surface mine.

Highlights

What GAO Found

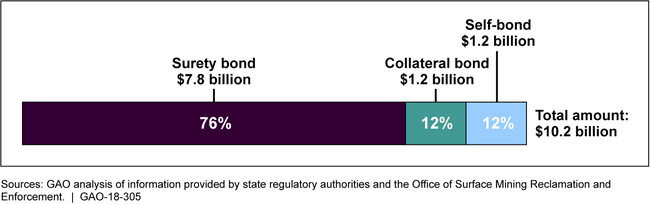

State agencies and the Department of the Interior's Office of Surface Mining Reclamation and Enforcement (OSMRE) reported holding approximately $10.2 billion in surety bonds (guaranteed by a third party), collateral bonds (guaranteed by a tangible asset, such as a certificate of deposit), and self-bonds (guaranteed on the basis of a coal operator's own finances) as financial assurances for coal mine reclamation.

Amount of Financial Assurances Held in 2017, by Type, for Reclaiming Coal Mines in States and on Indian Tribal Lands with Active Coal Mining

OSMRE and state agencies face several challenges in managing financial assurances, according to the stakeholders GAO interviewed. Specifically,

Obtaining additional financial assurances from operators for unanticipated reclamation costs, such as long-term treatment for water pollution, can be difficult.

Determining the financial stability of surety companies has been challenging in certain instances.

Self-bonding presents a risk to the government because it is difficult to (1) ascertain the financial health of an operator, (2) determine whether the operator qualifies for self-bonding, and (3) obtain a replacement for existing self-bonds when an operator no longer qualifies. In addition, some stakeholders said that the risk from self-bonding is greater now than when the practice was first authorized under the Surface Mining Control and Reclamation Act (SMCRA).

GAO's previous work examining environmental cleanup found that the financial risk to government and the amount of oversight needed for self-bonds are relatively high compared to other forms of financial assurances. GAO also previously reviewed federal financial assurance requirements for various energy and mineral extraction sectors and found that coal mining is the only one where self-bonding was allowed. However, because SMCRA explicitly allows states to decide whether to accept self-bonds, eliminating the risk that self-bonds pose to the federal government and states would require SMCRA be amended.

Why GAO Did This Study

Coal accounts for 17 percent of domestic energy production. SMCRA requires coal mine operators to reclaim lands that were disturbed during mining and to submit a financial assurance in an amount sufficient to ensure that adequate funds will be available to complete reclamation if the operator does not do so. Recent coal company bankruptcies have drawn attention to whether financial assurances obtained by OSMRE and state agencies will be adequate to reclaim land once coal mining operations have ceased.

GAO was asked to review management of financial assurances for coal mine reclamation. This report describes, among other things, the amounts and types of financial assurances held for coal mine reclamation in 2017 and the challenges that OSMRE and state agencies face in managing these financial assurances. GAO collected and analyzed data from OSMRE and 23 state agencies; reviewed federal laws, regulations, and directives; and interviewed OSMRE and state agency officials and representatives from organizations associated with the mining and financial assurance industries and environmental organizations.

Recommendations

GAO recommends that Congress consider amending SMCRA to eliminate self-bonding. Interior neither agreed nor disagreed with GAO's recommendation.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider amending SMCRA to eliminate the use of self-bonding as a type of financial assurance for coal mine reclamation. (Matter for Consideration 1) | On April 11, 2024, the Coal Cleanup Taxpayer Protection Act of 2024 (H.R. 7940, 118th Cong.) was introduced and referred to the House Committee on Natural Resources. Among other things, this bill would have amended SMCRA to eliminate self-bonding as a type of financial assurance for coal mine reclamation. No further actions were taken on this bill after it was introduced and referred to committee. Therefore, this matter remains open. Addressing this matter could help reduce the financial risk for future coal mine reclamation costs resulting from mines with unsecured financial assurances. As of February 2026, Congress has not passed legislation that would implement this matter, and we were unable to identify any bills in the 119th Congress responsive to this matter. |