Health Savings Accounts: Information on Features and Use, and Characteristics of Account Holders

Fast Facts

Health savings accounts allow eligible people to save money tax-free to pay for medical expenses. The accounts can earn interest and be invested. Some policymakers have raised concerns that wealthier people may use the accounts to accumulate tax-free savings and people with lower incomes may lack the funds to contribute.

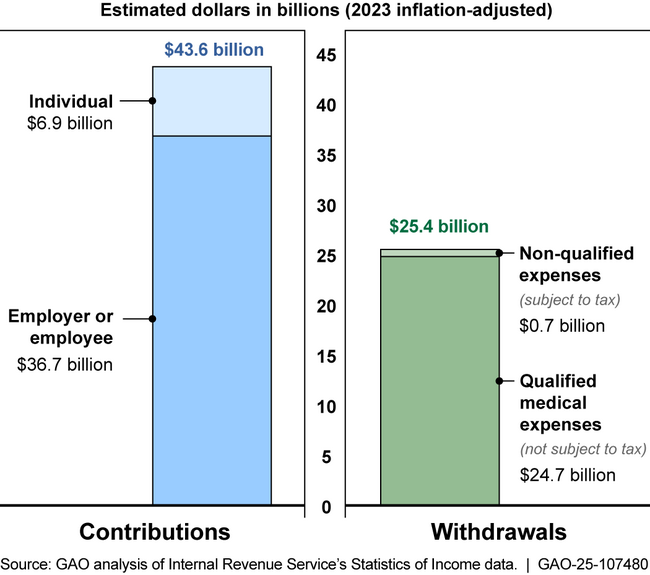

We found that in 2022, an estimated $43.6 billion were reported in contributions to the accounts, and $25.4 billion in withdrawals, according to IRS data. Of the withdrawals, over 97 percent were for qualified medical expenses; the remaining were for non-qualified expenses, such as cosmetic surgery, which can be taxed.

Highlights

Why This Matters

Health savings accounts (HSA) allow eligible people to save funds tax-free to pay for qualified medical expenses and can earn interest, be invested, and be carried into retirement. In 2023, HSAs held about $123 billion in assets. Some policymakers have raised concerns that wealthier people may use HSAs to accumulate tax-free savings and people with lower incomes may lack the funds to contribute.

GAO Key Takeaways

To open or contribute to an HSA, an individual must be enrolled in an HSA-eligible high-deductible health plan. These plans have relatively high deductibles, but often lower premiums and may be available to individuals through their employers, health insurance marketplaces, or issuers.

Of the nine HSA providers we interviewed, eight focused their marketing efforts on employers, and all had at least one fee associated with their HSA that account holders may have to pay.

In 2022, an estimated $43.6 billion in contributions and $25.4 billion in withdrawals were reported among the 16.5 million tax returns reporting HSA activity, according to Internal Revenue Service (IRS) data. Of the reported contributions, about 84 percent were from an employer or employee through payroll deductions, and 16 percent were from individuals directly to their HSAs. Of the reported withdrawals, over 97 percent were for qualified medical expenses; the remaining were for non-qualified expenses—such as groceries—that are subject to taxes.

We found that, among individuals in plans with high deductibles, HSAs and similar medical expense accounts were more common among those with higher incomes, Asian or White individuals, those in excellent or very good health, and those with employer-sponsored plans.

Total Health Savings Account Contributions and Withdrawals by Type, 2022

Note: Internal Revenue Service data from 2022 was the most recent year available at the time of our review.

How GAO Did This Study

We obtained responses from nine HSA providers that varied by size and geography. We also reviewed information from federal agencies, including the IRS and Centers for Disease Control and Prevention, and from stakeholder groups, including those representing consumers and industry.

For more information, contact John E. Dicken at dickenj@gao.gov.