Private Pensions: IRS and DOL Should Strengthen Oversight of Executive Retirement Plans

Fast Facts

Executive retirement plans allow some executives to defer their pay and related income taxes to future years. We looked at these plans and found:

Benefits for executives—e.g., no limits on how much pay can be deferred

Risks for executives—if companies go bankrupt, they may not receive deferred pay

Little oversight information—oversight agencies don’t have much data on who’s participating

Federal revenues—the effect of these plans on federal revenues is unknown

Our recommendations to IRS and the Department of Labor are to improve information about these plans and strengthen oversight.

Smashed piggy bank

Highlights

What GAO Found

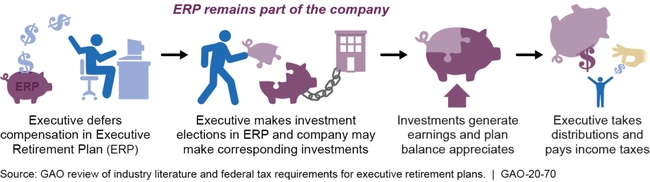

Executive retirement plans allow select managers or highly compensated employees to save for retirement by deferring compensation and taxes. As of 2017, more than 400 of the large public companies in the Standard & Poor's 500 stock market index offered such plans to almost 2,300 of their top executives, totaling about $13 billion in accumulated benefit promises. Top executives at large public companies generally accumulated more plan benefits than top executives at the smaller public companies in the Russell 3000 stock market index. Advantages of these plans include their ability to help executives increase retirement savings and potentially reduce tax liability, but the plans come with risks as well. To receive tax deferral, federal law requires the deferred compensation to remain part of a company's assets and subject to creditor claims until executives receive distributions (see figure). Department of Treasury officials and industry experts said executive retirement plans can be tax-advantaged and may have revenue effects for the federal government; however, the revenue effects are currently unknown.

Federal Income Tax Treatment of Deferred Compensation in Executive Retirement Plans

The Internal Revenue Service (IRS) oversees executive retirement plans for compliance with federal tax laws. For example, IRS must ensure that key executives are taxed on deferred compensation in certain cases where that compensation has been set aside, such as when a company that sponsors a qualified defined benefit retirement plan is in bankruptcy. However, IRS audit instructions lack sufficient information on what data to collect or questions to ask to help its auditors know if companies are complying with this requirement. As a result, IRS cannot ensure that companies are reporting this compensation as part of key executives' income for taxation. The Department of Labor (DOL) oversees these plans to ensure that only eligible employees participate in them since these plans are excluded from most of the federal substantive protections that cover retirement plans for rank-and-file employees. DOL requires companies to report the number of participants in the plan; however, the one-time single page filing does not collect information on the job title or salary of executives or the percentage of the company's workforce participating in these plans. Such key information could allow DOL to better identify plans that may be including ineligible employees. Without reviewing its reporting requirements to ensure adequate useful information, DOL may continue to lack insight into the make-up of these plans and will lack assurance that only select managers and highly compensated employees are participating.

Why GAO Did This Study

Some types of employers offer executive retirement plans to help select employees save for retirement. There are no statutory limits on the amount of compensation that executives can defer or benefits they can receive under these plans. However, employees in these plans do not receive the full statutory protections afforded to most other private sector employer-sponsored retirement plans, such as those related to vesting and fiduciary responsibility, among other things. These plans can provide advantages but they also have disadvantages because plan benefits are subject to financial risk, such as in a company bankruptcy. GAO was asked to review these plans.

This report examines, among other objectives, (1) the prevalence, key advantages, and revenue effects of executive retirement plans and (2) how federal oversight protects benefits and prevents ineligible participation. GAO analyzed industry-compiled Securities and Exchange Commission plan data for 2013 to 2017 (the most recent data available at the time of our analysis); reviewed relevant federal laws, regulations, and guidance; and interviewed officials from IRS and DOL, among others.

Recommendations

GAO is making four recommendations, including that IRS improve its instructions for auditing companies that offer these plans, and that DOL consider modifying reporting by companies to better describe participants in these plans. IRS and DOL neither agreed nor disagreed with our recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The IRS Commissioner should develop specific instructions within the Internal Revenue Manual, the Nonqualified Deferred Compensation Audit Techniques Guide, or other IRS training material to aid examiners in obtaining and evaluating information they can use to determine whether there exists a restricted period with respect to a company with a single-employer defined benefit plan and if a company with a single-employer defined benefit plan has, during a restricted period, set aside assets for the purpose of paying deferred compensation under an executive retirement plan. (Recommendation 1) |

IRS updated its Nonqualified Deferred Compensation Audit Technique Guide (ATG) to add specific instructions to aid examiners and converted the ATG to Publication 5528. Specifically, IRS added information in the ATG on identifying when restricted periods exist for a company with a single-employer defined benefit plan and the tax treatment to apply to such restricted periods. In addition, IRS updated the Internal Revenue Manual to raise awareness of the issue and direct examiners to the specific instructions in the ATG.

|

| Office of the Secretary for DOL | The Secretary of Labor should review and determine whether its reporting requirements for executive retirement plans should be modified to provide additional information DOL could use to oversee whether these plans are meeting eligibility requirements. (Recommendation 2) |

DOL requested that the ERISA Advisory Council (EAC) convene in September 2020 to consider this recommendation regarding executive retirement plans (known as a "top hat" plan). In its December 2020 report, the EAC recommended, among other things, that DOL amend the current alternative reporting regime for top hat plans to require that employers submit periodic (rather than one-time) reporting and to require additional data elements in the reporting statement. The EAC noted that "the alternative reporting scheme [for top hat plans] has resulted in an enormous regulatory blind spot" and that, similar to our report findings, "the lack of reliable, comparable data about top hat plans makes it very difficult to gauge whether top hat participation is appropriately limited to a select group of management or highly compensated employees." We commend DOL's request for the EAC to consider our recommendation. In June 2021, DOL indicated that, "as priorities and resources permit, the Department will discuss the issues GAO presented in its report and the EAC recommendations with interested stakeholders as part of its normal outreach activities." As of September 2023, that status is unchanged but DOL indicated that the likely next opportunity to consider proposing annual reporting changes for executive retirement plans could fall under the Department's planned project on general improvements to the Form 5500 reporting requirements. DOL noted that the agency is currently focusing its regulatory resources on the multiple regulatory, guidance, and report projects it was assigned under the SECURE 2.0 Act but, as of March 2025, did not provide a timeframe for when the planned project would occur. DOL noted that addressing the issue of executive retirement plan reporting would require DOL to engage in a public notice and comment process and obtain approval for such an information collection under the Paperwork Reduction Act. In August of 2025, DOL indicated that due to competing priorities and statutorily required directives from SECURE 2.0, EBSA does not have any current plans to pursue action on this recommendation. In light of similar findings and recommendations on top hat plan reporting requirements in the EAC report and our report, we encourage DOL to take additional action to amend its current reporting requirements to address the deficiencies identified. Without the addition of data elements and increased frequency in the reporting requirements for top hat plans, DOL will continue to have inadequate and likely outdated information with which to oversee the use of these plans.

|

| Office of the Secretary for DOL | The Secretary of Labor should explore actions the agency could take to help companies prevent the inclusion of rank-and-file employees in executive retirement plans and determine which, if any, actions should be implemented. (Recommendation 3) |

DOL requested that the ERISA Advisory Council (EAC) convene in September 2020 to consider this recommendation regarding executive retirement plans (known as a "top hat" plan) . In December 2020, the EAC reported that "...[it] believes that it is possible that the lack of guidance on top hat eligibility is inviting broader coverage than Congress intended" and recommended, among other things, that DOL "issue a request for information seeking comments from interested stakeholders on possible regulatory definitions of a 'select group of management or highly compensated employees,' including possible bright-line definitions and/or safe harbor/unsafe harbor definitions." We commend DOL's request for the Council to consider our recommendation. In June 2021, DOL indicated that "...EBSA has not encountered evidence of systematic abuses involving executive retirement plans or that ERISA's claims procedure rules and judicial remedies are inadequate to protect participants' benefit rights." The agency noted that "as priorities and resources permit, the Department will discuss the issues GAO presented in its report with interested stakeholders as part of its normal outreach activities." As of September 2023, DOL indicated the agency is currently focusing its regulatory resources on the multiple regulatory, guidance, and report projects it was assigned under the SECURE 2.0 Act. As of March 2025, that status is unchanged. In August of 2025, DOL indicated that due to competing priorities and statutorily required directives from SECURE 2.0, EBSA does not have any current plans to pursue action on this recommendation. While we recognize the importance for DOL to meet its obligations under the SECURE 2.0 Act, in light of similar findings and recommendations on top hat plan eligibility requirements in the EAC report and our report, we continue to encourage DOL to take additional actions to prevent the inclusion of rank-and-file employees in these plans, such as issuing a request for information regarding eligibility criteria or providing additional guidance to plan sponsors. The absence of clearer guidance or definition of what constitutes "a select group of management and highly compensated employees" may invite broader coverage in top hat plans than Congress intended and put employees inappropriately at risk.

|

| Office of the Secretary for DOL | The Secretary of Labor should provide specific instructions for companies to follow to correct eligibility errors that occur when rank-and-file employees are found to be participating in executive retirement plans, and should coordinate with other federal agencies on these instructions, as appropriate. (Recommendation 4) |

DOL requested that the ERISA Advisory Council (EAC) convene in September 2020 to consider this recommendation regarding executive retirement plans (known as a "top hat" plan). In December 2020, the EAC reported that "the primary obstacles associated with the correction of [top hat plan] eligibility failures appear to be tax issues...outside the remit of the Council." We commend DOL's request for the Council to consider our recommendation. In June 2021, DOL indicated that, "...EBSA has not encountered evidence of systematic abuses involving executive retirement plans or that ERISA's claims procedure rules and judicial remedies are inadequate to protect participants' benefit rights." The agency noted that "as priorities and resources permit, the Department will discuss the issues GAO presented in its report with interested stakeholders as part of its normal outreach activities." As we reported, the IRS indicated that DOL's suggested remedy for correcting eligibility errors in its 2015 amicus brief would likely be in violation of Internal Revenue Code section 409A rules around accelerated distribution which triggers tax consequences. We also reported that IRS officials told us they are willing to work with DOL to promulgate new section 409A regulations to create an exception to the accelerated payment rules for [top hat] plans that seek to remove ineligible rank-and file employees from the plan, but they noted that prescribing corrective action in these situations is under DOL's purview and that DOL would first need to delineate the meaning of a top hat plan employee and then decide the proper approach for removing ineligible employees before IRS can take further action. As of September 2023, DOL indicated that it is currently focusing its regulatory resources on the multiple regulatory, guidance, and report projects it was assigned under the SECURE 2.0 Act. As of March 2025, the agency has not implemented our recommendation. In August of 2025, DOL indicated that due to competing priorities and statutorily required directives from SECURE 2.0, EBSA does not have any current plans to pursue action on this recommendation. While we recognize the importance for DOL to meet its obligations under the SECURE 2.0 Act, we continue to encourage DOL to take action to provide instructions for companies to correct plan participant eligibility errors that occur and coordinate with other federal agencies, such as the IRS, on these instructions as appropriate. Without further action from DOL, top hat plans that adopt DOL's current suggested approach for corrective action would likely subject ineligible rank-and-file employees to unexpected tax consequences under 409A, thereby inadvertently harming these plan participants.

|