Financial Audit: Bureau of the Fiscal Service's Fiscal Years 2014 and 2013 Schedules of Federal Debt

Highlights

What GAO Found

In GAO's opinion, the Bureau of the Fiscal Service's (Fiscal Service) Schedules of Federal Debt for fiscal years 2014 and 2013 were fairly presented in all material respects, and Fiscal Service maintained, in all material respects, effective internal control over financial reporting relevant to the Schedule of Federal Debt as of September 30, 2014. GAO's tests disclosed no instances of reportable noncompliance for fiscal year 2014 with selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt.

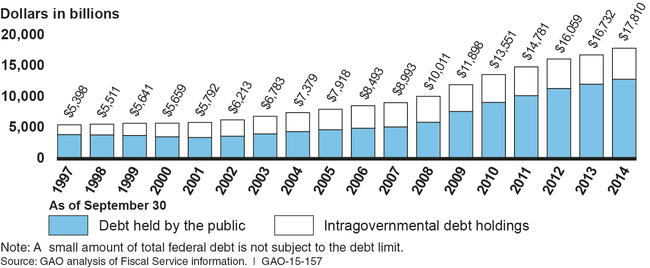

From fiscal year 1997, the first year of audit, through September 30, 2014, total federal debt managed by Fiscal Service has increased by 230 percent and the debt limit has been raised 15 times, from $5,950 billion to $17,212 billion. During fiscal year 2014, delays in raising the debt limit occurred for a total of 16 business days. Also, the debt limit was suspended for the period October 17, 2013, through February 7, 2014, and again from February 15, 2014, through March 15, 2015.

Total Federal Debt Outstanding, September 30, 1997, through September 30, 2014

During the delays, Treasury deviated from its normal debt management operations and took a number of extraordinary actions—consistent with relevant laws and regulations—to avoid exceeding the debt limit. As GAO has previously reported, the debt limit does not restrict the Congress's ability to enact spending and revenue legislation that affects the level of federal debt or otherwise constrains fiscal policy; it restricts Treasury's authority to borrow to finance the decisions already enacted by the Congress and the President. The United States benefits from the confidence investors have that debt backed by the full faith and credit of the United States will be honored. As GAO has also previously reported, delays in raising the debt limit can create uncertainty in the Treasury market and lead to higher Treasury borrowing costs. To avoid such uncertainty and related borrowing costs, GAO noted in its February 2011 and July 2012 reports related to the debt limit that the Congress should consider ways to better link decisions about the debt limit with decisions about spending and revenue at the time those decisions are made to avoid potential disruptions to the Treasury market and to help inform the fiscal policy debate in a timely way.

Why GAO Did This Study

GAO is required to audit the consolidated financial statements of the U.S. government. Because of the significance of the federal debt held by the public to the government-wide financial statements, GAO audits Fiscal Service's Schedules of Federal Debt annually to determine whether, in all material respects, (1) the schedules are reliable and (2) Fiscal Service management maintained effective internal control over financial reporting relevant to the Schedule of Federal Debt. Further, GAO tests compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt.

Federal debt managed by Fiscal Service consists of Treasury securities held by the public and by certain federal government accounts, referred to as intragovernmental debt holdings. Debt held by the public essentially represents the amount the federal government has borrowed to finance cumulative cash deficits. Intragovernmental debt holdings represent balances of Treasury securities held by federal government accounts—primarily federal trust funds such as Social Security and Medicare—that typically have an obligation to invest their excess annual receipts (including interest earnings) over disbursements in federal securities.

In commenting on a draft of this report, Fiscal Service concurred with GAO's conclusions.

For more information, contact Gary T. Engel at (202) 512-3406 or engelg@gao.gov.