Crop Insurance: Opportunities Exist to Improve Program Delivery and Reduce Costs

Fast Facts

To implement the federal crop insurance program, USDA partners with private insurance companies, which sell and service policies. In 2010, USDA negotiated a set rate of return with these companies—that is, how much companies can profit from these insurance policies.

However, we found that this expected rate of return was too high compared with market conditions. Reducing it could save the federal crop insurance program hundreds of millions of dollars a year.

We recommended that Congress consider directing USDA to adjust this expected rate of return.

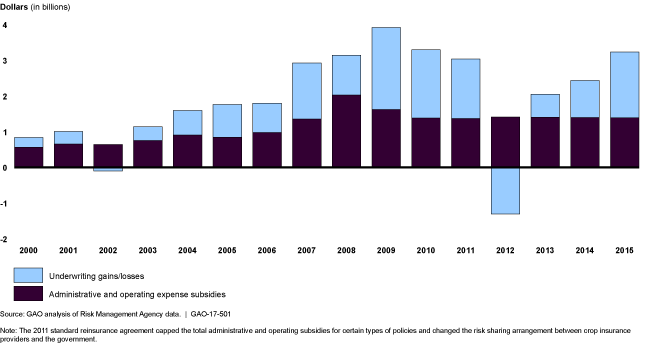

Government payments to insurance companies through the federal crop insurance program, 2000-2015

A graphic showing that in 14 of 16 years companies had underwriting gains.

Highlights

What GAO Found

The U.S. Department of Agriculture's (USDA) Risk Management Agency (RMA) makes payments to insurance companies to cover the cost of selling and servicing federal crop insurance policies. A cap on these payments stabilized them at about $1.4 billion per year from 2011 to 2015. In capping the annual payment to companies, RMA sought to make these payments more stable and dependable for companies and agents, but payments have fluctuated widely by crop, state, and county because, as GAO's analysis shows, the method RMA uses for calculating payments has allowed large fluctuations at the policy level. Specifically, RMA calculates payments based on such factors as crop price, and a price change can cause a change in the payments. For example, the average payment for almonds decreased by 42 percent from 2010 to 2011 but increased by 75 percent from 2013 to 2014. RMA could reduce such fluctuations and achieve greater stability by considering adjustments to how the payments are calculated when it negotiates a new agreement with companies.

The crop insurance program's target rate of return—the average annual rate of return that insurance companies are expected to earn—does not reflect market conditions. A 2009 USDA-commissioned study found that a 12.8 percent rate of return was reasonable for participating companies for 1989 through 2008 based on economic factors, such as interest rates. RMA used this study in 2010 negotiations with insurance companies to set a 14.5 percent target rate. According to GAO's analysis, which updated information in the study for 2009 through 2015, the reasonable rate of return declined, averaging 9.6 percent.

GAO identified two opportunities to reduce federal delivery costs for the program.

- First, given that GAO's analysis shows that the target rate of return does not reflect market conditions, that rate could be reduced. As a result, companies would earn a lower rate of return on their existing base of retained premiums. At the 2015 premium level, if the target rate were reduced by 4.9 percentage points, from the current rate of 14.5 percent to 9.6 percent, the companies' expected annual underwriting gains would decrease by $364 million.

- Second, the portion of premiums retained by companies could be reduced so that they would earn a rate of return on a smaller premium base. The portion of premiums retained by companies has changed little, averaging 77 percent since 2000, while USDA has retained the rest. Part of the justification for companies' retaining a significant portion of premiums was that they needed financial incentive to more carefully adjust farmers' loss claims. The need for this incentive decreased after a statutory change in 2000 improved RMA's ability to monitor those claims and companies' adjustment of them. Reducing the premiums that companies retain by 5 percentage points could reduce companies' annual underwriting gains by up to $100 million.

However, a provision in the Agricultural Act of 2014 requires any changes negotiated for a new SRA be budget neutral. To realize savings, such changes would require congressional action to repeal this provision. If Congress were to direct RMA to adjust the target rate in future negotiations or assess the portion of premiums companies retain, the agency could generate significant cost savings for the program.

Why GAO Did This Study

To implement the federal crop insurance program, USDA's RMA partners with private insurance companies, which sell and service policies. In 2010, USDA negotiated an agreement with insurance companies to set a national cap on the annual payments it makes to them for expenses and a target rate of return.

GAO was asked to examine (1) the changes in expense payments to companies due to the cap, (2) the extent to which the program's target rate of return reflects market conditions, and (3) opportunities for the federal government to reduce its delivery costs for the program. GAO analyzed RMA data on payments to companies for their expenses, conducted an updated analysis based on a USDA-commissioned study of the annual rate of return that companies should be expected to earn, and interviewed RMA officials.

Recommendations

Congress should consider repealing the Agricultural Act of 2014 provision that any revision to the agreement with insurance companies not reduce their expected underwriting gains and direct RMA to (1) adjust companies' target rate of return to reflect market conditions and (2) assess the portion of premiums that companies retain and adjust it, if warranted. GAO also recommends that RMA consider adjusting the method it uses to determine payments to insurance companies for expenses. RMA stated it will take steps to implement GAO's recommendation.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| To reduce the cost of delivering the crop insurance program, Congress should consider repealing the 2014 farm bill requirement that any revision to the standard reinsurance agreement not reduce insurance companies' expected underwriting gains, and directing the Risk Management Agency to, during the next renegotiation of the agreement, (1) adjust the participating insurance companies' target rate of return to reflect market conditions and (2) assess the portion of premiums that participating insurance companies retain and, if warranted, adjust it. | As of February 2025, Congress has not taken action to implement this matter. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Agriculture |

Priority Rec.

To reduce year-to-year fluctuations in the administrative and operating expense subsidies that companies receive at the crop, state, and county levels, the Secretary of Agriculture should direct the Administrator of the Risk Management Agency to consider adjusting the administrative and operating expense subsidy calculation method in a way that reduces the effects of changes in premiums caused by changes in crop prices or other factors when it renegotiates the standard reinsurance agreement. |

As of April 2025, we are reviewing information on the actions that USDA has taken in response to this recommendation and will update its status when our review is complete.

|