Supplemental Security Income: Wages Reported for Recipients Show Indications of Possible SSN Misuse

Highlights

What GAO Found

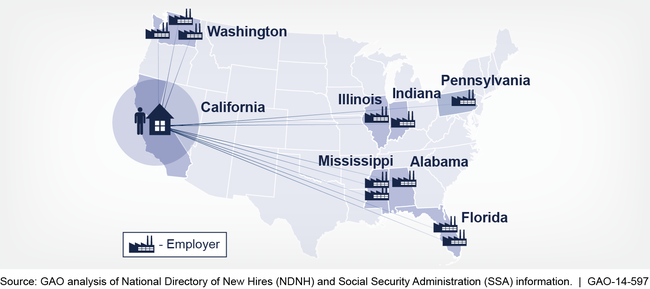

GAO's analysis of wages reported in the National Directory of New Hires (NDNH) initially showed that the Social Security Administration (SSA) made $19 million in potential overpayments to 10,187 recipients through its Supplemental Security Income (SSI) program in fiscal year 2010. Using a different methodology that includes additional causes of overpayments not considered in GAO's analysis, SSA estimated it made $3.3 billion in SSI overpayments in fiscal year 2010. The majority (70 percent) of the estimated overpayment amount GAO identified showed indications of possible Social Security number (SSN) misuse, such as employers reporting wages for recipients in multiple locations during the same quarter. For example, GAO determined that wages for 2,399 SSI recipients were reported solely by employers outside the recipient's state of residence. As the figure below shows, one individual in California had wages reported from 11 different employers in seven other states during the same quarter of calendar year 2010. This suggests that multiple individuals may be using the SSI recipient's SSN and name for work. The exact number of individuals who received overpayments and the exact amount of overpayments made to those individuals cannot be determined without detailed case investigations by SSA. GAO analyzed five recipient cases and provided the results to SSA.

Supplemental Security Income (SSI) Recipient with Reported Wages in Seven Different States

GAO analyzed employers with wages for SSI recipients from outside the recipient's state and found nine employers who reported wages for 15 or more SSI recipients during the same quarter who lived in different states from the employer's location. For example, a plant located in one state reported wages for 22 SSI recipients who lived in six other states, indicating possible SSN misuse. SSA has previously reported that privacy and disclosure issues have limited its ability to routinely share information with the Department of Homeland Security (DHS), which is responsible for enforcing employer compliance with immigration laws through its work-site enforcement strategy. Reviewing SSI wages at a summary level can provide information on certain employers that have high incidences of inaccurate wage reports. The ability to share information regarding potential unauthorized employment could enhance SSA's ability to address SSN misuse and help DHS better target its work-site enforcement efforts.

Why GAO Did This Study

In fiscal year 2012, SSA estimated it paid over $53.4 billion to SSI recipients, of which 8.1 percent, or $4.3 billion, SSA estimated to have been improper payments. The SSI program pays benefits to the aged, blind or disabled adults and children with limited income and resources.

GAO was asked to analyze potentially improper SSA disability payments. This report identifies potential SSI overpayments and indicators of possible SSN misuse. SSA provided GAO with a onetime file extract of SSI recipients as of December 2010 and the matching income from both the quarterly wage and unemployment insurance components of the NDNH database that included fiscal year 2010. GAO compared the SSI benefit and NDNH income data to identify potential overpayments. GAO randomly selected five individuals for case-file review. These cases cannot be projected to the overpayment population but provide illustrative examples of possible SSN misuse.

Recommendations

GAO recommends that the Acting Commissioner of Social Security work with the Secretary of Homeland Security to identify the data useful to DHS's work-site enforcement strategy and seek legislative authority to obtain such information, as appropriate. DHS agreed with GAO's recommendation and SSA agreed to the intent of the recommendation, but did not agree to seek legislative authority. GAO still believes this recommendation is valid as discussed in the report to help the federal government better utilize the complementary sources of data available at SSA.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Social Security Administration | To help strengthen SSA's efforts to monitor the SSI program, and pay accurate SSI benefits, as well as to enhance DHS's investigative efforts on behalf of its work-site enforcement strategy, the Acting Commissioner of Social Security should work with the Secretary of Homeland Security to identify the specific data useful to DHS's work-site enforcement strategy, including the new summary information that GAO identified on employers who file high numbers of wage reports with potentially misused SSNs, along with the corresponding privacy and disclosure restrictions, and seek legislative authority to allow the Secretary to obtain such information, as appropriate. |

GAO received correspondence from ICE HSI on December 16, 2014, stating that officials from both ICE HSI and SSA held a teleconference on October 3, 2014 to discuss GAO's recommendation for DHS ICE and SSA in its recent report, "Wages Reported for Recipients Show Indications of Possible SSN Misuse" (Audit GAO-14-597). During this discussion, SSA and ICE staff agreed they are not aware of any data they could legally share that would be useful to ICE's worksite enforcement efforts. Moreover, ICE staff acknowledged that it is aware that the earnings information in SSA records are protected by section 6103 of the Internal Revenue Code, and thus, SSA has no authority to seek a statutory change that would allow them to share such information with ICE. ICE noted if any data related to trends in SSN fraud that would assist with worksite enforcement, the agency might be interested in such data exchange with SSA. SSA said, they would confer internally to see whether any such data existed, and let ICE know what they found. Unfortunately, after thoroughly vetting this issue within the agency, SSA has concluded that there is no data related to SSN fraud trends they could share with ICE. However, SSA and ICE HSI did agree they would keep an open line of communication to assist one another, if needed. ICE HSI and SSA were grateful for the opportunity to meet to verify if there were any synergistic opportunities between the two agencies.

|

| Department of Homeland Security | To help strengthen SSA's efforts to monitor the SSI program, and pay accurate SSI benefits, as well as to enhance DHS's investigative efforts on behalf of its work-site enforcement strategy, the Acting Commissioner of Social Security should work with the Secretary of Homeland Security to identify the specific data useful to DHS's work-site enforcement strategy, including the new summary information that GAO identified on employers who file high numbers of wage reports with potentially misused SSNs, along with the corresponding privacy and disclosure restrictions, and seek legislative authority to allow the Secretary to obtain such information, as appropriate. |

GAO received correspondence from ICE HSI on December 16, 2014, stating that officials from both ICE HSI and SSA held a teleconference on October 3, 2014 to discuss GAO's recommendation for DHS ICE and SSA in its recent report, "Wages Reported for Recipients Show Indications of Possible SSN Misuse" (Audit GAO-14-597). During this discussion, SSA and ICE staff agreed they are not aware of any data they could legally share that would be useful to ICE's worksite enforcement efforts. Moreover, ICE staff acknowledged that it is aware that the earnings information in SSA records are protected by section 6103 of the Internal Revenue Code, and thus, SSA has no authority to seek a statutory change that would allow them to share such information with ICE. ICE noted if any data related to trends in SSN fraud that would assist with worksite enforcement, the agency might be interested in such data exchange with SSA. SSA said, they would confer internally to see whether any such data existed, and let ICE know what they found. Unfortunately, after thoroughly vetting this issue within the agency, SSA has concluded that there is no data related to SSN fraud trends they could share with ICE. However, SSA and ICE HSI did agree they would keep an open line of communication to assist one another, if needed. ICE HSI and SSA were grateful for the opportunity to meet to verify if there were any synergistic opportunities between the two agencies.

|