Low-Wage Workers: Poverty and Use of Selected Federal Social Safety Net Programs Persist among Working Families

Highlights

What GAO Found

According to GAO's analysis of data in the Census Bureau's Current Population Survey (CPS), on average, low-wage workers worked fewer hours per week, were more highly concentrated in a few industries and occupations, and had lower educational attainment than workers earning hourly wages above $16 in each year GAO reviewed—1995, 2000, 2005, 2010, 2015 and 2016. Their percentage of the U.S. workforce also stayed relatively constant over time. About 40 percent of the U.S. workforce ages 25 to 64 earned hourly wages of $16 or less (in constant 2016 dollars) over the period 1995 through 2016. The combination of low wages and few hours worked compounded the income disadvantage of low-wage workers and likely contributed to their potential eligibility for federal social safety net programs.

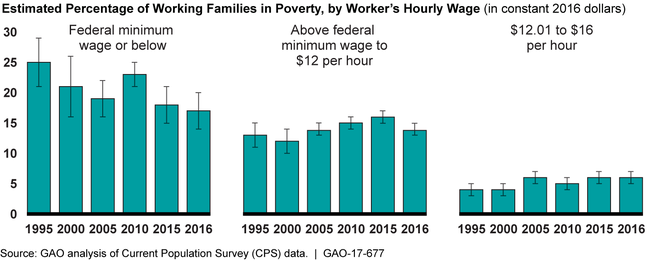

About 20 percent of families with a worker earning up to the federal minimum wage (currently $7.25 per hour), 13 percent of families with a worker earning above federal minimum wage to $12.00 per hour, and 5 percent of families with a worker earning $12.01 to $16 per hour were in poverty in each year GAO reviewed (see figure).The extent of poverty varied considerably by the type of family in which a worker lived. For example, single-parent families earning the federal minimum wage or below comprised a higher percentage of families in poverty. In contrast, married families with no children comprised the lowest percentage of families in poverty, and generally had family incomes at or above the poverty line.

Note: All references to the “federal minimum wage” are based on 110 percent of the hourly federal minimum wage in effect that year or the equivalent hourly calculated wage for salaried workers. Brackets are used to represent margins of error of estimated percentages at a 95 percent confidence level.

Families with a worker earning $16 or less per hour consistently used selected federally funded social safety net programs between 2005 and 2016, with varied factors affecting eligible families' participation. GAO estimated that the percentage of these families enrolled in Medicaid rose significantly over the past 2 decades, almost tripling among families with a worker earning more than the federal minimum wage between 1995 and 2016. In contrast, an estimated 5 percent or less of these families received cash assistance from the Temporary Assistance for Needy Families (TANF) program at least once in the prior calendar year from 1995 through 2016. A low-wage worker's family type also influenced the extent that families used selected social safety net programs. For example, among families with minimum wage earners in 2016, GAO estimated that about half or more married families used none of the programs GAO examined—Medicaid, TANF, Supplemental Nutrition Assistance Program, Earned Income Tax Credit, and Additional Child Tax Credit—while more than half of single-parent families used three or more. Program officials and others told GAO that eligible working families may not participate in programs for a variety of reasons, including time needed to apply for benefits, low benefit amounts, and assumed ineligibility.

Why GAO Did This Study

According to the Department of Labor, private-sector employers have added millions of jobs to the economy since the end of the most recent recession in 2009; however, many are in low-wage occupations. GAO was asked to examine several characteristics of low-wage workers and their families, including their use of federally funded social safety net programs over time.

This report answers the following questions: (1) What are the characteristics of the low-wage workforce and how have they changed over time? (2) To what extent are families with low-wage workers in poverty? and (3) To what extent do families with low-wage workers participate in selected social safety net programs and what factors affect their participation?

GAO analyzed CPS data from 1995, 2000, 2005, 2010, 2015, and 2016 on worker characteristics, family poverty, and participation in social safety net programs. GAO defined low-wage workers as those workers ages 25 to 64 earning $16 or less per hour. In addition, GAO interviewed officials with state and local social safety net programs and other experts in four metropolitan areas—Atlanta, San Francisco, Santa Fe, and Washington, D.C.—representing a range of local minimum wage levels relative to the federal minimum wage, costs of living, and participation rates in five selected federally funded social safety net programs.

For more information, contact Cindy Brown-Barnes at (202) 512-7215 or brownbarnesc@gao.gov and Oliver Richard at (202) 512-8424 or richardo@gao.gov.