Oil and Gas: Onshore Competitive and Noncompetitive Lease Revenues

Fast Facts

Federal onshore oil and gas leases generate about $3 billion a year in federal revenues. Leases are sold in competitive auctions. If there aren't adequate bids in an auction, leases can be sold noncompetitively.

Our analysis of 100,300 leases in 2003-2019 found:

Competitive leases averaged nearly 3 times greater revenues than noncompetitive leases

About 72,800 competitive leases produced $14.3 billion in revenue

Leases that sold for at least $100 an acre generated 3 times the royalties of all other leases combined during their first 10 years.

Management of federal oil and gas resources remains an issue on our High Risk List.

Highlights

What GAO Found

Pursuant to federal law, the Department of the Interior's (Interior) Bureau of Land Management (BLM) offers leases competitively through auction or noncompetitively for a fee if an adequate bid is not received. Competitive leases for oil and gas development on federal lands produced greater revenues, on average, than noncompetitive leases for fiscal years 2003 through 2019, according to GAO's analysis of revenues reported by Interior's Office of Natural Resources Revenue (ONRR) and leases from BLM. For this period, about 72,800 competitive leases produced about $14.3 billion in revenues—while total of 100,300 leases produced $16.1 billion. Average revenues from competitive leases over this time period were nearly 3 times greater than revenues from noncompetitive leases; about $196,000 and $66,000, respectively.

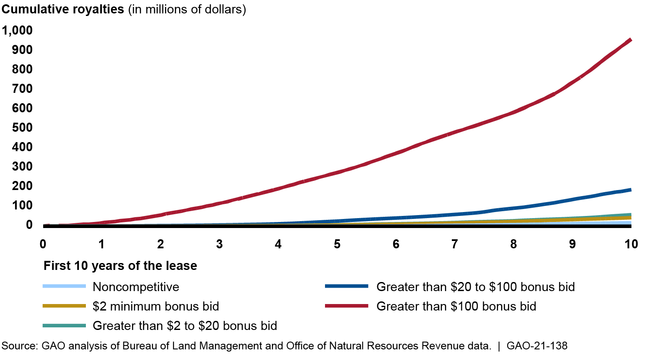

Based on GAO's analysis of leases that started in fiscal years 2003 through 2009, competitive leases produced oil and gas more often than noncompetitive leases during the leases' 10-year primary term. Further, competitive leases with high bonus bids (bids above $100 per acre) were more likely to produce oil and gas in their 10-year primary terms than both competitive leases with lower bonus bids and noncompetitive leases. Specifically, about 26 percent of competitive leases that sold with bonus bids above $100 per acre produced oil and gas and generated royalties in their primary term compared with about 2 percent for competitive leases that sold at the minimum bid of $2 per acre and about 1 percent for noncompetitive leases. GAO's analysis showed that competitive leases with high bonus bids generated over 3 times the amount of cumulative, or total, royalties by the end of their primary term than all other competitive and noncompetitive leases combined (see fig.).

Cumulative Royalties from Competitive Leases, by Bonus Bid, and Noncompetitive Leases That Started in Fiscal Years 2003 through 2009

Why GAO Did This Study

According to BLM, federal onshore oil and gas leases generate about $3 billion annually in federal revenues, including royalties, one-time bonus bid payments, and rents. The Federal Onshore Oil and Gas Leasing Reform Act of 1987 requires that public lands available for oil and gas leasing first be offered under a competitive bidding process. BLM offers leases with 10-year primary terms competitively through auction or, if the tract of land does not receive an adequate bid, noncompetitively for a fee. The minimum bid is $2 per acre, and bids at or above the minimum are called bonus bids.

ONRR is to collect revenues from oil and gas leases in accordance with the specific terms and conditions outlined in the leases, including revenues from rents and royalties. Lessees are to pay rent annually until production begins on the leased land and then pay royalties as a percentage of oil and gas production. Lease terms may be extended beyond the primary term if, for example, the lease is producing oil or gas.

GAO was asked to review oil and gas leasing on federal lands. This report describes oil and gas revenues from competitive and noncompetitive leases for fiscal years 2003 through 2019.

GAO analyzed federal lease and revenue data and interviewed Interior officials and four experts knowledgeable about federal oil and gas leasing. To consistently compare leases over their lifecycle, GAO analyzed revenues that occurred within the leases' primary term (first 10 years) for leases that started in fiscal years 2003 through 2009.

For more information, contact Frank Rusco at (202) 512-3841 or RuscoF@gao.gov.