Pension Advance Transactions: Questionable Business Practices Identified

Highlights

What GAO Found

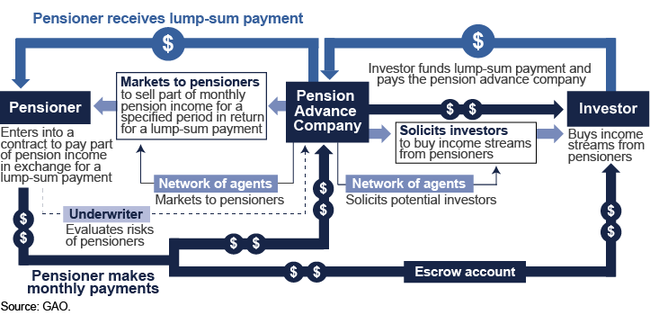

GAO identified at least 38 companies that offered individuals lump-sum payments or “advances” in exchange for receiving part or all of their pension payment streams. Eighteen of these companies were concentrated in one state, and 17 offered a range of other financial products in addition to pension advances. The 38 companies used multistep pension advance processes that included various other parties (illustrated below). At least 21 of the 38 companies were affiliated with each other in ways that were not apparent to consumers. All of the companies operated primarily as web-based companies, and some targeted financially vulnerable consumers with poor or bad credit nationwide.

Parties Involved in the Multistep Pension Advance Processes That GAO Reviewed

GAO received offers from 6 out of 19 pension advance companies. These offers did not compare favorably with other financial products or offerings, such as loans and lump-sum options through pension plans. For example, the effective interest rates on pension advances offered to GAO during its undercover investigation typically ranged from approximately 27 percent to 46 percent, which were at times close to two to three times higher than the legal limits set by the related states on the interest rates assessed for various types of personal credit.

GAO identified questionable elements of pension advance transactions related to the disclosure of rates or fees, and certain unfavorable terms of agreements. The Bureau of Consumer Financial Protection (CFPB) and Federal Trade Commission (FTC) have oversight responsibility over certain acts and practices that may harm consumers. According to CFPB officials, CFPB's oversight has been limited to instances where products met certain characteristics. FTC officials stated that FTC has not taken any public enforcement actions because it has not received many complaints, among other reasons. Six other federal agencies have oversight over pensions and provide related education. These agencies provided limited consumer education regarding pension advance transactions, but almost all agreed that it would be beneficial. Consumers who are vulnerable to financial exploitation may lack the information needed to make sound decisions. CFPB facilitates coordinating federal financial education and could help ensure information reaches relevant pensioners.

Why GAO Did This Study

There have been recent concerns about companies attempting to take advantage of retirees using pension advances. GAO was asked to review business practices related to pension advances. This report (1) describes the number and characteristics of pension advance companies and marketing practices; (2) evaluates how pension advance terms compare with those of other products; and (3) evaluates the extent to which there is related federal oversight. GAO identified 38 pension advance companies and related marketing practices using company websites and nonpublic databases. GAO conducted a more-detailed nongeneralizable assessment of 19 of these companies selected based on factors such as marketing claims and presence of or lack of complaints. GAO used undercover investigative phone calls to identify additional marketing practices and to obtain pension advance offers. This information was compared with the terms of other financial products, such as personal loans. View videos of undercover investigative calls to selected pension advance companies. GAO also examined the role of selected federal agencies with oversight of consumer protection and pension issues.

Recommendations

GAO recommends that CFPB and FTC review the pension advance practices identified in this report and exercise oversight or enforcement as appropriate. GAO also recommends that CFPB coordinate with relevant agencies to increase consumer education about pension advances. CFPB and FTC agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Consumer Financial Protection Bureau | In order to strengthen federal oversight or enforcement of pension advance products, the Director of CFPB should review pension advance practices, such as those highlighted in this report, and exercise oversight as appropriate. |

In response to our recommendation and related referrals of pension advance providers we identified during our review, CFPB distributed these referrals to its Office of Enforcement for use in investigations as appropriate, and on August 20, 2015, CFPB filed a complaint against two of these companies for violations of the Consumer Financial Protection Act of 2010 (Title X of the Dodd-Frank Act). By taking enforcement action against pension advance companies, CFPB has taken an important step to protect consumers.

|

| Federal Trade Commission | In order to strengthen federal oversight or enforcement of pension advance products, the Chairwoman of FTC should review pension advance companies and the questionable practices that we highlight in this report, and exercise enforcement as appropriate. |

We recommended that FTC review companies offering pension advances and the questionable practices that we highlighted in our report, and exercise enforcement as appropriate. In response to our report, FTC reviewed consumer complaints related to pension advances in its Consumer Sentinel complaint database and in April 2015, the FTC left phone messages for those consumers who had executed pension advance transactions, but none of the consumers returned FTC's call. FTC also reviewed pension advance advertising materials of numerous companies and stated it will continue to monitor the pension advance industry and take law enforcement action as appropriate. By reviewing pension advance companies and complaints from consumers, FTC has taken an important step to protect consumers.

|

| Consumer Financial Protection Bureau | To help ensure that consumer-education materials on pension advances reach their target audiences, the Director of CFPB should, through the Financial Literacy and Education Commission, coordinate with the federal agencies that regularly communicate with pensioners--such as the Employee Benefits Security Administration, Department of the Treasury, Pension Benefit Guaranty Corporation, Office of Personnel Management, and Departments of Defense and Veterans Affairs--on the dissemination of existing consumer-education materials on pension advances. |

In response to our recommendation, on March 16, 2015, CFPB's Office of Older Americans and Office of Servicemember Affairs released a consumer advisory regarding pension advances that highlighted things to do to protect your retirement pension. In addition, on April 8, 2015, CFPB representatives presented related material in a meeting with the Financial Literacy and Education Commission. By producing and disseminating consumer education materials about the risks of pension advances, CFPB has taken an important step to inform consumers, and thereby potentially mitigate the exploitation of consumers.

|